Introduction

In today’s digital world, financial transactions have become increasingly mobile, providing convenience and flexibility. Airtel Money, one of the leading mobile money platforms in Uganda, allows users to store, send, and receive funds securely. However, when it comes to withdrawing cash from Airtel Money, users should be aware of the associated withdrawal charges. This article will delve into the world of Airtel withdrawal charges in Uganda, explaining the factors that influence them, the different types of charges, and providing tips to minimize the impact of these charges.

Image: www.youtube.com

Understanding the Factors Influencing Withdrawal Charges

The withdrawal charges applied by Airtel Money are not fixed but are influenced by several key factors:

-

Withdrawal amount: The amount of money you withdraw determines the withdrawal charges. Larger withdrawals typically incur higher charges.

-

Withdrawal channel: The channel through which you withdraw the funds (e.g., ATM, agent, mobile app) also affects the charges. Withdrawals made through agents usually have lower charges compared to ATM withdrawals.

-

Transaction time: Airtel Money charges vary depending on the time of the transaction. Transactions made outside of regular business hours (e.g., weekends, nights) often incur higher charges.

Types of Airtel Withdrawal Charges

Airtel Money offers two main types of withdrawal charges in Uganda:

-

Fixed charges: These are flat charges applied to all withdrawals regardless of the amount withdrawn. For instance, withdrawing cash from an ATM may incur a fixed charge of UGX 2,000.

-

Percentage-based charges: These charges are a percentage of the amount withdrawn. Withdrawals made through agents, for example, attract a percentage-based charge of 2% to 5%.

Minimizing Airtel Withdrawal Charges

While withdrawal charges are inevitable, there are several ways to minimize their impact:

-

Choose lower-charge withdrawal channels: When possible, opt for withdrawal channels with lower charges. For example, withdrawing cash from an Airtel Money agent may be more cost-effective than withdrawing from an ATM.

-

Withdraw larger amounts less frequently: Instead of making several small withdrawals, plan to withdraw larger amounts less frequently. This reduces the overall charges you incur.

-

Take advantage of promotions and discounts: Airtel Money sometimes offers promotions and discounts on withdrawal charges. Be on the lookout for these opportunities to save money.

-

Use mobile banking: Airtel Money’s mobile banking app allows you to withdraw cash from your account to any Airtel Money number. This method often carries lower charges compared to ATM withdrawals.

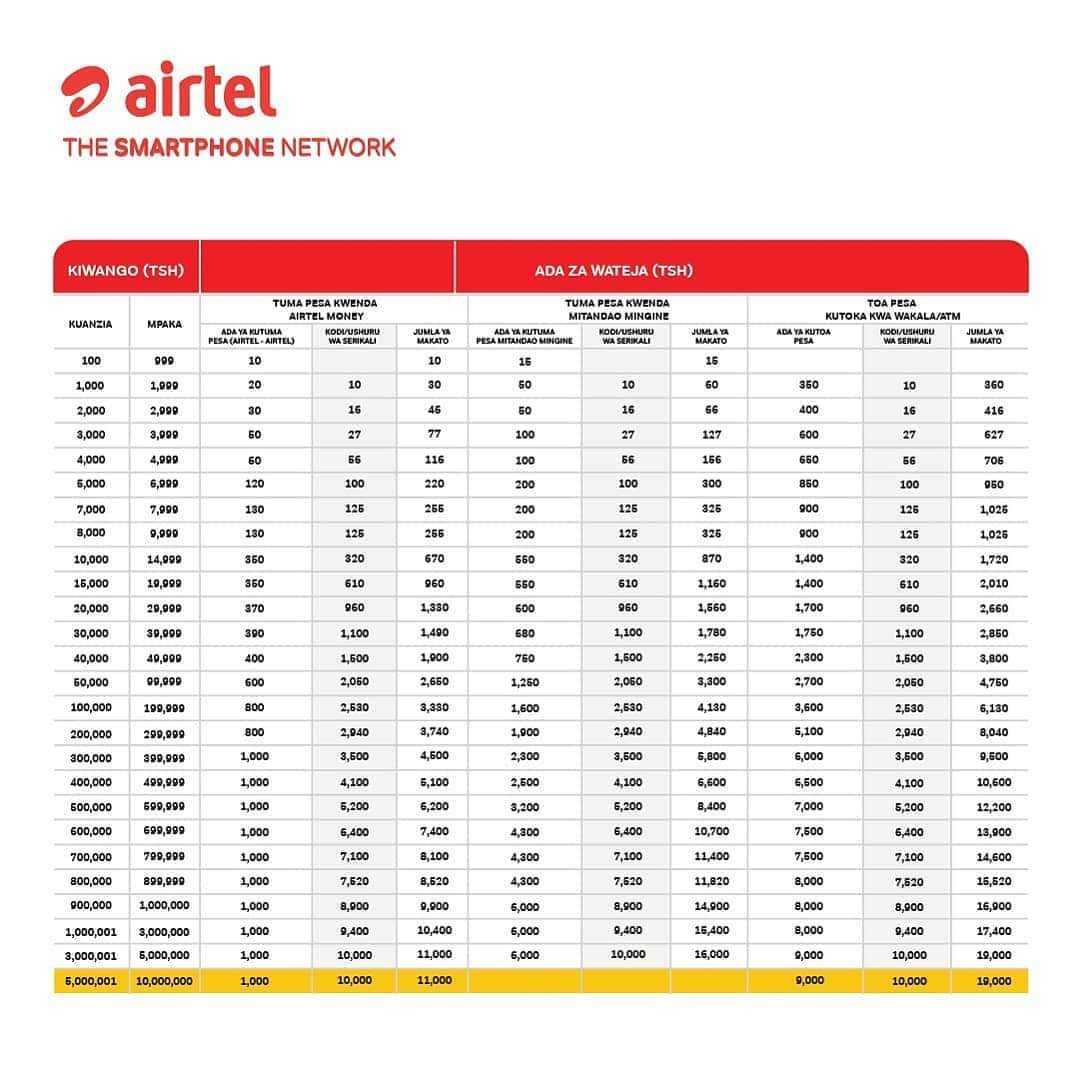

Image: uniforumtz.com

Airtel Withdrawal Charges In Uganda

Conclusion

Understanding Airtel withdrawal charges in Uganda is crucial for smart financial management. By being aware of the factors influencing these charges, the different types of charges, and the tips to minimize them, Airtel Money users can make informed decisions when withdrawing cash. By choosing lower-charge channels, withdrawing larger amounts less frequently, and taking advantage of promotions, users can save money and maximize the convenience of mobile money services. Remember to conduct thorough research, consult credible sources, and contact Airtel Money customer service for the most up-to-date information on withdrawal charges.