Introduction

The world of trading can be a daunting one, especially for beginners. With so many different markets and instruments available, it can be difficult to know where to start. However, if you’re looking for a way to trade that is both exciting and accessible, then synthetic indices may be the perfect option for you.

Image: derivfx.com

Traded on the MetaTrader 5 (MT5) platform, synthetic indices are a new type of financial instrument that offer a number of advantages over traditional indices. For example, synthetic indices are not subject to the same market fluctuations as traditional indices, which makes them less risky. They are also more flexible, allowing you to trade on a variety of different asset classes, including stocks, commodities, and currencies.

In this article, we will provide you with everything you need to know about how to trade synthetic indices on MT5. We’ll cover everything from the basics of synthetic indices to the best strategies for trading them. By the end of this article, you’ll be able to start trading synthetic indices with confidence!

What are Synthetic Indices?

Synthetic indices are a type of financial instrument that is created by combining the price movements of two or more underlying assets. This allows traders to speculate on the price movements of a particular asset or asset class without having to actually own the underlying assets. For example, you could trade a synthetic index that is based on the price movements of the S&P 500 index, without having to actually own any shares of any of the companies that make up the index.

There are a number of different ways to create synthetic indices. One common method is to use a mathematical formula to combine the price movements of two or more assets. For example, a synthetic index that is based on the S&P 500 index might be created by taking the average of the daily price movements of the 500 companies that make up the index. Another method for creating synthetic indices is to use a computer program to simulate the price movements of a particular asset or asset class.

Benefits of Trading Synthetic Indices on MT5

There are a number of benefits to trading synthetic indices on MT5, including:

- Reduced risk: Synthetic indices are not subject to the same market fluctuations as traditional indices, which makes them less risky. This is because synthetic indices are created using mathematical formulas or computer simulations, which means that they are not directly affected by the actions of market participants.

- High leverage: MT5 allows traders to use high leverage, which means that they can control a large amount of capital with a relatively small investment. This can increase the potential profits from trading synthetic indices, but it can also increase the risk of loss.

- Flexibility: Synthetic indices offer a great deal of flexibility, allowing you to trade on a variety of different asset classes. This means that you can diversify your portfolio and reduce the risk of loss.

- Accessibility: MT5 is a user-friendly platform that is available to traders of all levels of experience. This makes it easy to get started with trading synthetic indices, even if you are a beginner.

How to Trade Synthetic Indices on MT5

Here are the steps on how to trade synthetic indices on MT5:

- Open an MT5 trading account: The first step is to open an MT5 trading account with a broker that offers synthetic indices.

- Find a synthetic index to trade: Once you have an MT5 trading account, you can start to look for synthetic indices to trade. To do this, simply open the “Market Watch” window and click on the “Synthetic Indices” tab.

- Place a trade: Once you have found a synthetic index to trade, you can place a trade by clicking on the “New Order” button. From there, you will need to specify the amount of capital you want to risk on the trade, the type of order you want to place, and the stop-loss and take-profit levels.

- Monitor your trades: Once you have placed a trade, you should monitor it closely. This means keeping an eye on the price movements of the synthetic index, the size of your profit, and the risk of loss.

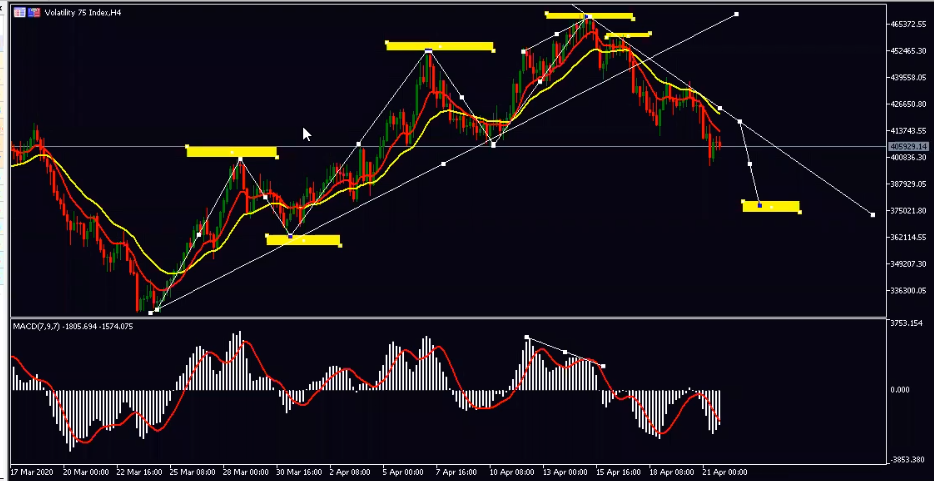

Image: forexbrainbox.com

Strategies for Trading Synthetic Indices

There are a number of different strategies for trading synthetic indices, including:

- Trend following: Trend following is a strategy that involves buying synthetic indices that are trending up and selling synthetic indices that are trending down. This strategy can be profitable, but it can also be risky.

- Range trading: Range trading is a strategy that involves buying synthetic indices that are trading within a defined range. This strategy is less risky than trend following, but it can also be less profitable.

- Breakout trading: Breakout trading is a strategy that involves buying synthetic indices that have broken out of a defined range. This strategy can be profitable, but it can also be risky.

How To Trade Synthetic Indices On Mt5

Conclusion

Trading synthetic indices on MT5 can be a profitable and exciting way to speculate on the price movements of different asset classes. However, it is important to understand the risks involved before you start trading. By following the steps outlined in this article, you can get started with trading synthetic indices on MT5 with confidence!