Are you a novice forex trader looking to conquer the complexities of lot sizes? Or perhaps an experienced trader seeking to refine your risk management strategies? This comprehensive guide will delve into the world of forex lot sizes, empowering you with the knowledge and tools to navigate the market with confidence.

Image: homecare24.id

For those unacquainted, a lot size represents the number of base units traded in a single forex transaction. It serves as a crucial parameter in calculating both potential profits and risks involved in a trade. Understanding lot sizes is paramount to any trader’s success, as it enables them to determine the appropriate position size for their trading strategy and risk tolerance.

The Concept of Forex Lot Sizes

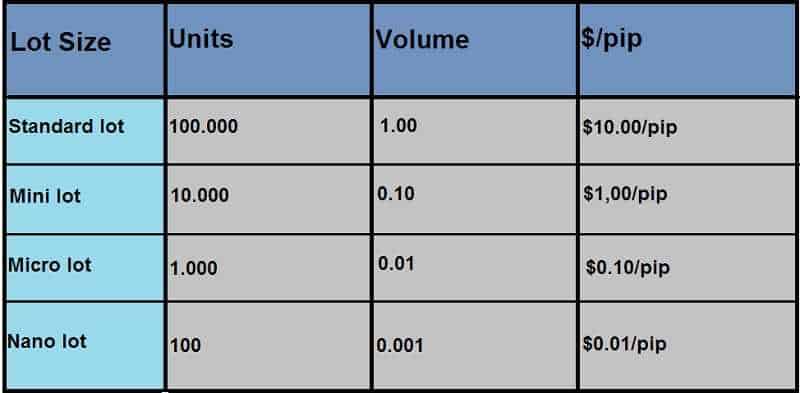

In forex trading, the standard lot size is 100,000 units of the base currency. However, for traders seeking greater flexibility, fractional lot sizes such as micro lot (1,000 units), mini lot (10,000 units), and nano lot (100 units) are also available.

The choice of lot size hinges on several factors, including account balance, risk appetite, and trading style. Smaller lot sizes are suitable for conservative traders or those with limited capital, while larger lot sizes may be employed by seasoned traders with a higher tolerance for risk.

Calculating Forex Lot Sizes

To determine the appropriate lot size for your trades, consider the following formula:

Lot Size = (Desired Risk / (Pip Value × Stop Loss)) / (Account Balance × Leverage)- Desired Risk: The amount of money you are willing to risk on each trade.

- Pip Value: The value of a one-pip change in the currency pair being traded.

- Stop Loss: The distance away from the entry price at which you will exit the trade to limit potential losses.

- Account Balance: The total balance in your trading account.

- Leverage: The amount of borrowed funds used to increase trading capital.

By plugging these values into the formula, you can calculate the appropriate lot size for your desired risk level and account balance.

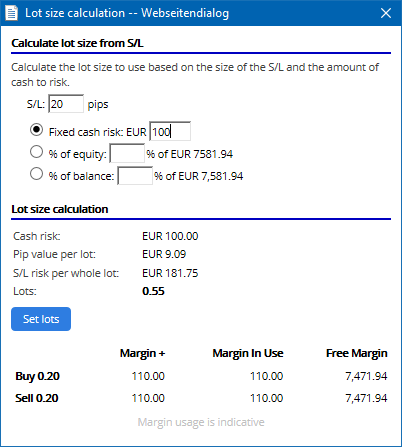

Using a Forex Lot Size Calculator

To simplify the process of calculating lot sizes, many online forex brokers offer lot size calculators. These tools require you to input your desired risk, pip value, stop loss, account balance, and leverage, and they will automatically calculate the recommended lot size.

Forex lot size calculators are user-friendly and convenient, especially for novice traders. They help ensure that you are not risking more than you can afford and that your trades are aligned with your risk tolerance.

Image: theforextradingcoursepdf.blogspot.com

Expert Insights on Forex Lot Sizes

“The most critical factor in determining lot size is your risk tolerance. Never risk more than you can afford to lose, and adjust your lot sizes accordingly.”

— Samantha Blais, Professional Forex Trader

“Leverage can be a double-edged sword. Use it wisely to potentially increase profits, but be mindful of the risks involved and never exceed your comfort level.”

— John Smith, Chartered Financial Analyst

Actionable Tips for Using Forex Lot Sizes Effectively

- Start with smaller lot sizes to familiarize yourself with the market and manage risk effectively.

- Use a forex lot size calculator for quick and accurate calculations.

- Adjust your lot sizes based on market conditions and your own risk tolerance.

- Consider using risk management tools such as stop-loss orders to protect your capital.

- Practice responsible trading habits by setting clear trading plans and following them diligently.

Forex Lot Size Calc

Conclusion

Mastering forex lot sizes is essential for successful trading in the currency markets. By understanding the concept and utilizing the forex lot size calculator, you can optimize your risk management strategies and enhance your chances of achieving profitability.

Remember, every trader’s risk tolerance and trading style are unique. Tailor your lot sizes accordingly, and never risk more than you can afford to lose. Forex trading, like any form of investing, involves both rewards and risks. By educating yourself and making informed decisions, you can navigate the markets with confidence and potentially reap the benefits of this dynamic arena.