I remember my first time trading forex. I was excited, but also nervous. I didn’t fully understand how to calculate my profits, and it took me a while to find a forex profit calculator that I could trust.

Image: www.bank2home.com

That’s why I’m writing this article. I want to share my knowledge about forex profit calculators and help you avoid the same mistakes I made. In this guide, we’ll explore what a pip is, how to use a forex profit calculator, and some tips for maximizing your pip potential. Let’s dive in!

Pips: The Building Blocks of Forex Profits

A pip, or point in percentage, is the smallest unit of change in a currency pair’s exchange rate. Most currency pairs are quoted to four decimal places, and a pip is the fourth decimal place.

For example, if the EUR/USD exchange rate is 1.1000, a one-pip movement would result in a change to 1.1001. Pips are used to calculate profits and losses in forex trading.

Pip Profit vs Pip Value

Pip profit refers to the total profit gained or lost on a trade, whereas pip value represents the monetary value of each pip movement.

Pip value is calculated based on the trade size and the currency pair being traded. The formula for calculating pip value is: Pip value = (Trade size / Exchange rate) x Pip movement

Forex Profit Calculator: Your Essential Trading Tool

A forex profit calculator is a valuable tool that allows traders to quickly and easily calculate their potential profits or losses. It considers factors such as pip movement, trade size, and exchange rates.

To use a forex profit calculator, simply enter the following information:

- Currency pair

- Trade size (in base currency)

- Exchange rate (at the time of trade entry)

- Target profit or loss (in pips)

The calculator will then display the potential profit or loss in the account currency.

Image: forexrobotnation.com

Expert Tips for Maximizing Pip Potential

Tip 1: Choose the Right Currency Pairs

Pairs with high volatility and liquidity, such as EUR/USD or GBP/USD, can offer greater pip potential.

Tip 2: Use Leverage Sparingly

Leverage can amplify profits, but it can also magnify losses. Use it cautiously and only when appropriate.

Tip 3: Set Realistic Targets

Don’t aim for unrealistic profit goals. Start with modest targets and gradually increase them as you gain experience.

Tip 4: Follow a Trading Plan

A trading plan will help you define your trading goals, risk tolerance, and entry and exit strategies. Stick to it to avoid emotional decision-making.

Tip 5: Manage Your Risk

Use stop-loss orders to limit potential losses and protect your capital.

Tip 6: Practice with a Demo Account

Most forex brokers offer demo accounts, which allow you to practice trading without risking real money. Use these accounts to test your strategies.

FAQ

Q: How often do I need to use a forex profit calculator?

A: It’s recommended to use a calculator every time you enter or exit a trade.

Q: Are there any other factors that affect pip potential?

A: Yes, factors such as market conditions, economic news, and geopolitical events can impact pip movement.

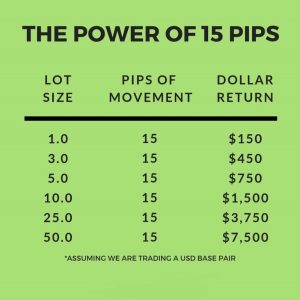

Q: Can I make a profit from small pip movements?

A: Yes, it’s possible to profit from small pip movements by trading larger trade sizes or using leverage. However, it’s important to manage your risk carefully.

Forex Profit Calculator Pips

Conclusion

Understanding pips and using a forex profit calculator are essential skills for successful forex trading. We recommend practicing with a demo account to familiarize yourself with these tools and to develop a sound trading plan before risking real money. With careful planning and execution, you’ll be well on your way to maximizing your pip potential and achieving your trading goals.

Are you interested in learning more about forex profit calculators or maximizing pip potential? Share your thoughts and experiences in the comments below!