Introduction

In the high-stakes arena of forex trading, astute position sizing can be the difference between securing lucrative profits and enduring devastating losses. To navigate this intricate realm successfully, traders must wield a sharp tool—the FX position size calculator. This sophisticated tool empowers traders with the ability to optimize the size of their positions, ensuring they align with their risk tolerance, account balance, and market volatility.

Image: appadvice.com

Conceptualizing Position Sizing

Position sizing refers to the meticulous determination of the number of units or lots to trade for a given financial instrument. It’s an intricate calculation that hinges on a nuanced understanding of risk management principles. Determining the optimal position size is crucial as it establishes the potential exposure to profit or loss for each trade.

The FX Position Size Calculator: A Trader’s Ally

The FX position size calculator emerged as a groundbreaking tool, revolutionizing the way traders approach risk management. By assimilating essential variables such as account balance, risk tolerance, stop-loss level, and market volatility, this indispensable tool computes the appropriate position size, mitigating the risks associated with excessive leverage.

Unveiling the Formula

At the heart of the FX position size calculator lies a mathematical formula that encapsulates the core principles of sound risk management.

Position Size = (Risk Percentage x Account Balance) / (Stop-Loss Distance x Market Volatility)

Each component of this formula plays a pivotal role in determining the optimal position size:

-

Risk Percentage: This denotes the trader’s predetermined willingness to risk on each trade, typically expressed as a percentage of their account balance.

-

Account Balance: The total funds available in the trader’s brokerage account serves as the basis for calculating the risk exposure.

-

Stop-Loss Distance: The stop-loss level, an integral part of any trading strategy, defines the point at which a trade will automatically close to limit potential losses. The distance between the entry price and the stop-loss level reflects the trader’s risk tolerance.

-

Market Volatility: Volatility, a fundamental characteristic of financial markets, gauges the extent of price fluctuations. By incorporating market volatility into the calculation, the calculator adjusts the position size to account for potential price movements.

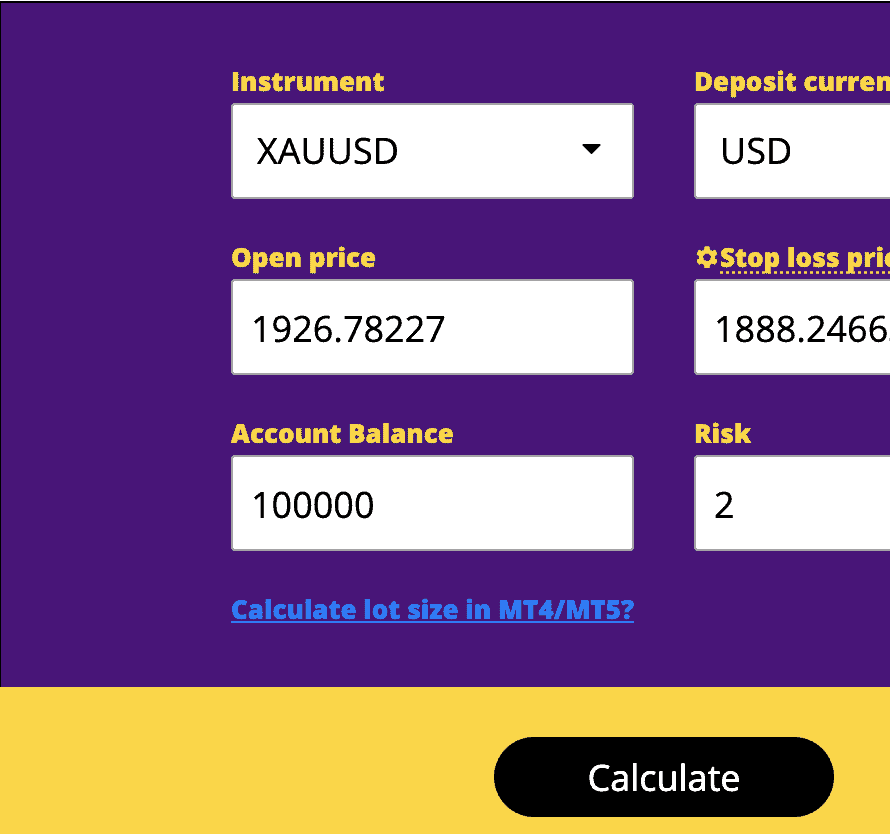

Image: baxiamarkets.com

Tailoring the Calculator to Individual needs

The adaptability of the FX position size calculator empowers traders to customize it to their specific trading objectives. By adjusting the risk percentage, traders can align the calculator with their risk appetite. Conservative traders may opt for a lower risk percentage, while those with a higher tolerance for risk may choose a bolder approach.

Beyond the Numbers: Risk Management Considerations

Aside from the precise numerical output, the FX position size calculator serves as a valuable reminder of the significance of risk management. It compels traders to confront their risk tolerance and adopt a disciplined approach to trading. Moreover, it dissuades traders from succumbing to the allure of overleveraging, a common pitfall that can result in severe financial setbacks.

Fx Position Size Calculator

Conclusion

The FX position size calculator stands as an indispensable tool for forex traders, enabling them to optimize their position sizes and trade with confidence. Its integration of risk management principles empowers traders to navigate market volatility, protect their capital, and enhance their chances of achieving long-term trading success. By embracing the calculator’s guidance, traders can harness the power of data-driven decision-making, fortifying their trading strategies with an unwavering commitment to risk management.