Introduction

Margin trading in forex involves using a broker’s leverage to amplify your trading profits. However, with great power comes great responsibility, and the flip side of leverage is the potential for substantial losses, up to and including the full amount of your account balance. One of the key risk management tools in margin trading is the “margin call.” Understanding what a margin call is, how it works, and how to avoid it is crucial for any forex trader. This article provides a comprehensive guide to margin calls in forex trading, empowering you with the knowledge to navigate the risks and protect your trading capital.

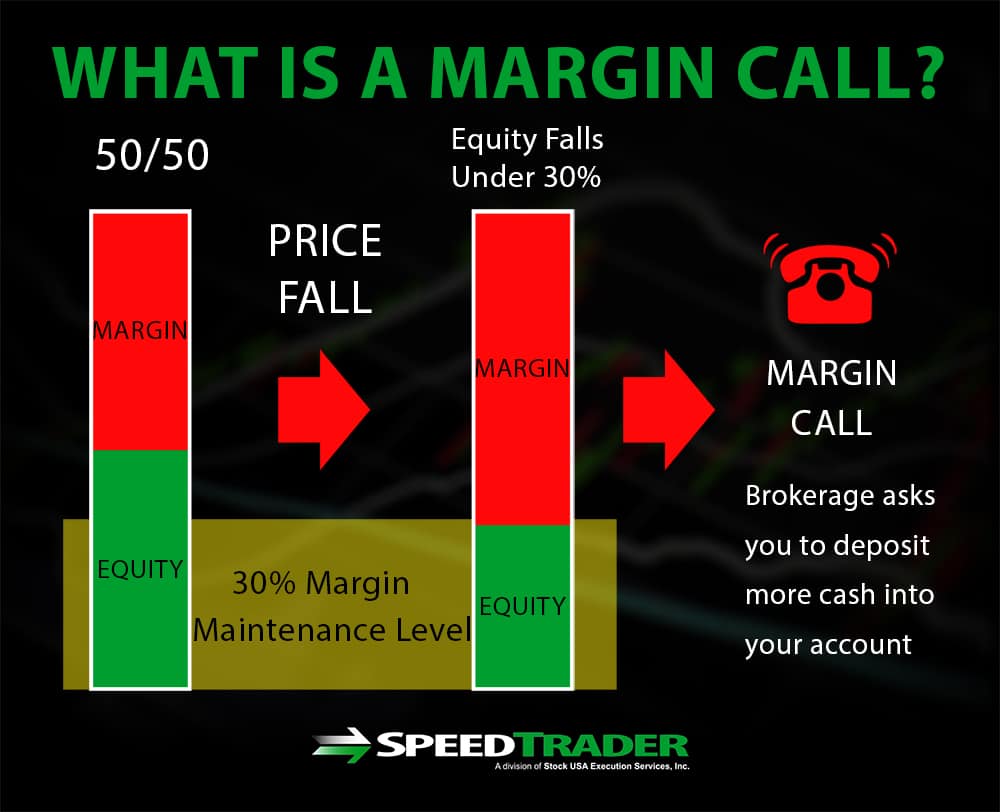

Image: speedtrader.com

What is a Margin Call?

A margin call is a notification issued by your broker when your trading account’s equity falls below a certain threshold, usually 10% of the initial deposit or “initial margin.” This threshold is also known as the “maintenance margin.” When a margin call occurs, you are required to deposit additional funds into your account to restore your equity above the maintenance margin level. If you fail to meet the margin call within a specified timeframe, your broker may forcibly close your open positions, resulting in losses that could exceed your initial deposit.

Anatomy of a Margin Call

To avoid facing financial stress due to a margin call, it’s important to build healthy trading habits, such as:

-

Calculating Your Margin Requirements: Before placing a trade, use a margin calculator to estimate the minimum margin required for the specific position size and leverage.

-

Determining Your Maintenance Margin: Know your broker’s maintenance margin requirements, which vary across platforms and account types. Adhering to these levels is crucial for avoiding margin calls.

-

Monitoring Market Volatility: Stay informed about macroeconomic events, news releases, and market conditions that can trigger sharp price movements. If high volatility is anticipated, consider adjusting your trading strategies or reducing your risk exposure by lowering your leverage or limiting your trade sizes.

-

Setting Stop-Loss Orders: Utilize stop-loss orders to automatically close your positions at a predetermined price, mitigating potential losses and safeguarding your trading capital.

Why Forex Brokers Issue Margin Calls?

Forex brokers issue margin calls for several reasons, primarily to:

-

Protect the Broker’s Interests: Margin calls ensure that brokers maintain sufficient margin in client accounts to cover potential losses. This minimizes their exposure to excessive risk should a trader’s positions result in significant losses.

-

Safeguard Clients from Excessive Losses: By mandating additional deposits, brokers give traders an opportunity to replenish their account balances and avoid severe losses. This serves as a risk management tool for traders, helping them preserve their capital.

Image: admiralmarkets.com

Consequences of Ignoring a Margin Call

Failing to heed a margin call can lead to severe consequences, including:

-

Forced Liquidation: If you don’t deposit the required funds within the stipulated time frame, your broker has the authority to forcibly liquidate your open positions. This can result in significant losses, as positions may be closed at unfavorable prices during market volatility.

-

Financial Burdens: Meeting margin calls may strain your financial resources. If you consistently experience margin calls, it could indicate a need to assess your risk appetite and adjust your trading strategies to better manage your risk.

Strategies for Avoiding a Margin Call

There are several strategies you can employ to effectively navigate margin trading and mitigate the likelihood of facing a margin call:

-

Use Appropriate Leverage: Select a leverage ratio that aligns with your risk tolerance and trading experience. Higher leverage magnifies both profits and losses, so it’s essential to choose cautiously.

-

Trade with a Realistic Stop-Loss Strategy: Determine optimal stop-loss levels for each trade, taking into account historical volatility and market conditions. This helps limit potential losses and prevents trades from spiraling out of control.

-

Manage Your Open Trades: Monitor your open positions regularly and adjust your risk exposure accordingly. If market conditions deteriorate or your analysis indicates a potential reversal in your trades’ favor, consider adjusting your positions or exiting trades altogether.

-

Maintain a Trading Journal: Keep a detailed record of your trades, including entry and exit points, profits, and losses. Analyzing your trading data can help you identify areas for improvement and enhance your overall trading strategy.

Margin Call Forex Trading

Conclusion

In conclusion, margin calls play a crucial role in forex trading by protecting both brokers and traders from excessive losses. Understanding the concept and consequences of margin calls empowers you to trade responsibly and manage your risk effectively. By implementing the strategies outlined in this guide, you can minimize the likelihood of encountering margin calls and safeguard your trading capital while pursuing profitable trading opportunities in the forex market.