The Nikkei Index is a stock market index that tracks the performance of the 225 largest publicly traded companies in Japan.

Image: currency.com

A Glimpse into the Nikkei Index

The Nikkei Index acts as a barometer of the Japanese economy, signaling the overall health and performance of the country’s stock market. It is widely followed by investors, analysts, and businesses both domestically and abroad.

History and Significance of the Nikkei

The Nikkei Index was first created in 1950 by the Nihon Keizai Shimbun, one of Japan’s leading financial newspapers.

Over the years, the Nikkei Index has become a trusted and established indicator of Japan’s economic strength. Its value is influenced by factors such as economic growth, corporate earnings, and global market trends.

Understanding the Composition of the Nikkei 225

The Nikkei 225 consists of companies from various industries, including electronics, automobiles, manufacturing, and finance.

The index is calculated by taking the total market capitalization of the 225 constituent companies and dividing it by the Nikkei 225 divisor. The divisor is adjusted periodically to account for factors such as stock splits and changes in market conditions.

Image: www.stockmarkettiming.com

Recent Trends and Developments in the Nikkei Index

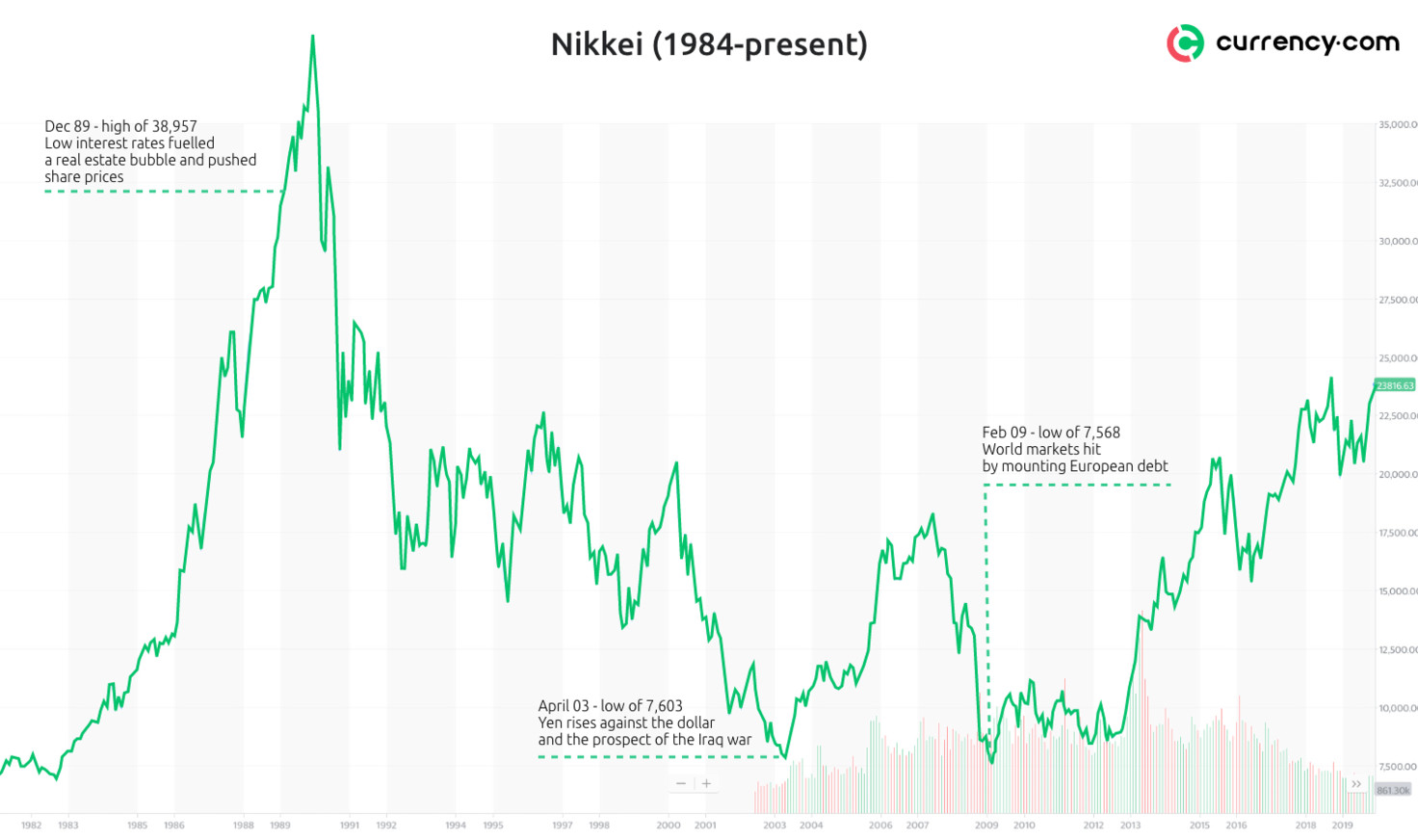

In recent years, the Nikkei Index has exhibited a fluctuating performance, impacted by global economic uncertainties, geopolitical events, and domestic factors.

Despite these fluctuations, the Nikkei Index remains a valuable indicator of the Japanese economy. Investors密切关注 its movements and performance when making investment decisions.

Expert Insights and Tips for Investors

Investing in the Nikkei Index can provide diversification and exposure to the Japanese market. Here are a few tips based on expert advice to consider:

- Conduct thorough research: Understand the Nikkei Index’s composition, historical performance, and current economic outlook before investing.

- Diversify investments: Combining investments in the Nikkei Index with other assets can mitigate risk and enhance overall portfolio performance.

- Monitor market conditions: Stay informed about economic developments, geopolitical events, and market trends that may impact the Nikkei Index.

Common Questions about the Nikkei Index:

- Q: What’s the difference between the Nikkei 225 and the Nikkei 500?

A: The Nikkei 225 tracks the performance of the 225 largest companies, while the Nikkei 500 includes a wider range of 500 companies. - Q: Why is the Nikkei Index important?

A: It serves as a barometer of Japan’s economic health and is widely used by investors to gauge market sentiment. - Q: What factors influence the Nikkei Index?

A: Economic growth, corporate earnings, global market trends, political events, and natural disasters can all impact the index.

What Is The Nikkei Index

Conclusion

了解 Nikkei Index 在帮助我们了解日本经济和股票市场表现方面具有至关重要的作用。通过密切关注其趋势和发展,投资者可以做出明智的投资决策。仔细考虑本文中概述的专家建议和见解可以增强和完善您的投资策略。

Are you interested in learning more about the Nikkei Index and Japan’s economy?