In the ever-evolving world of finance, currency trading has emerged as a lucrative opportunity for investors seeking financial freedom. As a trader myself, I have personally witnessed the thrill and potential rewards it offers. Whether you’re an experienced market veteran or just starting your trading journey, opening a currency trading account is the first step towards unlocking these possibilities.

Image: www.mstock.com

In this comprehensive guide, I’ll provide you with a detailed overview of open currency trading accounts, including their definition, benefits, types, and the latest industry trends. By equipping you with the necessary knowledge, I aim to empower you on your path to financial success.

Navigating the World of Open Currency Trading Accounts

Empowering Traders with Financial Flexibility

An open currency trading account enables traders to buy and sell currencies on the foreign exchange (Forex) market. This global marketplace, operating 24 hours a day, offers unmatched liquidity, allowing traders to execute trades efficiently.

By liquidating one currency to purchase another, you can potentially profit from fluctuations in currency exchange rates. These fluctuations occur due to various economic, political, and social factors, presenting traders with opportunities to capitalize on market movements.

Types of Currency Trading Accounts, Tailored to Your Needs

To cater to diverse trading styles and investor profiles, various types of currency trading accounts are available:

- Standard Accounts: Designed for beginners, these accounts offer basic trading features with competitive spreads and low minimum deposits.

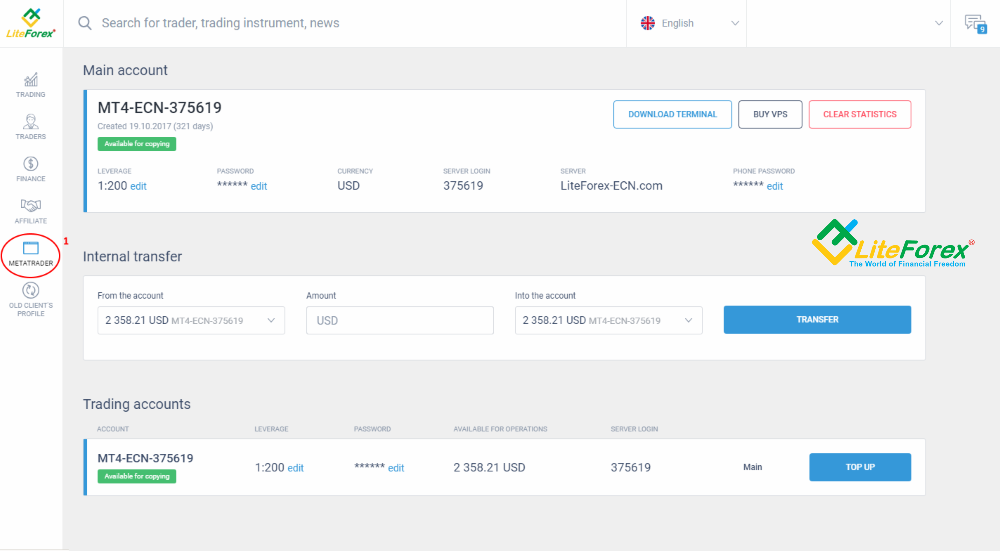

- ECN Accounts: Ideal for experienced traders, these accounts provide direct market access, offering real-time quotes and tighter spreads.

- Micro Accounts: Perfect for novice traders or those testing new strategies, micro accounts allow for trading with micro lots, reducing the financial risk involved.

Image: www.litefinance.com

Evolution of Currency Trading: Embracing Technological Advancements

Technology’s Transformation of the Trading Landscape

In recent years, the currency trading industry has embraced technological advancements, revolutionizing the trading experience:

- Automated Trading: Algorithmic trading strategies have become increasingly prevalent, executing trades based on predefined rules, reducing human error and maximizing efficiency.

- Mobile Trading: Mobile apps allow traders to access their accounts and execute trades from anywhere with an internet connection, enhancing convenience and flexibility.

- Social Trading: Platforms like eToro enable traders to connect with others, share strategies, and copy experienced traders’ trades.

Expert Insights and Proven Tips for Trading Success

To enhance your currency trading journey, here are some invaluable tips and expert advice:

- Define Your Strategy: Develop a trading plan outlining your goals, risk tolerance, and entry and exit strategies.

- Risk Management: Use stop-loss orders to limit potential losses and protect your capital.

- Stay Updated: Constantly monitor market news and economic indicators that may impact currency exchange rates.

Your Gateway to Financial Empowerment: FAQs on Open Currency Trading Accounts

Frequently Asked Questions

- What are the minimum requirements to open a currency trading account?

Typically, a valid government-issued ID, proof of residence, and a minimum deposit are required. - How much money do I need to start trading?

While minimum deposits may vary, it’s recommended to start with a comfortable amount that aligns with your risk appetite. - What are the risks involved in currency trading?

As with any investment, currency trading involves risks. Fluctuations in exchange rates can result in losses, which can exceed your initial investment. - How do I choose a reliable currency trading broker?

Look for a regulated broker with a solid reputation, competitive spreads, and a user-friendly platform.

Open Currency Trading Account

Conclusion: Embark on the Currency Trading Journey

Opening a currency trading account is a passport to a world of financial possibilities. Whether you seek to supplement your income, grow your wealth, or simply explore the exciting world of trading, I encourage you to take the first step today.

Remember, trading involves risks, but with knowledge, preparation, and a sound strategy, you can harness the power of currency markets and achieve your financial goals. I invite you to delve deeper into the world of open currency trading accounts, empowering yourself with the knowledge to make informed decisions and potentially reap the rewards this dynamic market offers.