Introduction

In the fast-paced world of foreign exchange (forex) trading, understanding the value of a pip is crucial for every aspiring trader. A pip, the abbreviation for “point in percentage,” represents the smallest increment of price movement in a currency pair. Grasping the pips dynamics is essential for determining potential profits, managing risk, and navigating the complex landscape of forex trading.

Pips: The Currency of Forex Fluctuations

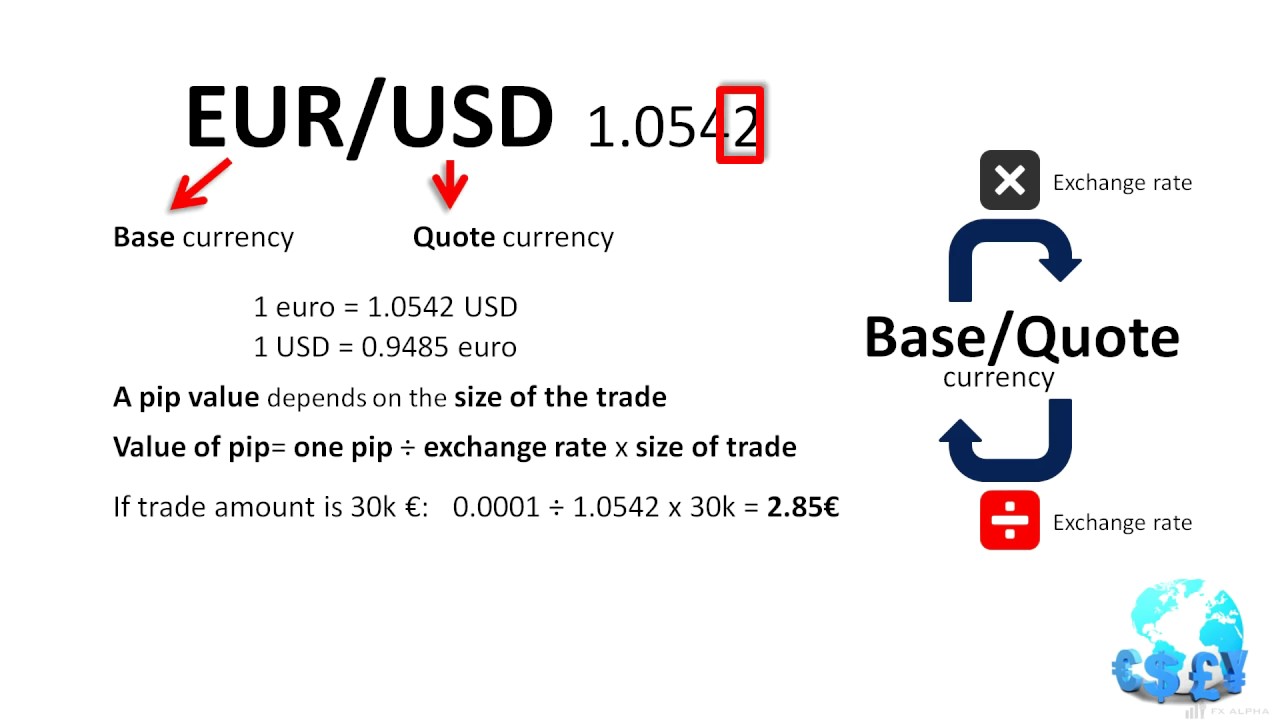

Every currency pair is represented as a ratio between two currencies, with their value constantly fluctuating against each other. A pip is the smallest unit of measurement for these price changes, typically expressed as a four-digit decimal (e.g., 1.2345). The pip value, however, varies depending on the currency pair being traded.

For currency pairs quoted in dollars, such as EUR/USD or GBP/USD, one pip is equal to 0.0001 of the quoted currency. For instance, if the EUR/USD exchange rate moves from 1.2345 to 1.2346, this indicates a price change of one pip, or 0.0001 euros.

Image: blog.dhan.co

In currency pairs that do not include the dollar, the pip value is determined differently. For instance, in the currency pair EUR/JPY, one pip is equal to 0.01 Japanese Yen. Similarly, in GBP/JPY, one pip represents 0.01 Japanese Yen.

Pip Calculation and Implication

Understanding how to calculate pip value is critical for determining potential profits and losses. To compute the pip value for a given currency pair, follow these steps:

- Determine the value of one pip in the quoted currency (0.0001 for dollar-quoted pairs).

- Multiply this value by the contract size (typically 100,000 units of the quoted currency).

For example, if you’re trading a EUR/USD contract with a contract size of 100,000 euros, one pip is worth:

0.0001 (pip value) x 100,000 (contract size) = 10 euros

It’s important to note that pip value can impact the profitability of a trade. The higher the pip value, the greater the potential profit or loss with each pip movement. Conversely, a lower pip value means smaller potential profits and losses.

Pips and Risk Management

Calculating pip value is vital not just for profit potential but also for effective risk management. By determining the pip value for a given trade, you can calculate the potential loss or gain for each pip movement. This information allows you to set appropriate stop-loss and take-profit orders, limiting potential losses and maximizing potential profits.

Image: forexeastoploss.blogspot.com

How Much Is A Pip In Forex

Pips: A Gateway to Forex Trading

Understanding the concept of pips and their value in forex trading is a foundational step for any aspiring trader. By grasping these principles, you can confidently navigate the dynamic forex market, assess risk, and devise a sound trading strategy. Remember, pips are the fundamental units of currency movement, and mastering their value will empower you to make informed decisions and unlock your forex trading potential.