Commodities, the raw materials that form the foundation of global commerce, have played a pivotal role in shaping economies and societies for centuries. From the Silk Road of ancient times to the modern-day supply chains that connect the world, commodities have fueled industrialization, transportation, and sustenance.

Image: es.semrush.com

The Foundation of Modern Economies

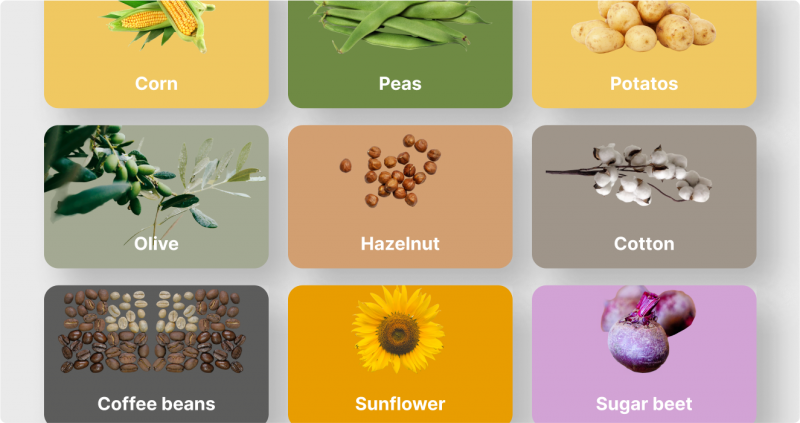

Commodities are the building blocks of countless products. Metals such as iron, copper, and aluminum are used in everything from skyscrapers to electronics. Energy sources like oil and gas power our homes and businesses. Agricultural commodities, such as soybeans, wheat, and coffee, nourish populations worldwide.

Impact on Prices and Inflation

Commodity prices have a significant impact on the cost of living. Fluctuations in the price of oil, for example, can ripple through the economy, affecting transportation costs, manufacturing expenses, and inflation rates.

A Global Market with Unique Characteristics

Unlike other traded goods, commodities have several distinct characteristics. They are:

- Fungible: Commodities are interchangeable, meaning one unit of the same commodity is as good as any other.

- Homogenous: Commodities have standardized quality and specifications, making them easily comparable and tradable.

- Low-differentiated: Commodities have few noticeable differences between producers, reducing consumer preference for specific brands.

Image: b2broker.com

Interconnected with World Events

Commodity markets are highly sensitive to geopolitical events, weather conditions, and changes in global demand. For instance, political instability in an oil-producing region can send shockwaves through the energy sector, impacting prices and supply chains.

Investing in Commodities: Balancing Risk and Reward

Investing in commodities can offer potential for diversification and return. However, it also carries risks, such as price volatility and geopolitical uncertainties. Investors considering commodity investments should carefully weigh these factors and consult with financial professionals.

Diversifying Portfolios

Commodities can add diversification to a portfolio because their prices often move independently of stocks and bonds. This can help to reduce overall portfolio risk.

Expert Advice for Navigating Commodity Markets

Based on my experience as a blogger covering commodities, here are some tips and expert advice:

- Understand Market Dynamics: Research and track global events, economic indicators, and supply chain disruptions that can impact commodity prices.

- Monitor Supply and Demand: Stay informed about factors that influence supply and demand, such as weather patterns, geopolitical events, and economic fluctuations.

The Power of Derivatives

Commodities can also be traded using financial derivatives, which offer flexibility and the ability to hedge risks. However, derivatives can be complex and carry their own set of risks, requiring investors to carefully understand their operation and potential consequences.

FAQs on Commodities

Q: What are the different types of commodities?

A: Commodities are broadly classified into four main categories: energy, metals, agricultural products, and precious metals.

Q: How are commodity prices determined?

A: Commodity prices are influenced by a multitude of factors, including supply and demand, production costs, transportation expenses, economic conditions, and geopolitical events.

Que Son Los Commodities

Conclusion

Commodities are essential to the functioning of global economies, providing the raw materials that fuel progress and innovation. Understanding their unique characteristics and market dynamics is crucial for businesses, investors, and policymakers alike. Whether you are a seasoned professional or a curious reader, I encourage you to delve deeper into the fascinating world of commodities and explore its impact on our interconnected world.