Investing in the stock market involves making informed decisions about which companies and sectors to allocate your precious capital. One invaluable tool that can guide your investment strategy is the value-weighted index. This sophisticated financial instrument provides a holistic view of the overall market by measuring the collective performance of a group of stocks. In this comprehensive guide, we’ll delve into the intricacies of value-weighted index calculation, exploring its history, methodology, and practical applications.

Image: www.slideshare.net

Defining Value-Weighted Index

A value-weighted index is a stock market index that calculates the market capitalization of its constituent companies and uses that information to determine the index’s overall value. Simply put, companies with a higher market capitalization have a greater influence on the index’s performance. Some of the most prominent value-weighted indices include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

Components of Value-Weighted Index

To calculate a value-weighted index, several key components come into play:

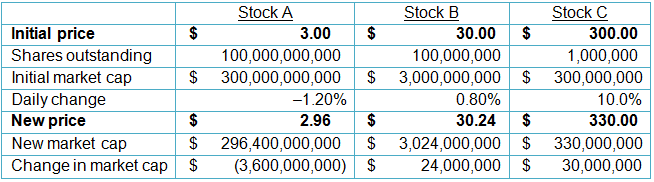

- Market Capitalization: Market capitalization refers to the total value of a company’s outstanding shares. The market capitalization for each company in the index is calculated by multiplying the number of shares outstanding by the current share price.

- Weighting: Each company’s market capitalization is used to determine its weighting within the index. The higher the company’s market capitalization, the greater its weighting. This means that changes in the stock price of large-cap companies will have a more significant impact on the index’s overall value than changes in the stock price of small-cap companies.

Calculating Value-Weighted Index

The calculation of a value-weighted index is a straightforward process:

- Determine the market capitalization of each constituent stock in the index.

- Sum the market capitalizations of all the constituent stocks.

- Divide the market capitalization of each constituent stock by the total market capitalization of the index.

- Multiply the resulting percentages by 100 to convert them to weights.

Image: rhayzlzenia.blogspot.com

Advantages and Disadvantages

Employing a value-weighted index has several advantages:

- Market Representation: Value-weighted indices provide a comprehensive representation of the broader stock market by including both large-cap and small-cap companies.

- Sector Insight: By examining the weighting of different sectors within a value-weighted index, investors can gauge the relative influence of various industries on the overall market performance.

- Benchmarking: Value-weighted indices serve as valuable benchmarks for investors, enabling them to compare the performance of their portfolios to the broader market.

However, there are also a few disadvantages to consider:

- Cap-Dominance: In a value-weighted index, large-cap companies dominate the index’s performance, potentially diminishing the influence of smaller companies.

- Price Fluctuations: Large swings in the stock price of a heavily weighted company can lead to substantial fluctuations in the index’s value, even if the overall market is stable.

Value Weighted Index Calculation

Practical Applications

Value-weighted indices are widely utilized by financial professionals and individual investors for various practical applications:

- Investment Strategy: Indices provide the foundation for constructing investment portfolios that align with specific risk and return objectives.

- Performance Tracking: By monitoring the performance of value-weighted indices over time, investors can assess the overall health of the markets.

- Risk Management: Value-weighted indices help investors diversify their portfolios by including a broad range of companies and sectors.

Mastering the concept of value-weighted index calculation empowers investors with a deeper understanding of market dynamics. Whether you’re a seasoned veteran or a budding stock enthusiast, leveraging the power of value-weighted indices can contribute to informed investment decisions and potentially enhance your financial success.