In the intricate tapestry of financial markets, technical analysis serves as a beacon amidst volatility, guiding traders and investors toward informed decisions. Amidst the myriad of patterns that grace candlestick charts, the ominous 3 Red Candles pattern emerges as a potent harbinger of bearish sentiment, signaling a potential reversal in bullish trends. This article delves into the depths of this pattern, deciphering its significance and equipping readers with the knowledge to discern its presence within market machinations.

Image: dolfinvest.com

Defining the 3 Red Candles Pattern: A Signal of Reversal

The 3 Red Candles pattern comprises a trio of consecutive red candles, each closing lower than the previous. This starkly contrasting hue against the backdrop of preceding green candles constitutes a bearish signal, indicating a shift in market sentiment from optimism to pessimism. The pattern’s simplicity belies its gravity, serving as an early warning system for traders seeking to safeguard their positions or capitalize on the impending downtrend.

Historical Context and Significance: The Pattern’s Pedigree

Within the annals of technical analysis, the 3 Red Candles pattern has etched its name as a venerable indicator. Its origins can be traced to the early days of stock market trading, where it was observed that a succession of red candles often preceded significant market declines. Over time, this pattern gained widespread recognition and became an integral part of traders’ arsenals.

Understanding the Pattern’s Formation: How It Unfolds

The formation of the 3 Red Candles pattern is predicated upon a confluence of factors. Typically, it emerges during a period of bullish trend exhaustion. As the uptrend falters, selling pressure intensifies, driving prices lower. This downward momentum manifests in the form of consecutive red candles, signaling a potential shift in market psychology.

Image: blog.elearnmarkets.com

Implications for Traders: Navigating Its Bearish Undertones

For traders, the 3 Red Candles pattern serves as a pivotal warning that the prevailing uptrend may be reaching its conclusion. It prompts a reevaluation of trading strategies, highlighting the need to consider profit protection measures or the potential for trend reversals. The pattern’s appearance underscores the importance of recognizing market sentiment shifts and adapting accordingly.

Applications in Real-World Trading: Harnessing Its Predictive Power

The 3 Red Candles pattern finds widespread application in real-world trading across various financial markets. Forex traders, for instance, utilize the pattern to discern shifts in currency pair dynamics, while stock traders rely on it to identify potential topping formations. Its versatility extends to commodities and indices, providing traders with a consistent framework for assessing market trends.

Incorporating Confirmation Factors: Enhancing Predictive Accuracy

While the 3 Red Candles pattern carries significant weight on its own, traders often employ confirmation factors to enhance its predictive accuracy. Volume analysis, for example, can corroborate the bearish implications of the pattern when accompanied by high selling volume. Additionally, the presence of other bearish indicators, such as negative divergence or resistance levels, can further bolster the pattern’s reliability.

Technical Analysis and the 3 Red Candles Pattern: A Symbiotic Relationship

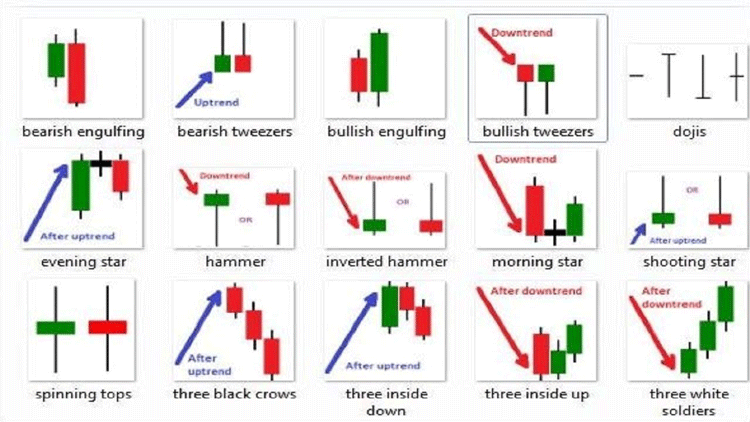

The 3 Red Candles pattern exists within the broader context of technical analysis. It complements other technical indicators, providing traders with a comprehensive view of market dynamics. By combining the pattern with trend analysis, support and resistance levels, and momentum oscillators, traders can refine their decision-making processes and improve their chances of success.

3 Red Candles Pattern

Conclusion: The 3 Red Candles Pattern as a Cornerstone of Market Analysis

The 3 Red Candles pattern stands as a cornerstone of technical analysis, offering traders a proven tool for identifying potential trend reversals. Its simplicity and reliability make it accessible to both novice and experienced traders alike. By understanding the pattern’s implications and incorporating it into their trading strategies, traders can navigate market complexities with greater confidence and enhance their overall profitability. As the financial markets continue to evolve, the 3 Red Candles pattern will undoubtedly remain an indispensable asset in the traders’ arsenal.