Immerse yourself in the intriguing world of the Fibonacci series and its profound implications in the realm of trading. This ancient numerical sequence, discovered by the renowned mathematician Leonardo Fibonacci, holds a captivating allure for traders seeking to decode market patterns and maximize their profit potential. As we delve into the depths of this enigmatic series, we’ll unravel its secrets and equip you with actionable insights to elevate your trading strategies.

Image: pocketoption.trading

Fibonacci Series: A Historical and Mathematical Perspective

First emerging in Fibonacci’s famed “Liber Abaci” in 1202, the Fibonacci series has captivated mathematicians and traders alike for centuries. Its defining characteristic lies in the fact that each number in the sequence is the sum of the two preceding ones. Thus, the series begins with 0 and 1, and subsequently unfolds as: 0, 1, 1, 2, 3, 5, 8, 13, 21, and so on.

One of the most fascinating aspects of the Fibonacci series is its omnipresence in nature, from the spiral patterns of galaxies to the arrangement of flower petals. This suggests an inherent mathematical harmony in the universe, a concept that has resonated profoundly with traders seeking an edge in the unpredictable market landscape.

Fibonacci Retracements: Guiding You Through Market Volatility

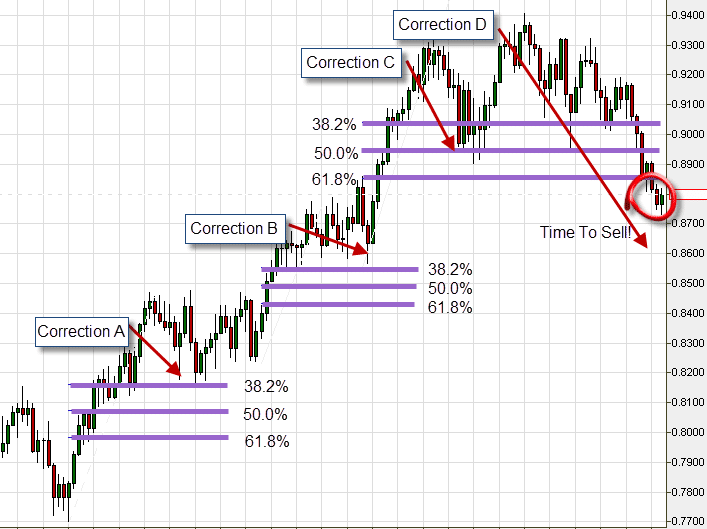

Fibonacci retracements, a cornerstone of technical analysis, are derived from the Fibonacci series and serve as invaluable indicators for identifying potential price movements. They are calculated as percentages of a significant price swing, such as a rally or decline. The most commonly used retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

These retracement levels represent areas where the price may pause or reverse its trend before continuing in its original direction. By identifying these levels, traders can anticipate potential support or resistance zones and adjust their trading strategies accordingly. Understanding Fibonacci retracements equips you with a powerful tool to navigate market volatility with increased precision.

Fibonacci Extensions: Predicting Target Price Levels

Fibonacci extensions, another invaluable tool in the trader’s arsenal, project potential price targets based on the Fibonacci series. Calculated by extending the Fibonacci retracement levels beyond the original price swing, these extensions provide insights into where the price may head if the trend continues. Common Fibonacci extension levels include 1.618, 2.618, 3.618, and 4.236.

Traders employ Fibonacci extensions to identify potential profit targets, as well as areas where they may consider adjusting their positions. By incorporating these projections into their trading plan, they can maximize their returns and minimize potential losses.

Image: learn2.trade

Expert Insights: Unlocking the Power of Fibonacci

Acclaimed traders and market analysts have long recognized the significance of the Fibonacci series in their trading journeys. George Lane, a renowned technical analyst, eloquently stated, “The Fibonacci ratios provide a road map for price action, allowing traders to anticipate potential support and resistance levels.”

Similarly, Robert Kiyosaki, the bestselling author of “Rich Dad Poor Dad,” emphasized the importance of utilizing Fibonacci retracements in his own trading strategies. By incorporating these principles, traders can align their actions with the inherent patterns of the market, increasing their odds of success.

Actionable Tips: Harnessing Fibonacci for Trading Success

-

Identify Key Price Swing: Determine the starting and ending points of a significant price movement, whether a rally or decline.

-

Calculate Fibonacci Retracement Levels: Use the identified price swing to calculate the Fibonacci retracement levels: 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

-

Monitor Price Action at Retracement Levels: Observe how the price reacts at these levels. If the price bounces off a retracement level, it indicates potential support or resistance.

-

Apply Fibonacci Extensions: Extend the retracement levels beyond the initial price swing to identify potential target price levels. This will help you anticipate potential profit targets and adjust your positions accordingly.

-

Practice and Patience: As with any trading technique, proficiency in Fibonacci trading requires practice and patience. Study historical price charts, test your strategies on demo accounts, and refine your approach over time.

Fibonacci Series In Trading

Conclusion: Fibonacci Series – A Guiding Light in the Trading Labyrinth

In the dynamic and ever-changing landscape of trading, the Fibonacci series stands out as a timeless and reliable companion. Its ability to uncover patterns, predict price movements, and guide trading decisions makes it an indispensable tool for traders of all levels. By embracing the principles of the Fibonacci series, you gain a competitive edge, empowering you to navigate market volatility with confidence and maximize your profit potential.

As you continue your trading journey, remember that the Fibonacci series is but one piece of the puzzle. Combine it with a comprehensive understanding of market fundamentals, technical analysis, and sound risk management principles to build a robust trading strategy that stands the test of time.

Embrace the fibonacci series as your guiding light in the trading labyrinth, and may your path be adorned with success and prosperity.