Image: www.logoskill.com

Introduction:

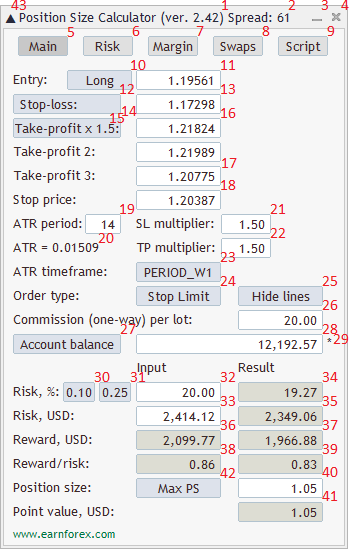

In the dynamic world of trading, where risks and rewards intertwine, determining the optimal position size is a crucial skill. Position size calculator indices empower traders with the ability to assess risk, manage their exposure, and maximize potential returns. Embark on this comprehensive guide to unlock the knowledge and strategies behind these essential tools.

Navigating Position Size Calculator Indices

Position size calculator indices are formulas that assist traders in calculating the appropriate size of their investments, based on factors such as risk tolerance, account balance, and volatility. Understanding these indices ensures informed trading decisions, helping traders avoid excessive risk while maximizing profit potential.

These indices typically incorporate a range of variables, including:

- Mark risk tolerance: The maximum percentage of equity traders are willing to risk per trade.

- Account balance: The available capital for trading.

- Margin requirement: The amount required as collateral when using leverage.

- Volatility: A measure of the price fluctuations of an asset.

Types of Position Size Calculator Indices

Various position size calculator indices exist, each with unique risk-to-reward profiles. Some common indices include:

- Fixed Fraction: Based on a fixed percentage of an account’s balance, regardless of volatility.

- Kelly Criterion: Considers volatility to adjust the position size based on the expected return.

- Relative Strength Index: Uses technical analysis to gauge market sentiment and determine appropriate position sizes.

- Volatility-Based: Adjusts the position size based on the current volatility of an asset.

Empowering Traders with Expert Insights

“Mastering position size calculation is akin to having a superpower in the trading arena,” says renowned trader John Carter. “It allows you to gauge risk, maximize potential returns, and trade with confidence.”

Trading experts emphasize the significance of using position size calculator indices in tandem with sound trading strategies. By integrating these calculations, traders can:

- Optimize Risk Management: Limit losses and protect their capital against adverse market movements.

- Maximize Capital Efficiency: Allocate capital effectively, ensuring sufficient resources for trades with high potential returns.

- Manage Emotions: Avoid trading based on fear or irrational decisions, enabling clear and disciplined execution.

Conclusion

Position size calculator indices are invaluable tools that empower traders with informed decision-making. By harnessing these indices and integrating expert insights, traders can effectively navigate the financial markets, mitigate risks, and enhance their trading performance. Remember, knowledge is power, and leveraging these tools will unlock your potential for success.

Image: www.priceactionlab.com

Position Size Calculator Indices