In the realm of stock trading, candlestick patterns stand as invaluable tools for traders looking to decipher market sentiments and anticipate future price movements. Among the plethora of candlestick patterns, the long upper wick candlestick holds a significant place, as it serves as a potent bearish signal, warning astute traders of potential market reversals. This article delves into the essence of long upper wick candlesticks, their implications in technical analysis, and the strategies employed by traders to harness their power for profitable trading.

Image: www.cmcmarkets.com

Delineating Long Upper Wick Candlesticks: A Visual Cue

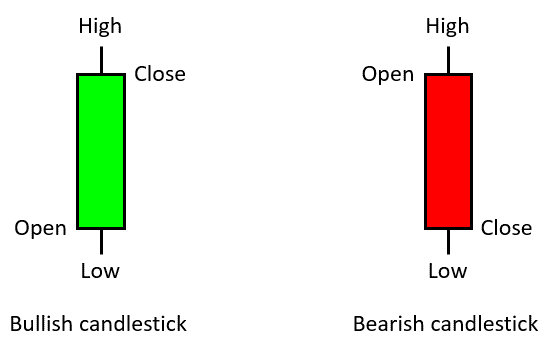

Long upper wick candlesticks, also referred to as “hammer” or “shooting star” patterns, are distinct candlestick formations characterized by their unique structure. They feature a long, thin upper wick that extends significantly above the body of the candle, while the lower wick is either short or nonexistent. The body of the candle can be either filled (black/red) or hollow (white/green), depending on whether the closing price is higher or lower than the opening price, respectively. The upper wick, acting as a flagpole, symbolizes buying pressure that was ultimately met with selling pressure, resulting in a reversal of the prevailing trend.

Interpreting the Bearish Signal: Understanding the Psychology Behind Long Upper Wick Candlesticks

The long upper wick candlestick conveys a clear message in the context of technical analysis: the bulls (buyers) attempted to push the price upward, but the bears (sellers) retaliated with greater force, reversing the bullish momentum and driving the price back down. This candlestick pattern often appears near resistance levels, indicating that the market has reached a point where further upward movement faces substantial selling pressure. It serves as a warning to traders that the bullish trend may be nearing exhaustion, and a potential reversal could be on the horizon.

Applying Long Upper Wick Candlesticks in Trading Strategies: A Practical Approach

Traders employ long upper wick candlesticks in tandem with other technical indicators to make informed trading decisions. These patterns can be used in both bullish and bearish market conditions, offeringvaluable insights into potential price movements. In a bullish trend, the appearance of a long upper wick candlestick near a resistance level can signal a possible trend reversal, prompting traders to consider taking profit or implementing stop-loss orders to protect their gains. Conversely, in a bearish trend, the emergence of this pattern can provide confirmation of the downtrend and encourage traders to enter short positions or add to existing short positions.

Image: www.learnstockmarket.in

Limitations and Contextual Factors: Acknowledging the Nuances of Long Upper Wick Candlesticks

While long upper wick candlesticks are generally regarded as bearish signals, it is crucial to note that they should not be interpreted in isolation. The overall market context, including prevailing trends, support and resistance levels, and other technical indicators, should be considered to make well-informed trading decisions. Additionally, false signals can occur, particularly in volatile markets, and traders should exercise caution when relying solely on this pattern for making trading decisions.

Long Upper Wick Candlestick

Conclusion: Unlocking the Bearish Potential of Long Upper Wick Candlesticks

In the ever-shifting landscape of stock trading, traders seeking an edge turn to technical analysis and candlestick patterns for guidance. Among these patterns, long upper wick candlesticks hold a prominent position, serving as reliable bearish signals that can help traders anticipate market reversals and make informed trading decisions. By understanding the implications of this candlestick pattern and incorporating it into their trading strategies, traders can harness its power to navigate market fluctuations and potentially enhance their profitability. Whether they are used in conjunction with other technical indicators or as stand-alone signals, long upper wick candlesticks remain a valuable tool for traders seeking to decipher market sentiments and make sound trading decisions.