When navigating the tumultuous waters of financial markets, traders seek an unwavering compass to guide their decisions. Amidst a sea of technical analysis tools, price action analysis stands tall, offering a time-tested approach to understanding market behavior. In this comprehensive guide, we delve into the nuances of price action trend trading, equipping you with the knowledge and insights to master this powerful technique. Our downloadable PDF provides a coherent and structured roadmap for aspiring traders seeking to harness the power of price trends.

Image: www.khanbooks.net

Unveiling the Timeless Allure of Price Trends

At its core, price action analysis centers on identifying and capitalizing on recurring patterns in market prices. As the adage goes, “The trend is your friend,” and price trends often offer valuable clues about the direction in which an asset is likely to move. By deciphering these patterns, traders gain a significant edge in predicting future price movements and maximizing their trading profits.

Essential Elements of Price Action Trading

The foundation of price action trading rests upon several key elements, each playing a pivotal role in uncovering market trends:

-

Candlesticks: A Visual Masterpiece

Candlesticks, with their vibrant colors and distinctive shapes, paint a vivid tableau of market sentiment. Each candlestick encapsulates a wealth of information, including the open, close, high, and low prices during a specific time interval. By studying candlestick charts, traders can discern potential trend reversals, continuation patterns, and critical support and resistance levels.

-

Image: www.cmcmarkets.comMoving Averages: Smoothing Out the Noise

Moving averages, like diligent accountants, smooth out price fluctuations, revealing the underlying trend. By calculating the average prices over a specified period, moving averages filter market noise and provide a clearer representation of the overall market direction.

-

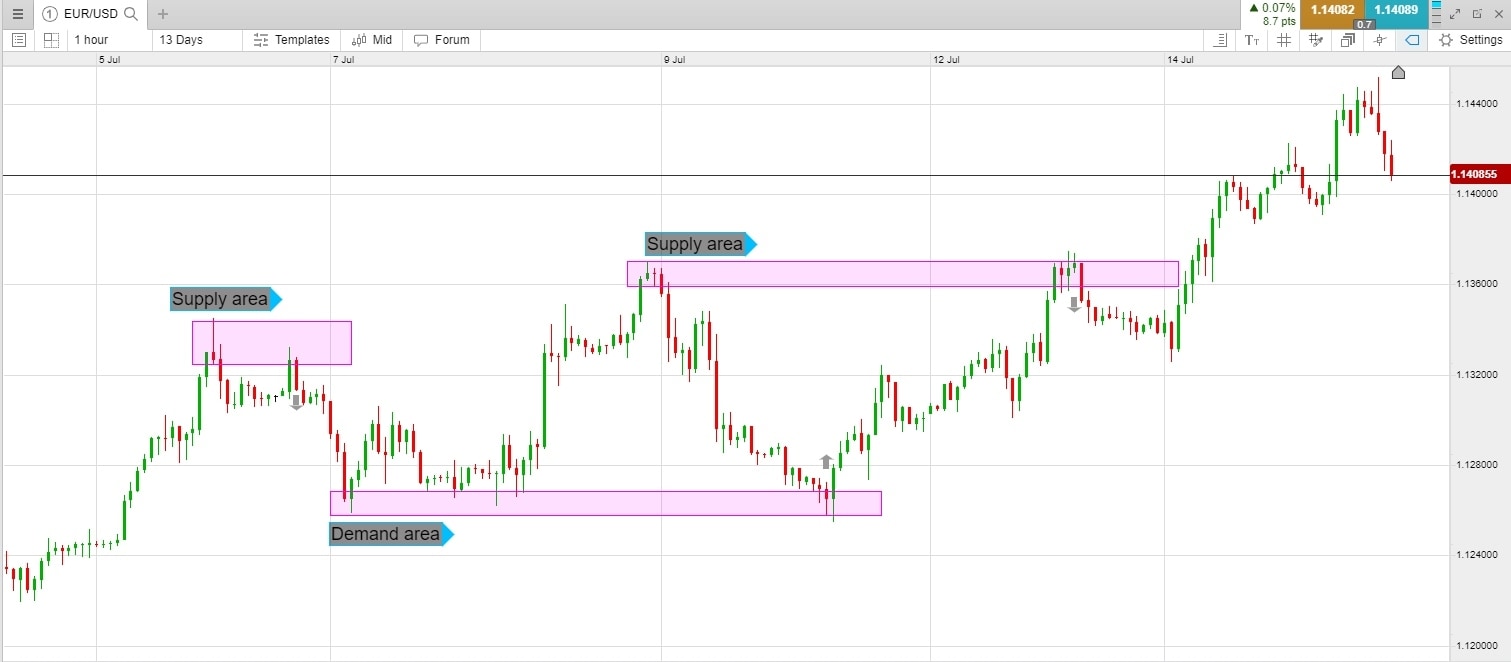

Support and Resistance: Defining the Battlefield

Support and resistance levels, akin to invisible barriers, signify areas where prices have difficulty breaking through. Support marks a price level below which prices tend to bounce, while resistance indicates a level above which prices struggle to rise. Identifying these levels allows traders to anticipate potential price reversals and plan their trading strategies accordingly.

Harnessing Price Action Trends for Trading Success

Empowered with the essential knowledge, traders can now embark on the path to trading price action trends effectively:

-

Trend Identification: Spotting the Trend Giants

Identifying trends is the cornerstone of price action trading. Traders meticulously scrutinize price charts, searching for consecutive higher highs and higher lows in uptrends or lower lows and lower highs in downtrends. These patterns signal the presence of a trend and provide valuable insights into market momentum.

-

Trend Confirmation: Seeking Validation

After identifying a potential trend, traders seek confirmation to bolster their conviction. This confirmation can come from various sources, such as the alignment of multiple moving averages, the breakout of a support or resistance level, or a divergence between price action and momentum indicators.

-

Trend Trading Strategy: Riding the Waves of Momentum

Armed with confirmation, traders can craft a trend trading strategy tailored to their risk tolerance and trading style. This strategy should outline entry and exit points, trade management techniques, and risk control measures. The goal is to capitalize on the trend’s momentum while minimizing potential losses.

Unleashing the Power of Our Comprehensive Trading Price Action Trends PDF

Complementing this guide, our downloadable PDF delves even deeper into the intricacies of price action trend trading, providing a comprehensive resource for traders of all experience levels. Within its pages, you will find:

-

A Step-by-Step Blueprint for Trend Trading Mastery

Our PDF unveils a structured roadmap, guiding you through each stage of the trend trading process, from identifying trends to executing profitable trades.

-

Real-World Trading Examples: From Theory to Practice

To bridge the gap between theory and practice, this PDF showcases real-world trading examples, demonstrating how to apply price action trading principles in live market conditions.

-

Advanced Techniques for Enhanced Accuracy

For ambitious traders seeking the next level, our PDF unveils advanced techniques, such as harmonic trading patterns and Elliott wave analysis, to refine your trend trading prowess.

-

Risk Management Strategies for Prudent Trading

Recognizing the paramount importance of risk management, this PDF emphasizes sound risk management strategies, empowering you to protect your trading capital and navigate market volatility.

Trading Price Action Trends Pdf

Embark on Your Trading Journey with Confidence

Whether you are a seasoned trader or just starting your journey into the world of price action trading, this guide and our downloadable PDF will equip you with the knowledge and insights to navigate the market’s ebb and flow with confidence. By mastering price trend trading, you not only enhance your trading skills but also gain a deeper understanding of financial markets, empowering you to seize opportunities and navigate challenges with unwavering conviction.