Embark on a journey into the realm of index futures trading, where precision and strategy converge. Dive into the intricacies of an index lot size calculator, a pivotal tool that empowers traders to navigate the complex world of index futures markets. Discover the secrets to maximizing returns, minimizing risks, and unlocking the full potential of your trading endeavors.

Image: www.priceactionninja.com

Understanding the Importance of Lot Size in Futures Trading

In the arena of futures trading, every contract represents a standardized quantity of the underlying asset. The lot size, also known as the contract size, dictates the number of units of the underlying asset that each contract encompasses. Comprehending the significance of lot size is paramount for effective futures trading.

The lot size serves as a critical determinant in calculating the value of a futures contract, dictating the potential profit or loss. It establishes a framework for determining the financial implications of your trading decisions, ensuring informed decision-making.

Introducing the Index Lot Size Calculator: A Trader’s Essential Tool

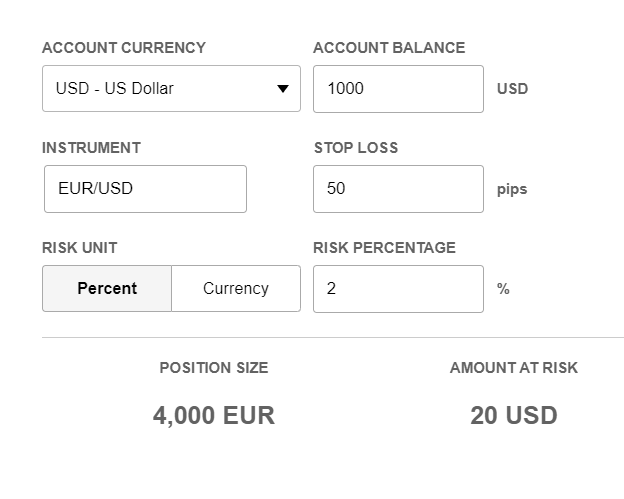

The index lot size calculator emerges as an indispensable tool for index futures traders, offering precision and efficiency in calculating the lot size for each trade. This invaluable resource empowers traders by automating complex calculations, saving time, and enhancing decision-making accuracy.

With an index lot size calculator at your fingertips, traders can swiftly determine the number of contracts required to align with their desired exposure to the underlying index. This facilitates optimal trade execution, maximizing potential returns and mitigating unnecessary risks.

Navigating the Index Lot Size Calculator: A Step-by-Step Guide

To harness the full potential of the index lot size calculator, follow these simple steps:

-

Select the desired index: Enter the ticker symbol or name of the index you intend to trade, such as the S&P 500, Nasdaq 100, or Dow Jones Industrial Average.

-

Specify the trading account currency: Indicate the currency you will use for trading, ensuring alignment with your brokerage account’s base currency.

-

Input the desired notional value: Determine the value, in your preferred currency, that you wish to allocate to the trade. This represents the total value of the underlying index you aim to gain exposure to through the futures contract.

-

Calculate: Click the “Calculate” button to initiate the calculation. The index lot size calculator will determine the corresponding lot size, expressed in the number of contracts, required to fulfill your desired notional value.

Image: indepthtrading.com

Unveiling the Secrets of Profit Optimization and Risk Management

The index lot size calculator transcends mere calculation; it empowers traders to make informed decisions, maximizing their profit potential while managing risks effectively. Here’s how:

-

Precision in position sizing: By precisely aligning the lot size with your desired exposure, you can optimize your trade position, ensuring it matches your risk tolerance and investment goals.

-

Enhanced risk management: The ability to calculate the contract value accurately allows for meticulous risk management. You can precisely determine the potential financial implications of each trade, enabling proactive adjustments based on market dynamics and your risk appetite.

-

Informed trade execution: The index lot size calculator provides a solid foundation for execution, ensuring efficient entry and exit from index futures positions.

Seeking Expert Insights: Leveraging Professional Guidance for Trading Success

Seasoned professionals in the realm of index futures trading advocate the judicious use of the lot size calculator for strategic decision-making. Here’s why:

“The lot size calculator is an invaluable asset, allowing me to swiftly determine the optimal contract size for my trades, ensuring alignment with my investment goals,” asserts Amelia, a seasoned futures trader with over a decade of experience.

“The ability to precisely calculate lot size enhances my risk management prowess, empowering me to mitigate potential losses and maximize profit opportunities,” adds Ethan, a renowned futures fund manager.

Index Lot Size Calculator

Conclusion: The Index Lot Size Calculator – A Gateway to Informed Trading

Embracing the index lot size calculator unveils a world of possibilities for index futures traders. By utilizing this powerful tool, you gain the ability to optimize lot size, manage risk effectively, and execute trades with precision.

As you delve deeper into the intricacies of the index lot size calculator, you will discover a formidable ally in your quest for successful futures trading, empowering you to navigate the market with confidence, seizing opportunities while navigating risks.

So, whether you’re a seasoned veteran or embarking on your futures trading journey, embrace the index lot size calculator as a trusted companion, guiding you towards a future of informed and profitable trading.