Introduction

Image: datalya.com

In the dynamic tapestry of financial markets, indices serve as crucial tools for investors and analysts to gauge market performance and make informed decisions. Among the multitude of indices available, price-weighted indices hold a prominent position, offering valuable insights into market trends and sentiment. This guide delves into the intricacies of price-weighted indices, empowering you with the knowledge to navigate financial complexities with confidence.

What is a Price-Weighted Index?

At its core, a price-weighted index is a stock market index that measures the performance of a group of stocks based solely on their prices. Each stock’s contribution to the index is determined by its price, regardless of the number of shares outstanding. This simple yet effective methodology provides a straightforward representation of price movements within the index.

Understanding Price-Weighted Indices

The calculation of a price-weighted index involves a straightforward process. Each stock in the index is assigned a weight proportional to its price. The aggregate price of all stocks in the index is then divided by the sum of the weights. The resulting value represents the index’s level at any given time.

For instance, if an index consists of two stocks, Stock A priced at $50 and Stock B priced at $100, the index value would be calculated as:

Index Value = (50 x 1 + 100 x 1) / (1 + 1) = $75

Advantages of Price-Weighted Indices

Price-weighted indices offer several advantages:

- Transparency: Their calculation is straightforward and easy to understand, making them accessible to investors of all levels.

- Historical Significance: Price-weighted indices have been in use for decades, providing a long-term perspective on market trends.

- Simplicity: They focus solely on price movements, excluding factors such as market capitalization or dividends, which can be complex to interpret.

Limitations of Price-Weighted Indices

While useful, price-weighted indices have limitations to consider:

- Market Dominance: They can be heavily influenced by high-priced stocks, which can skew their representation of overall market performance.

- Inability to Reflect Market Capitalization: They ignore the size of companies, meaning small-cap stocks have the same weight as large-cap stocks.

- Sensitivity to Extreme Price Changes: They can be overly reactive to sharp price movements in individual stocks.

Expert Insights and Actionable Tips

Financial experts recommend the following insights and tips when using price-weighted indices:

- Consider Alternative Indices: Price-weighted indices should not be the sole determinant for investment decisions. Consider also using market-capitalization-weighted indices to complement your analysis.

- Understand the Biases: Be aware of the potential biases introduced by price weighting and adjust your interpretations accordingly.

- Focus on Long-Term Trends: Price-weighted indices provide better insights into long-term trends than short-term fluctuations.

Conclusion

Price-weighted indices are essential analytical tools in the financial world, offering a simple yet effective way to track market performance. By understanding their principles, advantages, and limitations, investors can harness the power of these indices to make informed decisions and navigate the financial markets with confidence. Remember, the pursuit of financial knowledge is an ongoing journey, and by exploring further resources and engaging with experts, you can master the intricacies of price-weighted indices and empower yourself in the financial arena.

Image: www.economicsdiscussion.net

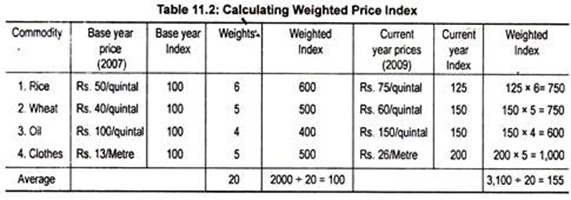

How To Calculate Price Weighted Index