Introduction

The journey into the captivating realm of financial trading inevitably leads us to grapple with the enigmatic concept of position sizing. Determining the optimal number of shares, contracts, or lots to purchase or sell can be a daunting task, especially when navigating the dynamic terrain of indices. Understanding the delicate balance between risk tolerance and profit potential is paramount, and this is where the indispensable tool known as the Position Sizing Calculator for Indices emerges.

Image: www.rebatekingfx.com

In this comprehensive guide, we will delve into the intricate intricacies of the Position Sizing Calculator for Indices, exploring its profound implications for successful trading outcomes. With a focus on clarity and accessibility, we will unveil the concepts, strategies, and real-world applications that empower traders to wield this powerful tool effectively.

Unveiling the Position Sizing Saga

The Position Sizing Calculator for Indices serves as a guiding compass for traders, providing precise insights into the appropriate trade size for any given scenario. This invaluable tool hinges upon two fundamental variables:

-

Risk Tolerance: Representing the trader’s willingness to withstand potential financial setbacks, risk tolerance dictates the maximum acceptable loss that a trader is prepared to endure.

-

Expected Volatility: Quantifying the anticipated price fluctuations of the index being traded, volatility measures the extent to which the index’s value can deviate from its current level, providing a gauge of its inherent risk.

By harmoniously synthesizing these two critical parameters, the Position Sizing Calculator for Indices enables traders to ascertain the ideal trade size that optimally aligns with their risk appetite and the prevailing market conditions.

Harnessing the Calculator’s Wizardry: A Practical Approach

Embarking on the path of utilizing the Position Sizing Calculator for Indices requires a systematic approach. Here’s a concise guideline to ensure proficient exploitation of this analytical treasure:

-

Determining Risk Tolerance: Establishing one’s risk tolerance is crucial. Commence by assessing personal financial circumstances, including income, expenses, and investment goals. A general rule of thumb suggests risking no more than 1-2% of your trading capital per trade.

-

Estimating Expected Volatility: To gauge anticipated volatility, traders can consult historical price data or employ volatility indicators such as Bollinger Bands, Keltner Channels, or Average True Range (ATR). These technical tools provide invaluable insights into the index’s historical price behavior, helping traders make informed volatility estimates.

-

Plugging in the Parameters: With risk tolerance and expected volatility in hand, input these values into the Position Sizing Calculator for Indices. The calculator will then compute the recommended number of shares, contracts, or lots to trade while adhering to the specified risk parameters.

Positioning for Triumph: Strategies and Techniques

Proficiency in utilizing the Position Sizing Calculator for Indices serves as a foundation for effective trading strategies:

-

Fixed Percentage of Account: Allocate a predetermined percentage of one’s trading capital to each trade. This strategy simplifies risk management and promotes consistency.

-

Volatility-Based Sizing: Adjust trade size dynamically based on the prevailing volatility of the index being traded. Higher volatility warrants smaller positions, while lower volatility permits larger positions with the same risk profile.

-

Multiple Trade Strategy: Divide the desired trade size into smaller, incremental positions and enter the market at different price levels. This strategy, known as a scaling-in approach, can improve risk management and increase profit potential.

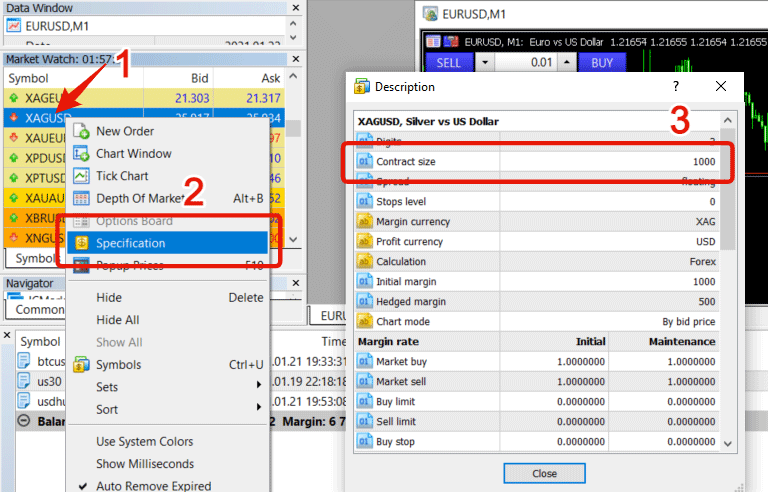

Image: www.researchgate.net

Indices Position Size Calculator

Conclusion

The Position Sizing Calculator for Indices empowers traders with an unparalleled tool to navigate the intricacies of index trading with precision and confidence. By harnessing the insights provided by this invaluable tool, traders can optimize trade sizes, mitigate risk, and amplify profit potential. Remember, consistent research, patience, and discipline remain the cornerstones of successful trading, and the Position Sizing Calculator for Indices serves as a powerful ally in this ongoing endeavor.