As a seasoned trader, I’ve witnessed firsthand the power of candle patterns in deciphering market sentiments. Candlesticks are not mere price bars; they are visual representations of market psychology, capturing the interplay of emotions, greed, and fear.

Image: www.lupon.gov.ph

Like ancient hieroglyphs, candle patterns whisper secrets of future price movements, empowering traders to make informed decisions amid market volatility. These patterns, birthed from centuries of market observations, have endured the sands of time, guiding traders to trading success.

Unveiling the Anatomy of Candle Patterns

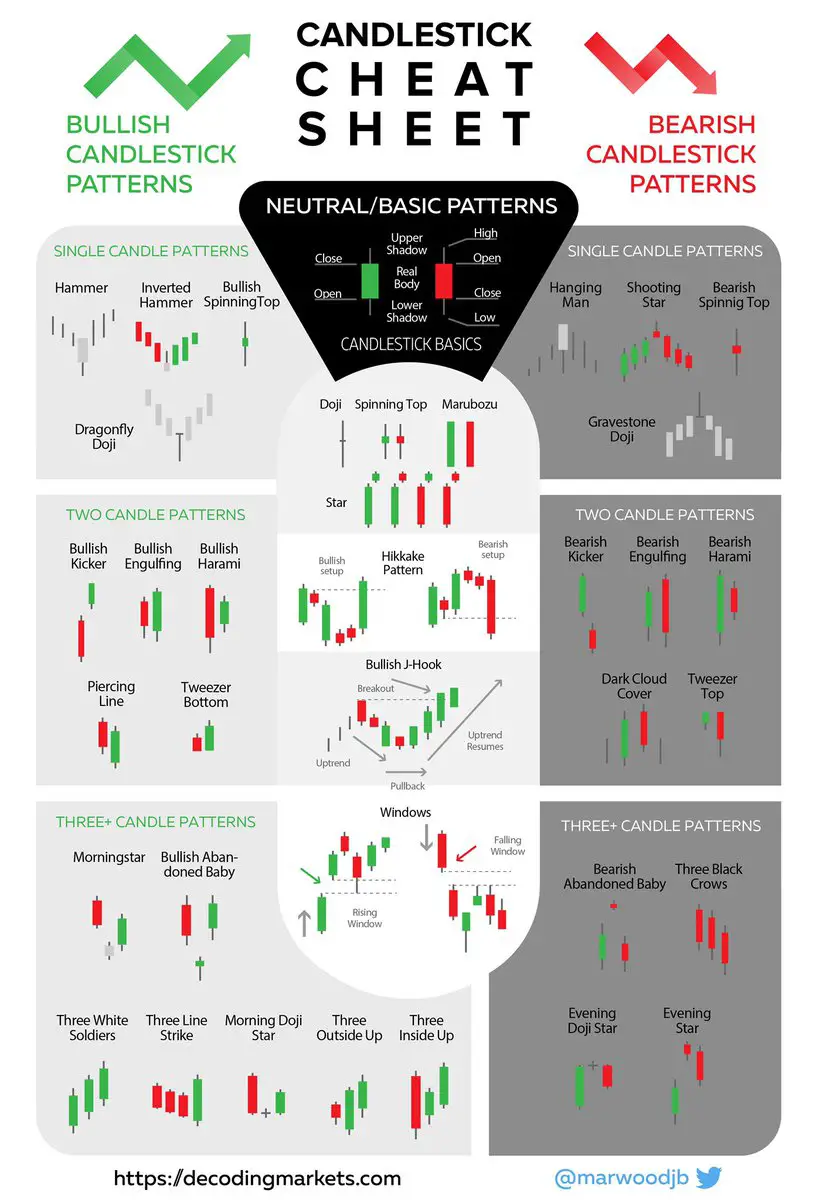

A candlestick embodies the essence of price action, where the body depicts the range between the open and close prices, and the wicks or shadows extend beyond these boundaries, revealing the highs and lows.

The relationship between the body and shadows, along with their position within the broader market context, creates a myriad of candle patterns. Each pattern carries its own significance, whispering tales of market sentiment, momentum, and potential reversals.

A Visual Tapestry: Types of Candle Patterns

The candle pattern lexicon is a vast one, with each pattern carrying its own story. From the bullish engulfing pattern, signaling a surge in buying pressure, to the bearish piercing line, hinting at a reversal in an uptrend, every pattern is a piece of the trading puzzle.

Some of the most widely recognized candle patterns include:

- Bullish Patterns: Morning Star, Hammer, Bullish Engulfing Pattern

- Bearish Patterns: Evening Star, Hanging Man, Bearish Engulfing Pattern

- Neutral Patterns: Doji, Harami, Spinning Top

Trading with Candle Patterns: Embracing the Language of the Market

Mastering candle patterns is akin to learning a new language, a language that the market speaks to reveal its secrets. By deciphering these patterns, traders gain an edge, predicting price movements with greater accuracy.

While candle patterns provide valuable insights, they should not be considered foolproof indicators. They are but one tool in the trader’s arsenal, to be used in conjunction with other technical and fundamental analysis techniques for optimal decision-making.

Image: www.pinterest.pt

Expert Insights: Unlocking the Secrets of Candle Patterns

Seasoned traders have imparted invaluable wisdom on the effective use of candle patterns. Here are some expert tips to enhance your trading strategy:

- Context is King: Candle patterns take on different meanings depending on the market context. Analyze patterns in relation to the prevailing trend, support and resistance levels, and overall market sentiment.

- Confirmation is Crucial: Do not rely solely on single candle patterns. Seek confirmation from other indicators, such as moving averages or volume analysis, to increase the reliability of your trading signals.

- Pattern Completion is Key: Allow candle patterns to fully develop before making trading decisions. Incomplete patterns can be misleading, potentially leading to false signals.

FAQ: Demystifying Candle Patterns

Q: How important is volume in candle pattern analysis?

A: Volume plays a crucial role in confirming the strength and validity of candle patterns. High volume during a pattern formation indicates strong market sentiment behind the move.

Q: Can candle patterns be used in all market conditions?

A: Candle patterns can be effective in various market conditions, but they may be less reliable during volatile and choppy price action.

Q: How can I improve my candle pattern trading skills?

A: Practice and experience are key. Study historical charts, analyze real-time market data, and test different trading strategies to gain a thorough understanding of candle patterns and their application.

Candle Patterns For Trading

Conclusion

Candle patterns are an invaluable tool for traders seeking to decipher the ebb and flow of the market. By mastering these patterns, traders can navigate market volatility with greater confidence, making informed trading decisions that lead to potential profitability.

Embark on this journey of discovery, immersing yourself in the world of candle patterns. Let their ancient wisdom guide your trading, unlocking the secrets of the market and transforming you into a skilled market navigator. Are you ready to embrace the power of candle patterns?