In the intricate realm of currency trading, the concept of “pip” emerges as a crucial unit of measurement, serving as the smallest discernible change in the value of a currency pair. Understanding the worth of a pip forms the cornerstone of successful forex trading, empowering traders to navigate market fluctuations with precision.

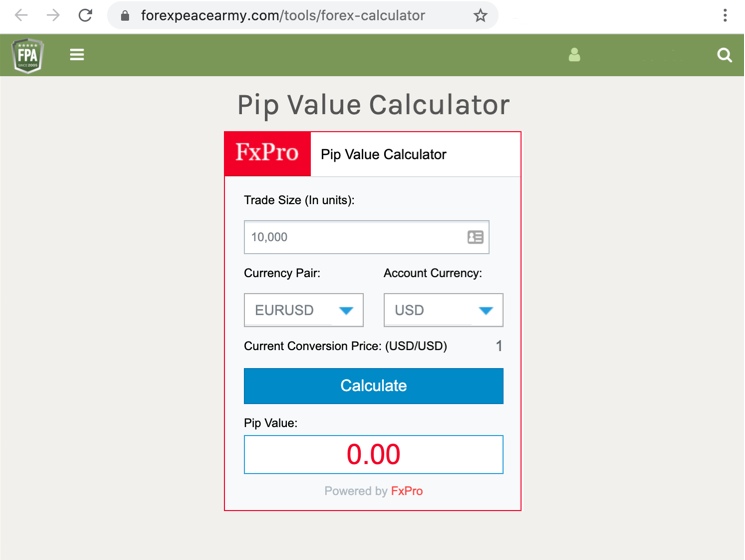

Image: www.forexpeacearmy.com

A pip, short for “point in percentage,” represents the fourth decimal place in currency quotes. For major currency pairs, such as EUR/USD or GBP/USD, one pip equates to a one-point shift in the exchange rate. For example, if the EUR/USD quote moves from 1.2345 to 1.2346, it signifies a gain of one pip for the euro against the U.S. dollar.

The value of a pip varies depending on the currency pair in question. For instance, one pip for EUR/USD equates to 0.0001 euros (or 0.001 cents in U.S. dollars), while one pip for USD/JPY amounts to 0.01 yen (or 0.0001 cents in U.S. dollars). The higher the exchange rate, the smaller the pip value.

Calculating Pip Value: Deciphering the Formula

To ascertain the pip value for any currency pair, the following formula proves invaluable:

Pip Value = (1 / Conversion Rate) x 10,000

For instance, to determine the pip value for GBP/USD, where the conversion rate is 1.4567, we employ the formula as follows:

Pip Value = (1 / 1.4567) x 10,000 = 6.867

Therefore, one pip for GBP/USD equates to 0.0006867 British pounds (or 0.001 cents in U.S. dollars).

Traders’ Lifeline: The Significance of Pips

In the foreign exchange market, pips serve as the yardstick by which profits and losses are measured. A trader’s ultimate goal is to accumulate as many pips as possible, signifying gains in the value of their chosen currency pairs. The value of a pip, therefore, directly translates into the potential profitability of a trade.

Understanding pip values is crucial for calculating potential profit and loss. Consider this scenario: a trader buys 10,000 units of EUR/USD at an exchange rate of 1.2450. If the rate subsequently increases to 1.2460, the trader gains 10 pips (the difference between the two rates).

Profit = Pip Value x Number of Units x Number of Pips

In this case:

Profit = 0.0001 10,000 10 = 1 euro

Currency Conversion: Embracing Pips

The concept of pips plays an integral role in currency conversion as well. When converting one currency to another, traders leverage pip values to determine the exchange rate and the associated transaction costs.

For instance, to convert 500 euros to U.S. dollars at an exchange rate of 1.2450, we employ the pip value formula:

Pip Value = (1 / 1.2450) x 10,000 = 0.0008038

Conversion = Pip Value x Number of Units

Therefore:

*Conversion = 0.0008038 500 = 0.4019 euros**

Consequently, the trader receives 401.9 U.S. dollars after converting 500 euros.

