Introduction

In the realm of financial trading, effective risk management is paramount. Traders constantly seek strategies to mitigate losses and maximize profits, and MT5 close sells code emerges as a potent tool in this pursuit. MT5, a versatile trading platform, offers an array of technical indicators and analytical features, empowering traders to craft sophisticated trading automation strategies. Among these, close sells code stands out as a highly effective mechanism for managing trades and controlling risk. This article will delve into the world of MT5 close sells code, exploring its history, methodology, and practical applications. We will uncover how this code can transform your trading experience, providing valuable insights and actionable strategies.

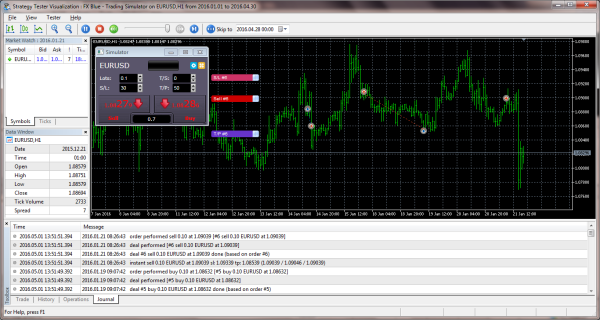

Image: www.mql5.com

Unveiling MT5 Close Sells Code: A Foundation for Success

MT5 close sells code is a specific type of algorithmic trading code designed to automate the closing of sell orders when certain pre-defined conditions are met. These strategies are highly customizable, allowing traders to tailor them to their unique risk tolerance, trading style, and market conditions. At the heart of MT5 close sells code lies a set of parameters, which specify the conditions under which the sell order will be closed. These parameters can include price levels, moving averages, technical indicators, or a combination thereof. By harnessing the power of automation, MT5 close sells code can execute trades instantaneously, removing the element of human error and emotional decision-making.

Historical Evolution: Tracing the Origins of MT5 Close Sells Code

The roots of MT5 close sells code can be traced back to the early days of algorithmic trading. In the 1970s, pioneers in the field developed rudimentary trading systems that relied on predefined rules to automate trade execution. These early systems laid the foundation for modern MT5 close sells code, which has evolved over the years with the advancement of computing power and the proliferation of sophisticated trading platforms. Today, MT5 close sells code is an indispensable tool for traders of all levels, offering a high degree of flexibility, customization, and trading automation.

Practical Applications: Unlocking the Potential of Close Sells Code

The practical applications of MT5 close sells code are vast and varied. Traders can employ this code to implement a diverse range of trading strategies, tailored to their specific objectives. Some popular use cases of MT5 close sells code include:

-

Trailing Stop Loss Protection: Close sells code can be used to implement trailing stop loss orders, which automatically adjust the stop loss level as the market moves in the trader’s favor. This dynamic approach helps protect profits while allowing the trade to run until a pre-defined profit target is reached.

-

Time-Based Exit Strategies: Traders can use close sells code to automate time-based exits from trades. This is particularly useful for swing traders who hold positions for longer periods and wish to exit trades at specific times, regardless of price action.

-

Risk Management: Close sells code can be an effective tool for managing risk. By setting specific closing conditions, traders can mitigate potential losses and protect their trading capital.

Image: teknopre.blogspot.com

Real-World Examples: Success Stories and Case Studies

The effectiveness of MT5 close sells code is evidenced by numerous success stories and case studies. Professional traders worldwide have harnessed the power of this code to automate their trading decisions, leading to significant improvements in their profitability and risk management. One notable example is the “Time-Based Exit EA,” a popular MT5 close sells code that automates trades based on a pre-defined time frame. This EA has gained widespread recognition for its ability to consistently generate profits even in volatile market conditions.

Best Practices for Using Close Sells Code: Maximizing Results

To maximize the effectiveness of MT5 close sells code, traders should adhere to several best practices:

-

Thorough Backtesting: Before deploying close sells code in a live trading environment, traders should diligently backtest the strategy using historical data. This process helps validate the strategy’s performance and identify potential areas for improvement.

-

Optimization and Fine-Tuning: Each trading strategy is unique, and traders should customize and fine-tune their close sells code to suit their individual trading style and risk tolerance. This involves adjusting the input parameters of the code until it aligns precisely with the trader’s objectives.

-

Risk Management: Traders should always employ sound risk management practices when using MT5 close sells code. This includes setting appropriate stop loss levels, managing position size, and diversifying trading strategies.

Mt5 Close Sells Code

Conclusion

MT5 close sells code is a powerful tool that can transform the trading experience. By automating the closing of sell orders based on pre-defined conditions, traders can improve their risk management, enhance their trading strategies, and maximize their profitability. However, it is essential to remember that successful trading requires a combination of technical expertise, knowledge of the markets, and a disciplined approach. Traders who effectively harness the power of MT5 close sells code, while adhering to best practices and principles, stand to gain a significant edge in the highly competitive world of financial trading.