Navigating the dynamic and often volatile forex market requires a robust risk management framework. Whether you’re a seasoned trader or just starting, securing your funded accounts is paramount to long-term success. This guide will arm you with essential strategies to minimize risks and maximize profits in your forex trading endeavors.

Image: market-bulls.com

Understanding Risk Management in Forex Trading

Risk management in forex trading encompasses strategies and techniques designed to protect your capital by mitigating potential losses. It involves identifying, assessing, and controlling risks associated with each trade. A well-defined risk management plan establishes clear rules and guidelines to guide your trades, preventing emotional decision-making in the heat of market fluctuations.

Key Risk Management Strategies

1. Position Sizing

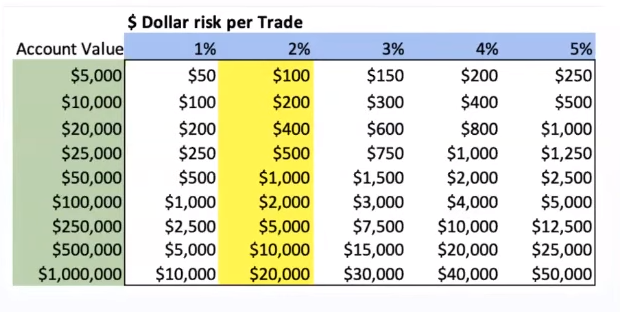

Position sizing determines the volume or amount of currency you trade in each order. It involves considering your account balance, risk tolerance, and the potential profit or loss associated with the trade. Proper position sizing ensures that a single losing trade doesn’t wipe out a significant portion of your capital.

Image: www.optionmatters.ca

2. Stop-Loss Orders

Stop-loss orders are automated instructions that automatically close a trade when the price reaches a predetermined level, limiting your losses if the market moves against you. By setting a stop-loss, you define the maximum amount you’re willing to lose on a particular trade.

3. Take-Profit Orders

Take-profit orders work in a similar way to stop-loss orders, but they close a trade when the price reaches a target profit level. These orders help you secure profits when the market moves in your favor, preventing greed from overriding sound judgment.

4. Hedging

Hedging involves opening multiple trades with opposite positions in different currencies. This strategy seeks to reduce the risk of large losses by balancing potential gains and losses across different trades. While hedging can be a complex technique, it can be effective in managing exposure to market fluctuations.

5. Risk/Reward Ratio

The risk/reward ratio compares the potential profit to the potential loss of a trade. Traders aim for a favorable ratio, where the profit target significantly exceeds the stop-loss level. This ensures that the potential profit outweighs the potential risk.

Expert Advice and Tips

1. Establish Clear Trading Rules: Define specific rules for entering and exiting trades, including position sizing, stop-loss levels, and profit targets. Stick to these rules religiously to avoid impulsive decisions.

2. Manage Emotions: Trading involves emotions, but it’s crucial to control them. Avoid making decisions based on fear or greed. Be patient, disciplined, and objective in your trading approach.

FAQs on Risk Management in Forex Trading

- What is the most important aspect of risk management?

Identifying, assessing, and controlling potential risks in each trade is the foundation of effective risk management.

- How can I determine the appropriate position size?

Consider your account balance, risk tolerance, and the potential profit or loss of the trade to establish an optimal position size.

- What are the benefits of using stop-loss orders?

Stop-loss orders limit potential losses by closing trades at predetermined levels, providing peace of mind and preventing emotional decision-making.

Risk Management Strategies For Funded Forex Accounts

Conclusion

Mastering risk management strategies is essential for success in forex trading. By implementing the techniques outlined in this guide, you can protect your funded accounts, minimize losses, and position yourself for consistent profitability. Remember, risk management is not just about avoiding losses but also about maximizing the potential for long-term gains.

Are you ready to elevate your forex trading game with robust risk management practices? Take the first step today and start implementing these strategies into your trading.