Introduction

As a beginner in the forex market, one of the most crucial aspects to master is determining the appropriate position size for your trades. Proper position sizing is essential for managing risk and maximizing potential profits while minimizing losses. In this comprehensive guide, we will delve into the world of position size calculators, equipping you with the knowledge and tools to make informed decisions about your trade size. Join us as we explore the multifaceted world of position size calculations in forex trading.

Image: www.babypips.com

Understanding Position Size Calculators

Position size calculators are invaluable tools that help traders determine the optimal size of their trades based on various factors such as their account balance, risk tolerance, trading strategy, and market volatility. By utilizing these calculators, traders can avoid the pitfalls of overleveraging and minimize the potential impact of adverse price movements on their trading capital.

Commonly used position size calculators employ different formulas and incorporate risk parameters to guide traders towards prudent position sizing. These formulas may include the percentage of risk approach, fixed-ratio method, and the Kelly criterion. Each method has its own advantages and disadvantages, and traders should choose the one that best aligns with their risk tolerance and trading style.

A Step-by-Step Guide to Using Position Size Calculators

- Determine Your Risk Tolerance: Assess your comfort level with risk and establish a maximum acceptable loss per trade. This determination should be based on your financial situation and trading goals.

- Identify Your Trading Strategy: Choose a trading strategy that suits your preferences and risk tolerance. Different strategies may require different position sizes.

- Select a Position Size Calculator: Opt for a reputable and accurate position size calculator that provides multiple risk-based sizing options.

- Input Your Parameters: Enter the following information into the calculator: account balance, risk tolerance, stop-loss level, and market volatility.

- Calculate Your Position Size: The calculator will generate an optimal position size based on the inputted parameters.

Tips for Effective Position Sizing

- Start Small: Begin with a conservative position size to minimize risk. Gradually increase the size as you gain experience and confidence in your trading abilities.

- Consider Risk-Reward Ratio: Consider the potential profit and loss for each trade to ensure a favorable risk-reward scenario.

- Use Stop-Loss Orders: Implement stop-loss orders to limit losses in unfavorable market conditions.

- Be Disciplined: Stick to your predefined position size calculations and avoid impulsive trading decisions.

- Monitor Market Volatility: Keep an eye on market volatility and adjust your position sizes accordingly to manage risk exposure.

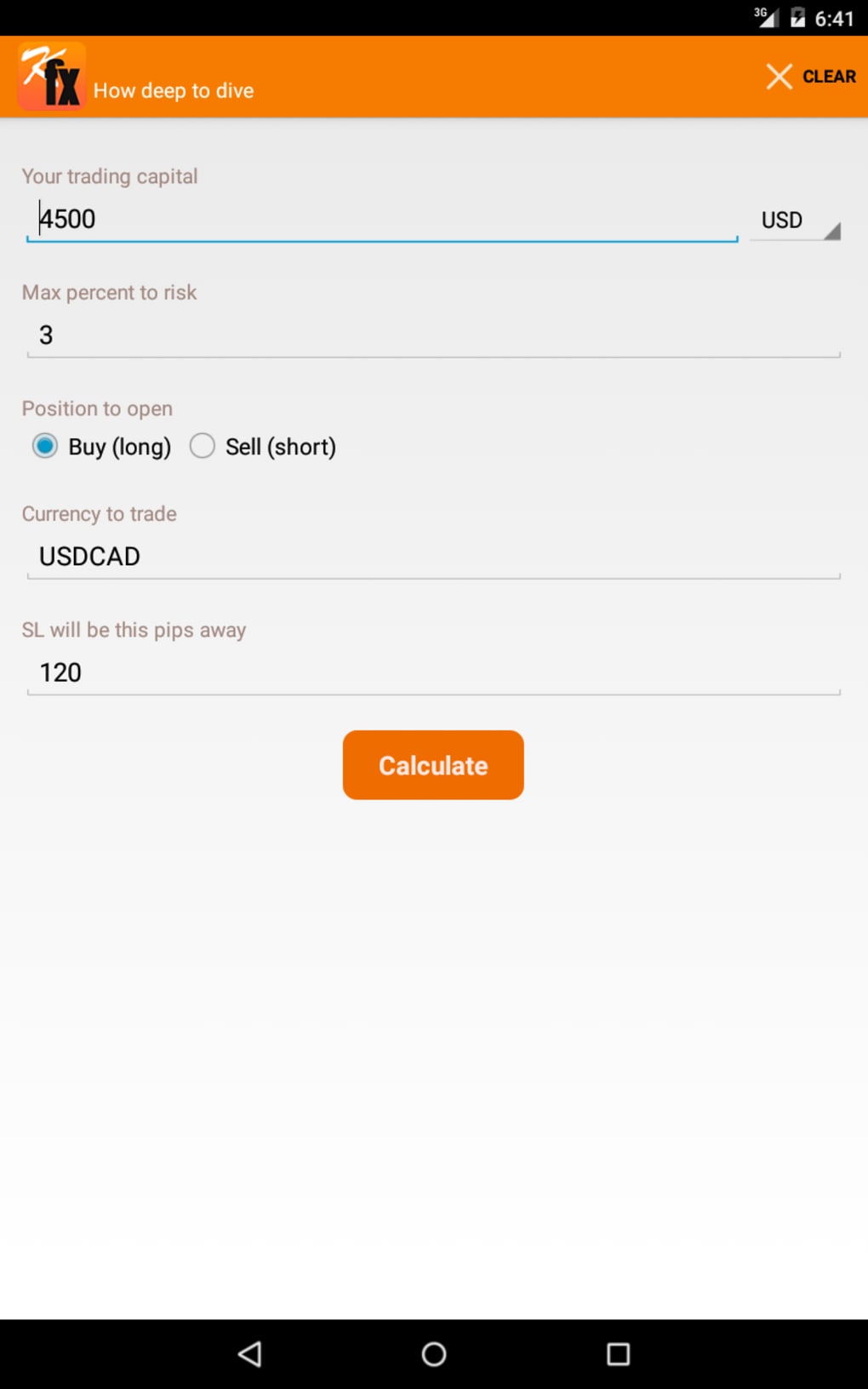

Image: forex-position-size-calculator.en.softonic.com

Frequently Asked Questions (FAQs)

- What is the best position size calculator? The best calculator is the one that meets your trading needs and risk tolerance. Explore different calculators and choose the one that provides the most reliable and consistent results.

- How do I determine my risk tolerance? Evaluate your financial resources, risk-taking abilities, and trading goals to establish a suitable risk tolerance level.

- Can I use the same position size for all trades? Position size should be tailored to each trade based on factors such as risk exposure and market conditions.

- What is the importance of a stop-loss order? A stop-loss order is crucial for managing risk and protecting your trading capital from excessive losses.

Position Size Calculator Forex

Conclusion

Position size calculators are powerful tools that can assist forex traders in determining the optimal trade size to align with their risk tolerance and trading strategy. By utilizing these calculators and following the guidelines outlined in this article, traders can effectively manage risk and enhance their chances of success in the fast-paced world of forex trading. Whether you are a novice trader or an experienced professional, mastering the art of position sizing is paramount to achieving your financial objectives and unlocking the full potential of the forex market.

So, are you ready to take the next step in your forex trading journey? Embrace the power of position size calculators and unlock the gateway to optimized risk management and enhanced profitability. Let us know if you have any further questions or require additional insights into the exciting realm of forex trading.