Introduction

In the vast expanse of the foreign exchange (forex) market, traders navigate a complex world of currencies, spreads, and leverage. Among the pivotal tools at their disposal is the EUR/USD lot size calculator, a crucial instrument that empowers them to determine the precise size of their trades. In this comprehensive guide, we will delve into the intricacies of the EUR/USD lot size calculator, equipping you with the knowledge and expertise to trade the world’s most popular currency pair with confidence.

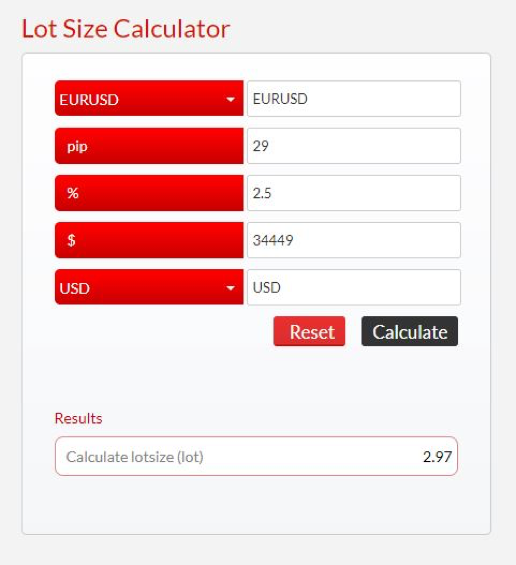

Image: forextraininggroup.com

Understanding the EUR/USD Lot Size

Before delving into the calculator’s functionality, let’s first establish a firm understanding of the EUR/USD lot size. In the forex market, a lot represents a standardized unit of currency. The standard lot size for the EUR/USD pair is €100,000, signifying that each trade executed involves this exact amount. However, for those with varying risk tolerances and capital levels, smaller lot sizes known as micro lots (€1,000) and mini lots (€10,000) are also available.

Enter the EUR/USD Lot Size Calculator

The EUR/USD lot size calculator, available online or as a standalone application, emerges as an indispensable tool for traders seeking to mitigate risk and maximize efficiency. Its user-friendly interface empowers traders to input key parameters, including the desired lot size, currency pair, and leverage, to precisely calculate the value of their trades in both euros and U.S. dollars.

Navigating the Calculator’s Parameters

-

Lot Size: Specify the desired lot size (standard, mini, or micro) based on your trading strategy and risk tolerance.

-

Currency Pair: Indicate that you’re trading the EUR/USD currency pair.

-

Leverage: Input the leverage employed for the trade. Leverage, expressed as a ratio (e.g., 1:100), amplifies both profits and losses, so cautious use is paramount.

-

Trade Value: The calculator automatically computes the trade value based on the specified parameters, displaying it in both euros and U.S. dollars.

Image: www.youtube.com

Benefits of Using the Calculator

The EUR/USD lot size calculator offers a plethora of benefits for both novice and experienced traders:

-

Risk Management: By determining the exact value of trades, traders can meticulously calculate potential profits and losses, tailoring their risk exposure to match their trading objectives.

-

Efficiency: The calculator streamlines the trade execution process by eliminating manual calculations, saving traders precious time and minimizing the risk of errors.

-

Informed Decision-Making: The calculator fosters informed trading decisions by providing a clear understanding of the trade’s monetary implications, enabling traders to weigh risk-to-reward scenarios more effectively.

Expert Insights: Maximizing Calculator Usage

Seasoned forex traders offer valuable insights into harnessing the calculator’s full potential:

-

Tailor Leverage to Your Risk Tolerance: Evade excessive leverage as it can magnify losses; instead, align leverage with your risk appetite for sustainable trading.

-

Monitor Market Conditions: Keep abreast of market volatility and adjust lot sizes accordingly. Increased volatility warrants smaller lot sizes to mitigate risk, while stable market conditions allow for larger trades.

-

Consider Trading Psychology: Factor in your emotional state and avoid impulsive trades under intense market conditions. Maintaining a calm and composed demeanor is paramount for sound decision-making.

Eur Usd Lot Size Calculator

Conclusion

The EUR/USD lot size calculator emerges as an invaluable tool for traders navigating the forex market’s complexities. By empowering them to accurately determine the monetary value of their trades, the calculator promotes risk management, efficiency, and informed decision-making. Embrace this powerful tool and embark on your forex trading journey with a clear understanding of the risks and rewards. Remember, consistent learning and a strategic mindset are the keys to long-term success. Stay vigilant, trade wisely, and unlock the boundless opportunities of the global foreign exchange market.