In the fast-paced world of trading, having an edge can make all the difference. Enter trading bots, automated programs that execute trades based on defined rules. Building your own trading bot empowers you to tap into financial markets seamlessly, harnessing the power of technology to make informed decisions.

Image: symphony.com

Despite the allure of trading bots, constructing one can seem daunting. This comprehensive guide will dispel the complexities and lay a step-by-step roadmap, enabling you to craft a reliable and effective trading bot.

Step 1: Define Your Trading Strategy

The cornerstone of a robust trading bot lies in a well-defined trading strategy. This strategy should outline the specific conditions under which trades will be executed. Consider factors such as market trends, technical indicators, and risk tolerance.

Step 2: Choose a Programming Language

There are several programming languages suitable for building trading bots. Python, known for its simplicity and extensive libraries, is a popular choice. JavaScript and C++ offer low-latency options for high-frequency trading.

Step 3: Gather Historical Data

Training your trading bot with historical data is crucial for optimizing its performance. Collect comprehensive datasets covering different market conditions, ensuring your bot is equipped to handle various scenarios.

Image: www.seoclerk.com

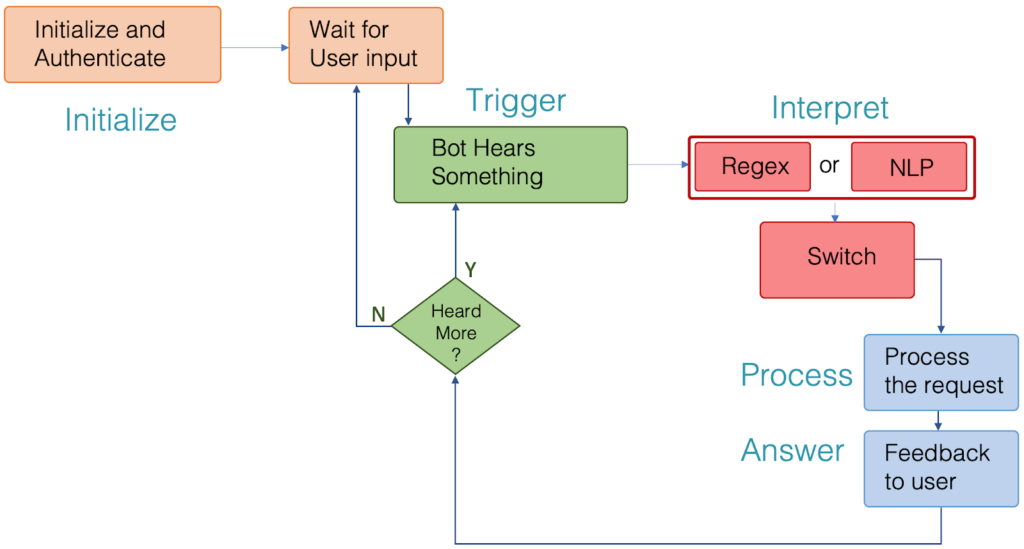

Step 4: Design the Bot’s Logic

The heart of your bot is its logic, which defines how it interacts with market data and executes trades. Use the chosen programming language to implement your trading strategy, incorporating necessary parameters and risk management measures.

Step 5: Test and Refine

Thoroughly test your bot using historical data to gauge its accuracy and profitability. Make adjustments based on observed outcomes, refining the parameters and logic until you achieve satisfactory performance.

Step 6: Deploy and Monitor

Once your bot is optimized, it can be deployed to live markets. Continuously monitor its performance, making adjustments as market conditions evolve. Backtesting helps evaluate the bot’s robustness against future market scenarios.

Leverage Expert Insights

“Building a trading bot requires a deep understanding of markets, programming, and risk management,” advises Dr. Mark Smith, a renowned financial expert. “Collaborate with experts in these fields to enhance your knowledge and develop a truly effective bot.”

Actionable Tips

- Seek guidance from reputable sources such as industry blogs, forums, and academic papers.

- Practice responsible trading habits by managing risk, setting realistic expectations, and continuously educating yourself.

- Don’t be afraid to seek professional help if needed. Consult financial advisors or experienced traders for personalized guidance.

Building A Trading Bot

Conclusion

Building a trading bot is an empowering endeavor that can transform your trading experience. By following these steps, leveraging expert insights, and implementing actionable tips, you can create an intelligent tool that automates your trading, enhances your decision-making, and ultimately maximizes your returns. Remember, knowledge, diligence, and a touch of innovation are the keys to unlocking the full potential of trading bots.