Unveiling the Key to Precision in Index Trading

In the fast-paced world of index trading, conquering inconsistencies and achieving profitability is paramount. A vital aspect of this pursuit lies in using an indices lot size calculator. This tool empowers traders with the precision they need to match their trading strategies with market realities, optimizing profits and mitigating risks.

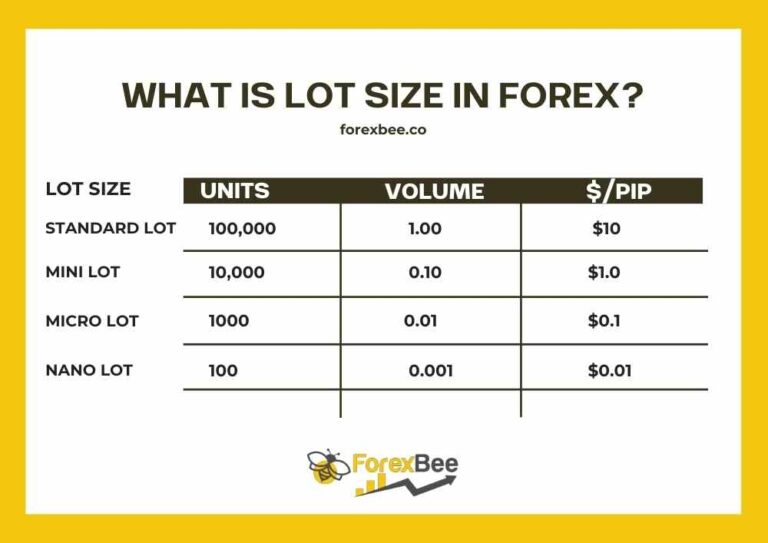

Image: forexbee.co

The Essence of Lot Size and Its Role in Trading

Lot size, in the realm of trading, refers to the predefined number of shares, currencies, or other assets constituting a single unit of trade. Understanding lot size is especially crucial in index trading, where indices represent a collection of stocks or other assets.

Calculating lot size accurately is indispensable for several reasons. It avoids potential missteps in executing trades, ensures an alignment between trading strategy and market conditions, and facilitates optimal risk management by predetermining the potential gain or loss for each trade.

Demystifying Indices Lot Size Calculators

An indices lot size calculator functions as a valuable tool that calculates the number of index units or contracts equivalent to a specific monetary value. This empowers traders to align their trading capital with their desired exposure to the underlying index, thereby maximizing gains.

To effectively utilize this calculator, traders simply enter the desired notional value (exposure or the monetary amount they wish to invest) and the current index value. The calculator promptly delivers the precise number of index contracts to be purchased or sold.

Empowering Traders with Lot Size Optimization

Leveraging an indices lot size calculator grants traders the following advantages:

- Precise Trade Execution: Ensures trades are executed as per the intended monetary exposure, eliminating any miscalculations or discrepancies.

- Well-Informed Decision-Making: Facilitates informed trading decisions by accurately determining the correct number of index contracts to align with the desired investment goals.

- Optimized Risk Management: Precalculates potential profit or loss, allowing traders to make informed decisions about order placement, position sizing, and stop-loss levels.

Image: skymazon.com

Expert Advice and Tips for Effective Lot Size Management

To harness the full potential of lot size calculators, consider the following expert recommendations:

- Embrace a Conservative Approach: Start with smaller lot sizes, gradually increasing them as you gain experience and confidence in the market.

- Risk Management as Priority: Never exceed the predefined risk parameters. Position sizing should align with both your trading strategy and financial capabilities.

- Seek Continuous Education: Stay abreast of market trends, economic indicators, and trading strategies. Knowledge empowers informed decision-making.

FAQs on Indices Lot Size Calculators

- Q: What is the difference between lot size and contract size?

- A: Lot size typically signifies the number of underlying assets in a contract. Contract size represents the total value of the underlying assets in a contract.

- Q: How do I select the appropriate lot size for my trades?

- A: Consider factors such as trading capital, risk tolerance, market conditions, and trading strategy when determining lot size.

Indices Lot Size Calculator

Conclusion

Mastering the indices lot size calculator is a cornerstone of successful index trading. This tool empowers traders with unparalleled precision, risk management capabilities, and the ability to trade confidently. Equipped with this knowledge, traders can elevate their trading strategies and reap the rewards of a well-informed approach.

Are you ready to unlock the full potential of index trading with the indices lot size calculator? Let your journey to financial success begin today!