Introduction: The World of Foreign Exchange

In the realm of international finance, the foreign exchange market (forex) reigns supreme. Forex is a vast and interconnected marketplace, facilitating the global trade of currencies. With daily trading volumes reaching trillions of dollars, forex offers immense opportunities for currency traders, institutions, and businesses alike.

Image: hercules.finance

At the heart of every forex transaction lies the spread – a fundamental concept that significantly impacts a trader’s profitability. In this article, we will delve into the world of forex spreads, exploring their mechanics, significance, and how they influence trading strategies.

Understanding the Forex Spread

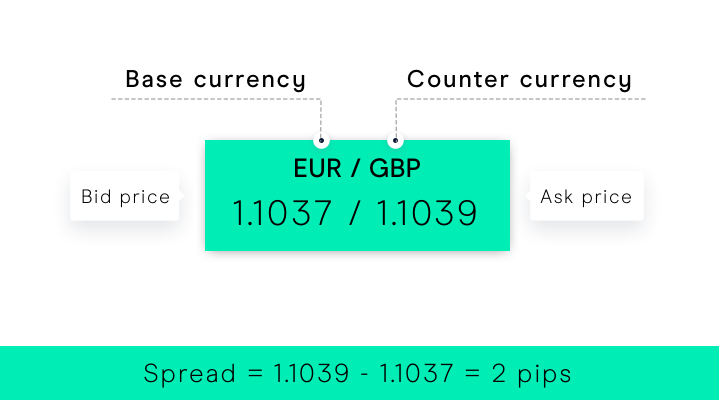

Simply put, the forex spread is the difference between the bid price (the price at which a currency pair can be bought) and the ask price (the price at which it can be sold). This spread represents the profit margin earned by market makers, who facilitate the execution of forex trades.

Spreads are typically quoted in pips, which are the smallest units of value for currencies. For instance, if the EUR/USD pair has a spread of 1.5 pips, it means that the difference between the bid price and the ask price is 0.00015.

Factors Influencing the Spread

Several factors can affect the spread:

Market Volatility: During periods of high market volatility, spreads tend to widen as increased uncertainty raises the risk for market makers.

Currency Liquidity: Liquid currencies like the US dollar or the euro typically have narrower spreads, as they are more accessible and heavily traded.

Time of Day: Spreads are often narrower during peak trading hours due to increased market activity and reduced liquidity risk.

Brokerage Fees: Different forex brokers may offer varying spreads based on their operating costs and commission structures.

Types of Spreads

Fixed Spread: As the name suggests, a fixed spread remains constant regardless of market conditions. This provides predictability, but may not be the most competitive option if volatility is low.

Variable Spread: Variable spreads fluctuate in line with market conditions. They can be more cost-effective in stable markets but may widen significantly during volatile periods.

Raw Spread: A raw spread is the spread directly from the market without any additional brokerage markup. This offers the tightest spreads, but traders may incur additional fees from the broker.

Image: www.cmcmarkets.com

Impact of the Spread on Trading Profitability

The spread is a crucial factor that impacts trading profitability. A higher spread implies reduced profit or increased loss, while a narrower spread enhances profit potential.

Traders should carefully consider the spread when selecting a forex pair and timing their trades. Choosing currency pairs with lower spreads and trading during periods of reduced volatility can result in improved profitability.

Forex What Is A Spread

Conclusion: Navigating the Forex Spread

The forex spread is an integral concept in currency trading, influencing both trading strategies and profitability. By understanding the dynamics of spreads, timing trades effectively, and choosing brokers with competitive offerings, traders can optimize their performance in the forex market.

Remember, the forex spread is not just a cost but a fundamental part of the trading process. By harnessing the insights provided in this article, you can elevate your forex trading journey and increase your chances of success.