A Step-by-Step Guide to Master Technical Analysis

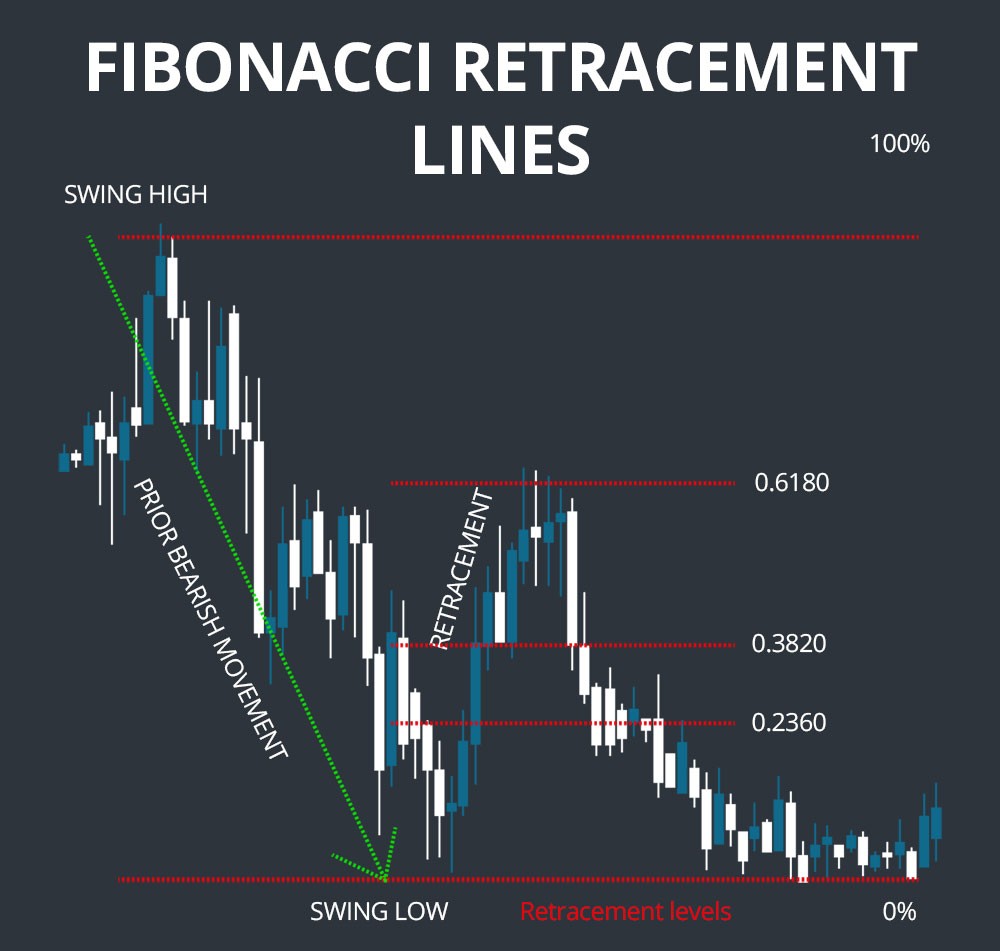

Fibonacci retracement is a powerful technical analysis tool that traders and investors use to identify potential support and resistance levels in the financial markets. By understanding how to place Fibonacci retracement on a chart, you can gain a deeper insight into the potential direction of price movements and make more informed trading decisions.

Image: investbro.id

What is Fibonacci Retracement?

Fibonacci retracement is a series of horizontal lines that are drawn on a chart, connecting two significant price points, typically a swing high and a swing low. These lines represent the Fibonacci ratios, which are a set of mathematical proportions believed to occur frequently in nature and financial markets. The key Fibonacci ratios used in retracement are 23.6%, 38.2%, 50%, 61.8%, and 100%.

How to Place Fibonacci Retracement on a Chart

To place Fibonacci retracement on a chart, follow these steps:

- Identify Two Significant Price Points: Identify a recent swing high and a swing low that represent a significant price move. The swing high should be the highest point reached in an uptrend, while the swing low should be the lowest point reached in a downtrend.

- Insert Fibonacci Retracement Indicator: Most charting platforms offer a Fibonacci retracement indicator. Select the indicator from the platform’s menu and drag it onto the chart.

- Set the Price Points: Click on the chart at the swing high and then drag the cursor down to the swing low. This will set the two price points for the Fibonacci retracement calculation.

- Observe the Retracement Lines: Fibonacci retracement lines will automatically be drawn on the chart, connecting the swing high and swing low. The lines will represent the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and 100%.

Interpreting Fibonacci Retracement

After placing the Fibonacci retracement on the chart, you can interpret the lines to identify potential support and resistance levels.

- Support Levels: The Fibonacci retracement lines at 38.2%, 50%, and 61.8% are considered potential support levels. If the price falls after a downtrend, these lines may act as support and cause the price to bounce back.

- Resistance Levels: The Fibonacci retracement lines at 23.6% and 100% are considered potential resistance levels. If the price rises after an uptrend, these lines may act as resistance and cause the price to pull back.

Image: www.andrewstradingchannel.com

Tips and Expert Advice

- Use Fibonacci Retracement in Conjunction with Other Indicators: Fibonacci retracement is a powerful tool, but it should not be used in isolation. Combine it with other technical indicators, such as trend lines, moving averages, or oscillators, for a more comprehensive analysis.

- Consider the Market Context: The effectiveness of Fibonacci retracement depends on the overall market context. In trending markets, Fibonacci retracement levels tend to hold better than in non-trending markets.

- Be Aware of False Signals: Fibonacci retracement can generate false signals. Price may not always reverse at the Fibonacci retracement levels. Therefore, it is important to confirm any reversal signals with other technical indicators or fundamental analysis.

FAQs

Q: What are the most significant Fibonacci ratios?

A: The most significant Fibonacci ratios used in retracement are 23.6%, 38.2%, 50%, 61.8%, and 100%.

Q: How do I use Fibonacci retracement to identify support and resistance levels?

A: The Fibonacci retracement lines at 38.2%, 50%, and 61.8% are potential support levels, while the lines at 23.6% and 100% are potential resistance levels.

Q: Are Fibonacci retracement levels always accurate?

A: No, Fibonacci retracement levels can generate false signals. It is important to confirm any reversal signals with other technical indicators or fundamental analysis.

How To Place Fibonacci Retracement On Chart

Conclusion

Fibonacci retracement is a valuable technical analysis tool that can provide insights into potential support and resistance levels in the markets. By understanding how to place Fibonacci retracement on a chart and interpret the results, you can enhance your trading decision-making and potentially improve your trading performance.

Are you interested in learning more about Fibonacci retracement and other technical analysis techniques? Leave a comment below and let’s continue the conversation.