Introduction

In the realm of foreign exchange (forex) trading, the concept of “lot” holds immense significance. A forex lot represents a standardized unit of currency that serves as the minimum tradable amount. Understanding the nuances of forex lot trading, particularly the intricacies of trading 1 lot, is crucial for both novice and seasoned traders. In this comprehensive guide, we delve into the world of forex trading 1 lot, exploring its history, significance, and practical applications to empower traders with the knowledge they need to navigate the forex markets effectively.

Image: trueforexfunds.com

What is a 1 Lot in Forex Trading?

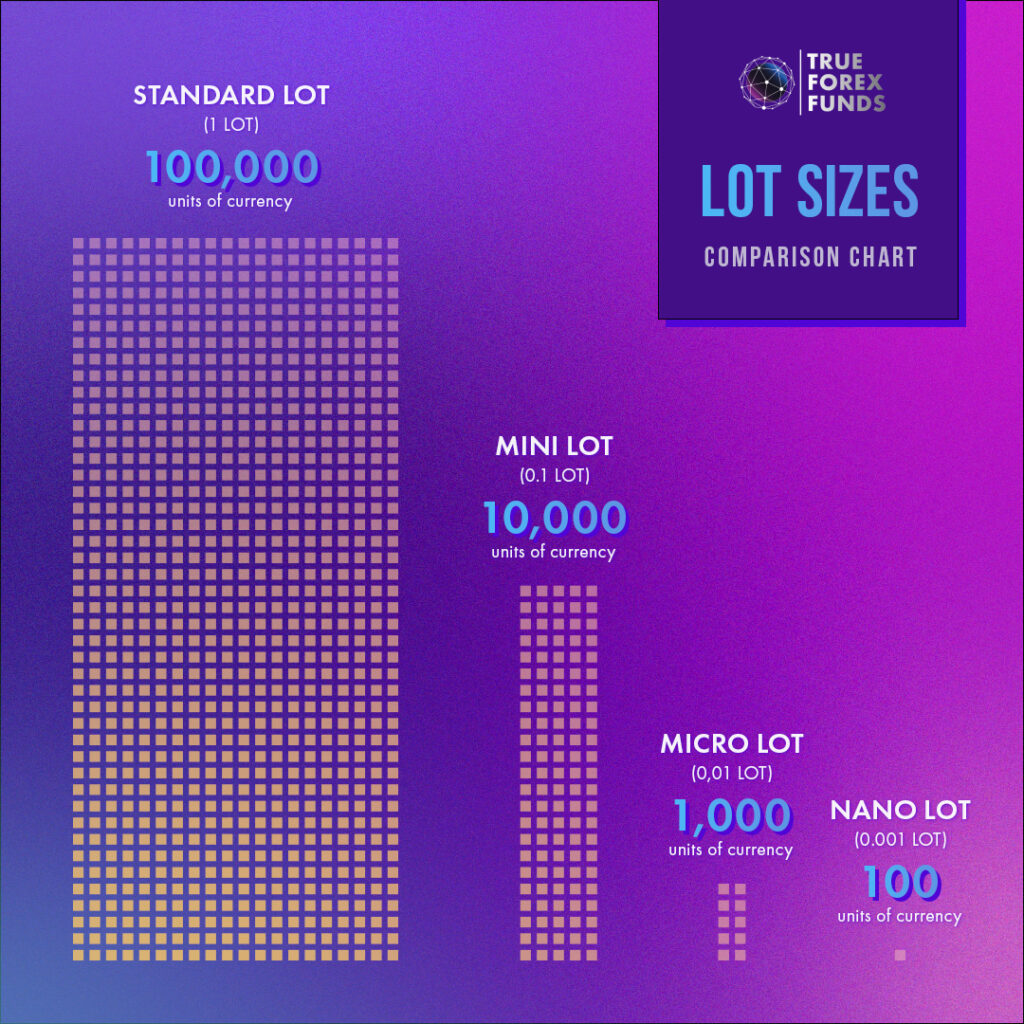

A forex lot, in its most fundamental sense, represents a standardized contract size for trading currencies. The standard lot size in the forex market is 100,000 units of the base currency in a currency pair. For instance, if you trade the EUR/USD currency pair, 1 lot would equate to 100,000 euros. It’s important to note that the lot size can vary depending on the currency pair being traded. For example, in the case of currency pairs involving the Japanese yen (JPY), 1 lot typically represents 100,000,000 JPY.

Importance of 1 Lot Trading

Comprehending the significance of trading 1 lot in forex lies in its implications for risk management and potential profits. By trading fixed lot sizes, traders can standardize their risk exposure across different currency pairs. This approach simplifies the process of calculating potential profits and losses, as the pip value remains constant for each lot traded. It also allows traders to compare their performance against benchmarks and other traders more efficiently.

Historical Evolution of Lot Sizing

The concept of lot sizing in forex trading has evolved over time. In the early days of forex trading, lot sizes were primarily determined by the capabilities of trading platforms and the available technology. As trading technology advanced, lot sizes became more standardized, and the industry gradually adopted the standard lot size of 100,000 units. The standardization of lot sizes has facilitated greater transparency and consistency in forex trading.

Image: tradingkit.net

Applications of 1 Lot Trading

1 lot trading finds applications across various trading styles and strategies. Whether you’re a scalper seeking quick profits, a day trader focusing on intraday price movements, or a longer-term investor implementing position trading strategies, understanding 1 lot trading is essential. It provides a common ground for comparing returns and assessing risk exposure, enabling traders to make informed decisions aligned with their individual trading goals.

Trading 1 Lot with Leverage

Leverage plays a significant role in forex trading, including 1 lot trading. Leverage allows traders to control a larger position with a smaller amount of capital, amplifying both potential profits and losses. It’s essential to use leverage prudently, as it can magnify both gains and losses, potentially leading to substantial financial implications. Adequately managing leverage requires traders to possess a sound understanding of risk management techniques and market dynamics to minimize the associated risks.

Choosing the Right Lot Size for Your Trading Strategy

Selecting the appropriate lot size is crucial for successful 1 lot trading. The optimal lot size aligns with your trading style, risk tolerance, and available capital. Novice traders are generally advised to start with micro lots or mini lots, which are smaller contract sizes, to limit their potential exposure. As they gain experience and confidence, traders can gradually increase their lot size, provided they have a robust risk management strategy in place.

Forex Trading 1 Lot

Conclusion

1 lot trading is a fundamental aspect of forex trading, providing a standardized contract size for currency transactions. Understanding 1 lot trading is essential for developing effective risk management strategies and maximizing trading potential. Whether you’re a seasoned trader or just starting out, embracing a holistic approach to 1 lot trading, encompassing market knowledge, risk management techniques, and sound decision-making, is the key to unlocking success in the dynamic world of forex trading.