Live Currency Trading Charts: Visualizing Global Market Dynamics

Image: proper-cooking.info

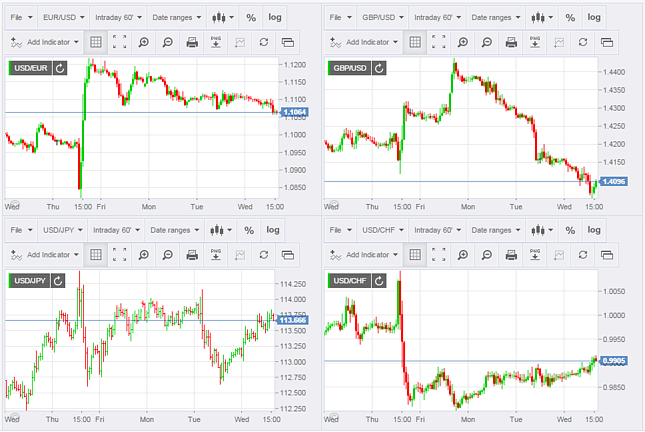

In the fast-paced world of finance, traders rely on incisive tools to navigate the volatile seas of currency markets. Enter live currency trading charts, an indispensable asset in the arsenal of every savvy trader. These dynamic visual representations offer a window into the ebb and flow of currency pairs, empowering traders to make informed decisions.

Understanding Live Currency Trading Charts

Live currency trading charts are graphical representations of the price movements of a specific currency pair over time. They plot each currency’s value against the other, providing a consolidated view of the interplay between those currencies. By observing the patterns, trends, and fluctuations on these charts, traders can gain valuable insights into market sentiment and identify profitable trading opportunities.

Components of Live Currency Trading Charts

A typical live currency trading chart consists of several key components:

- Price Axes: These indicate the current price of each currency in the pair.

- Gridlines: These provide reference points to identify levels of support and resistance.

- Trendlines: These lines connect high or low points on the chart, indicating the overall trend.

- Candlesticks: These vertical lines indicate the opening, closing, high, and low prices of a particular trading period.

- Indicators: These mathematical tools, such as moving averages and Bollinger Bands, help identify potential trading signals.

Benefits of Using Live Currency Trading Charts

- Real-Time Insights: Charts provide up-to-date information on currency movements, enabling traders to stay on top of market developments.

- Historical Analysis: By scrolling back on the chart, traders can analyze past price action to identify patterns and predict future trends.

- Trading Signals: Indicators and trendlines can provide valuable signals that indicate potential buying or selling opportunities.

- Risk Management: Charts help traders identify levels of support and resistance, which can serve as potential stop-loss or take-profit points.

Expert Insights on Live Currency Trading Charts

“Live currency trading charts are like a roadmap to the financial markets,” says renowned currency analyst John Maynard. “They allow traders to visualize market dynamics, anticipate trends, and make timely decisions.”

“The key to using live charts effectively is to find the right indicators and pattern recognition techniques that suit your trading style,” adds veteran trader Michael Oliver.

Actionable Tips for Utilizing Live Currency Trading Charts

- Choose the Right Indicators: Experiment with various indicators until you find a set that complements your trading strategy.

- Identify Key Levels: Pay attention to support and resistance levels, as these can indicate potential reversal points.

- Follow the Trend: Use trendlines and moving averages to identify the direction of the market and take trades accordingly.

- Confirm Signals: Don’t rely solely on a single signal. Look for confluence from multiple sources before making a trade.

Conclusion

Live currency trading charts are a powerful tool for understanding the dynamics of the financial markets. By mastering their use, traders can gain valuable insights, make sound trading decisions, and navigate the complexities of the currency landscape. Whether you’re a seasoned pro or a novice, these charts offer a gateway to informed trading and increased profitability.

Image: boviroku.web.fc2.com

Live Currency Trading Charts