Embark on your Forex journey with confidence by grasping the crucial concept of position size.

In the tumultuous realm of Forex trading, success hinges upon prudent risk management. Position sizing, the cornerstone of this vital endeavor, empowers you to calibrate the precise amount of capital you risk on each trade, safeguarding your financial well-being while maximizing profit potential. Embrace this article as your guide to unraveling the intricacies of position sizing in Forex, equipping you with the knowledge and strategies to navigate the markets with proficiency and aplomb.

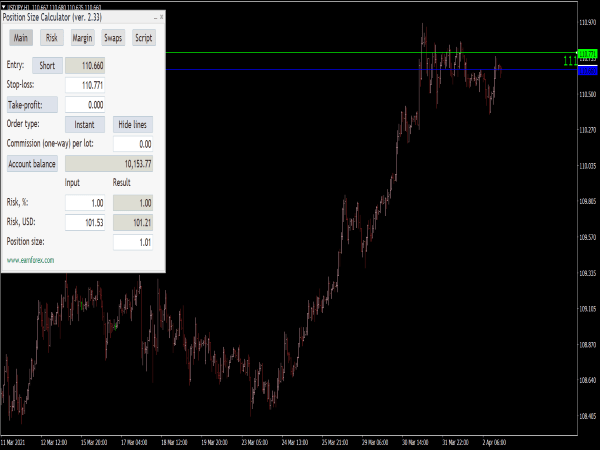

Image: howtotradeonforex.github.io

Deciphering the intricacies of position sizing

Position sizing revolves around determining the optimal trade size based on your risk tolerance, account balance, and trade parameters. Neglecting this crucial aspect can lead to unwelcome surprises, jeopardizing your financial fortitude. Various formulas and methods guide position sizing, empowering you to optimize your risk-reward ratio for each trade.

A cornerstone of effective position sizing lies in comprehending your risk tolerance. It’s the extent of potential loss you’re willing to endure on a single trade. Understanding your risk tolerance allows you to set appropriate position sizes, ensuring that you’re not venturing into uncharted and potentially perilous territories.

Paramount Account considerations

Your account balance dictates the resources at your disposal, directly influencing your position sizing decisions. A judicious approach involves venturing into trades with a position size that doesn’t exceed a predetermined percentage of your account balance. This conservative stance bolsters your financial resilience, preventing substantial losses that could cripple your trading endeavors.

Unraveling trade dynamics

Trade parameters, encompassing entry and exit points, profit targets, and stop-loss levels, play a pivotal role in position sizing. These factors, when synergized, determine the risk-reward ratio of your trade, providing insights into the potential profit or loss you stand to incur.

Image: www.forex.academy

Master the art of position sizing

1. Leverage the 1% rule:

This rule of thumb suggests restricting your risk on any single trade to a maximum of 1% of your account balance. This conservative approach safeguards your capital, preventing substantial setbacks that could erode your trading prowess.

2. Embrace risk-reward ratios:

Scrutinize the potential reward of a trade relative to the risk involved. A favorable risk-reward ratio, typically 2:1 or higher, indicates a trade with a potentially lucrative payoff in relation to the risk undertaken.

3. Utilize position calculators:

Harness the power of online position calculators to swiftly determine your ideal position size based on your predefined risk parameters. These tools expedite calculations, enabling you to trade with precision and efficiency.

4. Practice prudent risk management:

Diversify your trades, spreading your risk across multiple positions. Avoid concentrating your capital on a single trade, as this exposes your account to excessive risk. Implement stop-loss orders to safeguard your profits and minimize losses when market conditions shift against your favor.

Calculate Position Size Forex

Conclusion

Position sizing stands as a cornerstone of prudent Forex trading, empowering you to navigate market volatility with confidence and mitigate risk effectively. By internalizing the concepts outlined in this article, you’ll gain the knowledge and skills to calculate position size meticulously, safeguarding your capital and maximizing profit potential. Embrace position sizing as a vital tool in your trading arsenal, propelling you towards Forex mastery and financial success.