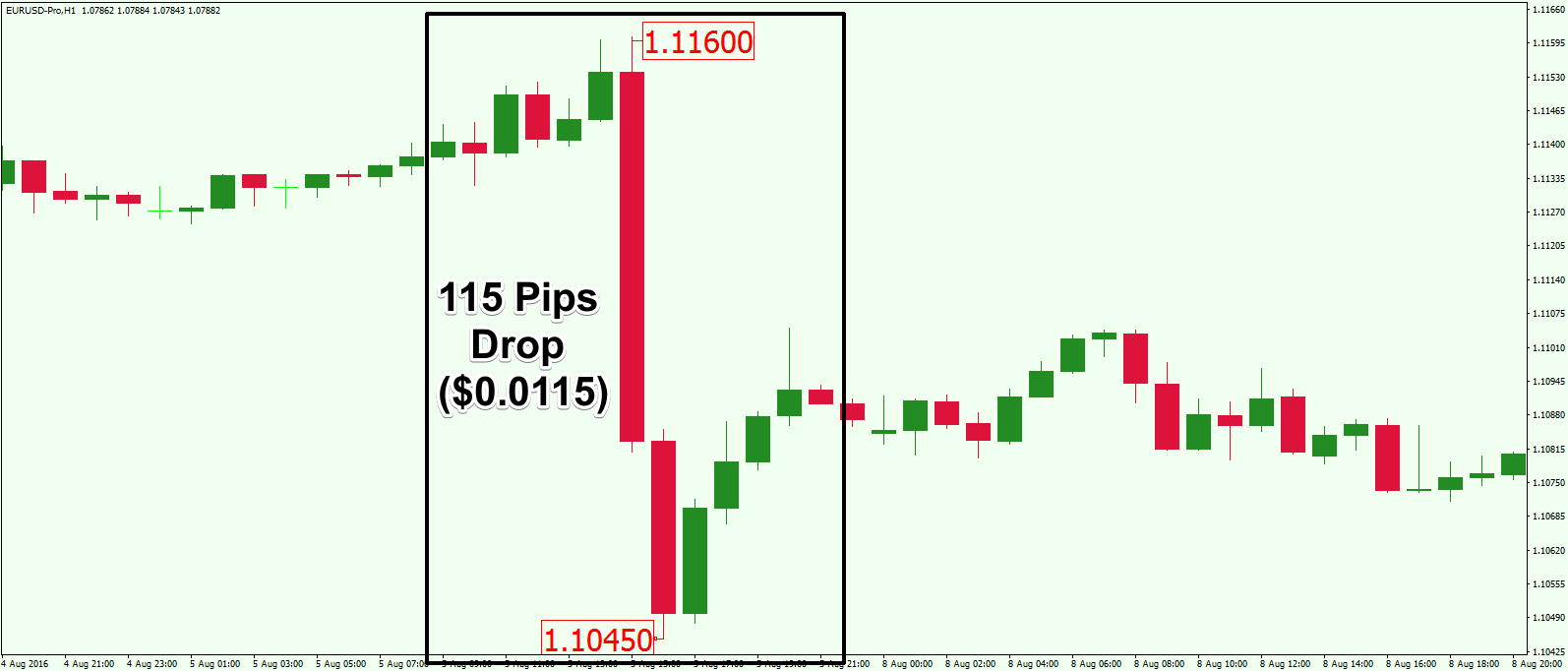

Image: forextraininggroup.com

How Much Is One Pip

https://youtube.com/watch?v=6pip1oe8LrI

Conclusion: The Power of Pips

In the dynamic world of currency trading, pips emerge not merely as abstract units of measurement but as the backbone of market transactions. Their significance extends beyond mere mathematical calculations, encompassing the essence of profit-seeking and currency conversion. Understanding the value of a pip empowers traders to make informed decisions, navigate market fluctuations effectively, and unlock the full potential of foreign exchange trading. Whether seeking lucrative gains or managing currency risk, the concept of pips proves an indispensable tool in the trader’s armamentarium.