If you are on the edge of comprehending the intriguing world of synthetic indices trading, this extensive guide will equip you with all you need to get started. Whether you’re a seasoned trader yearning to increase your expertise or a novice eager to explore new trading horizons, this detailed article will empower you with the knowledge and strategies to navigate the dynamic market of synthetic indices.

Image: studylib.net

Synthetic Indices: An Introduction

Synthetic indices are artificial financial tools that mimic the performance of underlying assets such as stocks, bonds, commodities, or currencies. They are created by financial institutions and offer a convenient and cost-effective alternative to trading the actual underlying assets. Unlike traditional indices that are calculated based on the average of their components’ prices, synthetic indices are derived from complex mathematical models and algorithms.

One of the key features of synthetic indices is that they allow traders to access markets that may otherwise be inaccessible or difficult to trade. For example, synthetic indices based on foreign markets or exotic assets often provide a more accessible entry point for investors who lack the resources or expertise to trade in those markets.

Trading Synthetic Indices: Strategies and Techniques

Trading synthetic indices involves developing a sound understanding of the underlying assets’ behavior and market dynamics. Here are some fundamental strategies to consider:

- Trend following: Track the overall trend of the underlying assets and enter trades in line with the trend’s direction.

- Mean reversion: Identify potential reversals in price direction and place trades based on the expectation that the underlying assets will revert to their historical mean.

- Pairs trading: Trade two highly correlated synthetic indices simultaneously, profiting from the spread between their prices.

- Arbitrage: Capitalize on price discrepancies between synthetic indices and the corresponding underlying assets.

Navigating the Regulatory Landscape

Before engaging in synthetic indices trading, it’s crucial to familiarize yourself with the regulatory landscape governing these products. Regulatory bodies in different jurisdictions have established guidelines to protect investors and ensure market integrity. It’s essential to ensure that your broker is licensed and regulated and to comply with all applicable laws and regulations.

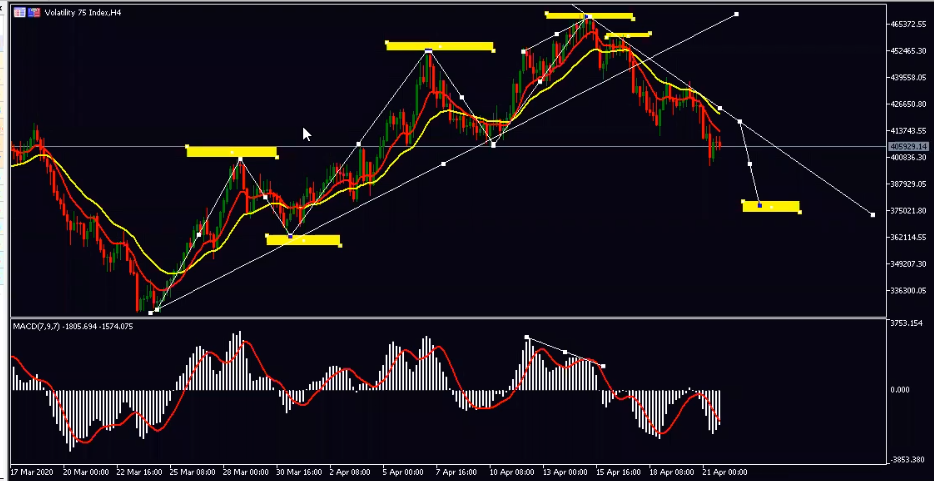

Image: forexbrainbox.com

Expert Tips for Trading Synthetic Indices

To enhance your chances of success in synthetic indices trading, consider these expert tips:

- Choose a reputable broker: Select a brokerage that offers robust trading instruments, real-time market data, and educational resources to support your trading endeavors.

- Understand the underlying assets: Acquire a thorough understanding of the underlying assets of the synthetic indices you trade, as their price movements directly impact your trades.

- Manage risk effectively: Implement prudent risk management strategies such as stop-loss orders and position sizing to limit potential losses.

- Stay updated with market news and analysis: Monitor financial news, economic data releases, and market commentary to stay informed about potential market-moving events.

FAQ on Synthetic Indices Trading

- Q: What are the benefits of trading synthetic indices?

A: Synthetic indices offer cost-effective exposure to underlying assets, provide access to otherwise inaccessible markets, and allow for diversified trading strategies. - Q: Is trading synthetic indices risky?

A: Like any financial trading, synthetic indices trading involves risk. It’s essential to understand the risks involved and implement sound risk management practices. - Q: What are the regulatory considerations for synthetic indices trading?

A: Regulatory guidelines vary across jurisdictions. Ensure that your broker is licensed and compliant with the regulations applicable in your region. - Q: How can I learn more about synthetic indices trading?

A: Numerous resources are available online, including articles, tutorials, and webinars. Additionally, you can seek guidance from experienced traders or financial professionals.

How To Trade Synthetic Indices

Conclusion

Trading synthetic indices can provide new avenues for portfolio diversification and profit potential. By embracing a comprehensive understanding of the topic, implementing robust trading strategies, and adhering to best practices, you can navigate the synthetic indices market with greater confidence. Stay informed, embrace continuous learning, and explore this dynamic trading domain to unlock its rewards.

Is the topic of trading synthetic indices resonating with you? Share your thoughts and experiences in the comments section, and let’s continue exploring the world of synthetic indices together.