In the fast-paced world of forex trading, volatility can often be a double-edged sword. While high volatility can present lucrative opportunities for experienced traders, it also comes with increased risk. For those seeking a more stable trading experience, understanding the least volatile forex pairs is crucial. In this comprehensive guide, we delve into the world of low-volatility currencies, exploring their characteristics, benefits, and strategies for successful trading.

Image: currency.com

Understanding Forex Volatility

Forex volatility measures the extent to which the exchange rate of a currency pair fluctuates over a period of time. It is typically expressed as a percentage and can vary widely depending on various economic, political, and market factors. High volatility indicates that the exchange rate is experiencing significant fluctuations, while low volatility suggests a more stable price movement.

The Importance of Low Volatility

Low-volatility forex pairs offer traders several advantages. Firstly, they can minimize potential losses. When volatility is low, the exchange rate is less likely to experience sudden and drastic movements, reducing the risk of significant drawdowns. Secondly, lower volatility can lead to more consistent profits. Stable price movements allow traders to hold positions for longer periods, increasing the likelihood of profitable trades. Thirdly, low-volatility pairs can be more accessible to beginner traders who may not have the experience or risk tolerance to handle highly volatile markets.

Identifying Low-Volatility Pairs

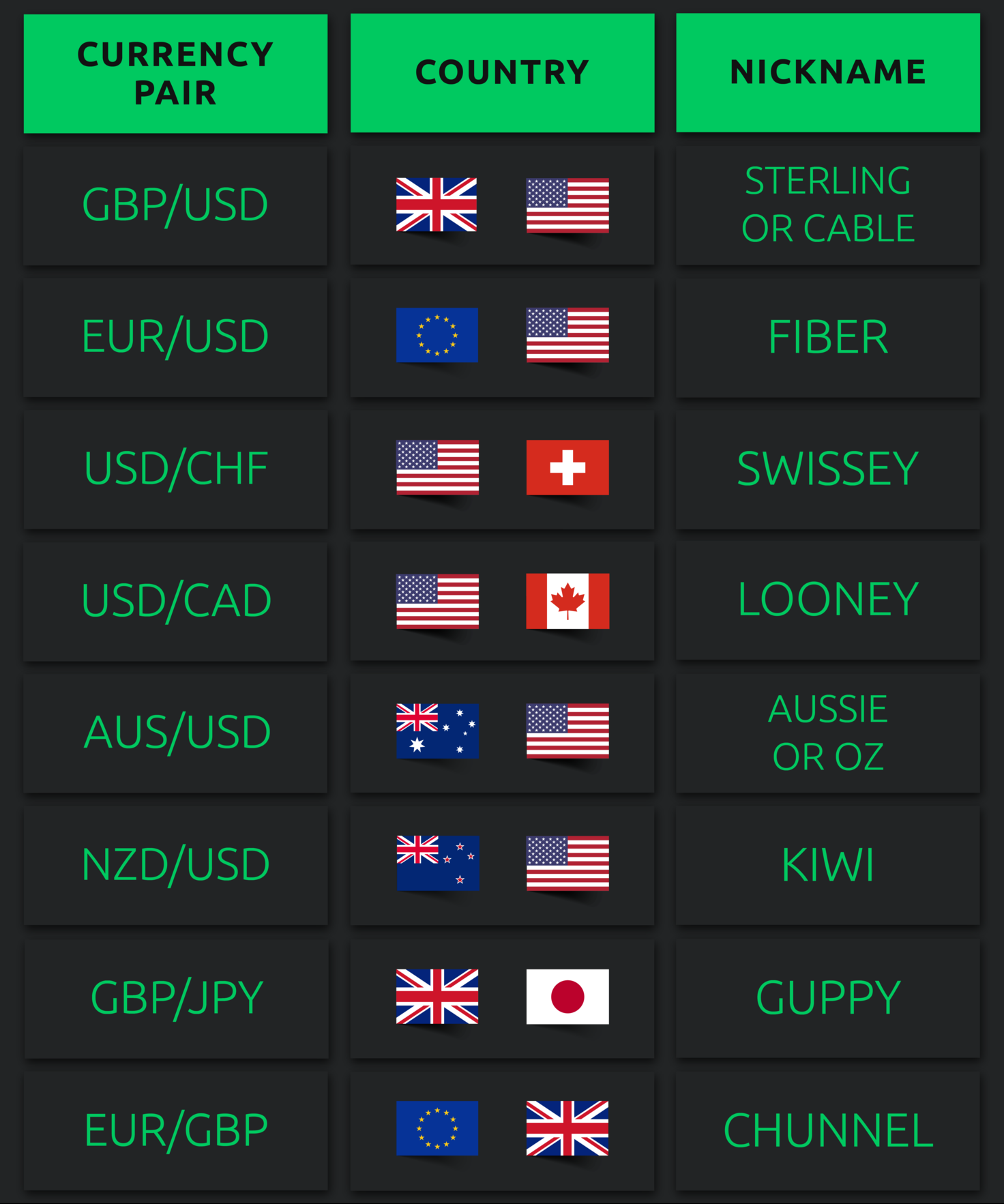

The following forex pairs are generally considered to be the least volatile:

- USD/CHF (US Dollar/Swiss Franc)

- EUR/CHF (Euro/Swiss Franc)

- AUD/NZD (Australian Dollar/New Zealand Dollar)

- GBP/JPY (British Pound/Japanese Yen)

- EUR/AUD (Euro/Australian Dollar)

These pairs consist of currencies from countries with stable economies and limited political risk. They also tend to have relatively low interest rate differentials, which can contribute to lower volatility.

Image: indicatorchart.com

Trading Strategies for Low Volatility Pairs

Trading low-volatility forex pairs requires a different approach than trading highly volatile pairs. Here are some strategies to consider:

- Long-term investing: Given their stable nature, low-volatility pairs are well-suited for long-term investments. Traders can buy and hold these pairs over months or even years, aiming for gradual appreciation.

- Carry trading: Carry trading involves borrowing in a currency with a low interest rate and investing in a currency with a higher rate. This strategy can generate profit from the interest rate differential, and low-volatility pairs can be ideal for this purpose due to their relatively stable exchange rates.

- Range trading: Range trading involves identifying a specific price range within which a currency pair is trading. Traders then buy at the bottom of the range and sell at the top, profiting from the repeated price fluctuations. Low-volatility pairs are often confined to well-defined ranges, making them suitable for this strategy.

Least Volatile Forex Pairs

Conclusion

In the realm of forex trading, understanding the least volatile forex pairs can open doors to stable and profitable opportunities. By choosing pairs with low volatility, traders can minimize risk, generate consistent returns, and tailor their strategies accordingly. Whether you are a beginner seeking a more manageable trading experience or an experienced trader looking to diversify your portfolio, the least volatile forex pairs offer a path towards stable success in the ever-fluctuating forex market.