Introduction

In the realm of financial markets, interest rate swaps play a pivotal role in managing and mitigating risk associated with interest rate fluctuations. These complex instruments allow counterparties to exchange future interest payments based on different interest rates or currencies, enabling them to customize their exposure to specific interest rate scenarios. To effectively navigate this intricate landscape, it is essential to understand how an interest rate swap calculator works.

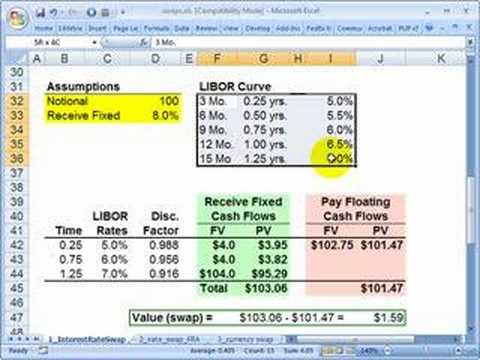

Image: www.youtube.com

This comprehensive guide will delve into the intricacies of interest rate swap calculators, providing a detailed explanation of their functionality, practical applications, and the crucial role they play in financial risk management.

Demystifying Interest Rate Swaps

Interest rate swaps are agreements between two parties who exchange interest payments based on two different interest rates or currencies. The purpose of this exchange is to alter the interest rate exposure of one or both parties. Swaps can be tailored to cater to specific risk management objectives, such as locking in favorable interest rates or hedging against potential rate increases or decreases.

Unveiling the Interest Rate Swap Calculator

An interest rate swap calculator is a vital tool that assists in analyzing and valuing interest rate swaps. It enables users to quickly and accurately determine the net payment obligations for each party, taking into account various factors such as swap details, interest rates, and payment schedules.

Navigating the Swap Terminology

Before delving into the mechanics of the calculator, it is essential to familiarize oneself with the key terminology associated with interest rate swaps:

- Notional Principal Amount: The hypothetical amount of money on which interest payments are calculated.

- Fixed Rate: A predetermined interest rate that remains constant throughout the life of the swap.

- Floating Rate: An interest rate that fluctuates based on a specified benchmark, such as LIBOR or Prime Rate.

- Swap Maturity: The date on which the interest rate swap agreement expires.

Image: www.clarusft.com

Deciphering Interest Rate Swap Calculations

Interest rate swap calculators rely on specific formulas to determine the net payment obligations for each party involved in the swap. The calculations take into account the following:

- Present Value of Fixed Leg: The value of the fixed rate leg, calculated using the notional principal amount, fixed rate, and time to maturity.

- Present Value of Floating Leg: The value of the floating rate leg, calculated using the notional principal amount, floating rate, and time to maturity.

- Net Payment: The difference between the present value of the fixed leg and the present value of the floating leg, which determines the net amount that one party must pay to the other.

Step-by-Step Guide to Using an Interest Rate Swap Calculator

1. Input Swap Details:

Enter the notional principal amount, fixed rate, floating rate, maturity date, and payment frequency into the calculator.

2. Calculate Present Values:

The calculator automatically computes the present value of the fixed and floating legs.

3. Determine Net Payment:

Based on the calculated present values, the calculator determines the net payment obligation. A positive value indicates that the first party must pay the second party, while a negative value indicates that the reverse is true.

Applications of Interest Rate Swap Calculators

- Risk Management: Interest rate swaps enable businesses to manage interest rate risk by locking in favorable rates or hedging against fluctuations.

- Fixed Income Investment: Swaps can be used to modify the yield profile of bond portfolios, converting variable-rate investments into fixed-rate assets or vice versa.

- Arbitrage Opportunities: Interest rate swap calculators help identify potential arbitrage opportunities when there is a divergence between different interest rates.

- Customized Risk Management Solutions: By tailoring swaps to specific needs, businesses can craft bespoke solutions that mitigate their unique interest rate risks.

Interest Rate Swap Calculator

Conclusion

Interest rate swap calculators are indispensable tools for both individuals and institutions seeking to understand and leverage the potential of interest rate swaps. By comprehending the mechanics behind these calculators, parties can effectively gauge the risk-reward dynamics of specific interest rate swap agreements and make informed decisions to manage their financial exposure. Armed with this knowledge, they can navigate the complexities of interest rate swaps with confidence, optimizing their risk management strategies and potentially enhancing their financial outcomes.