In the complex world of economics, financial instruments like indices play a crucial role in gauging market performance and guiding investment decisions. Among these indices, the price weighted index stands out as a versatile tool for measuring price fluctuations in a basket of assets. This insightful guide will equip you with a comprehensive understanding of what a price weighted index is, how it’s calculated, and its significance in the financial realm.

Image: www.chegg.com

Unveiling the Essence of a Price Weighted Index

A price weighted index, also known as a market capitalization weighted index, is a type of stock market index that measures the performance of a group of companies based on their market capitalization. Market capitalization is calculated by multiplying the current market price of a company’s stock by the number of its outstanding shares.

Within a price weighted index, each company’s contribution to the index’s value is directly proportional to its market capitalization. Hence, companies with higher market capitalizations carry more weight in influencing the overall index value. This differs from an equal weighted index, where all companies in the basket have an equal impact on the index’s value, regardless of their size.

Demystifying the Calculation Process

The formula for calculating a price weighted index is straightforward:

Index Value = (Current Price of Company 1 x Number of Outstanding Shares of Company 1 + ... + Current Price of Company n x Number of Outstanding Shares of Company n) / Index Divisor- Current Price: Refers to the latest market price of each company’s stock.

- Number of Outstanding Shares: Indicates the total number of shares available in the market.

Once the sum of the market capitalizations is obtained, it is then divided by an index divisor, which is a constant value used to ensure consistency in the index’s calculation over time. The index divisor is typically determined at the index’s inception and adjusted periodically to account for changes in the number of companies included in the index or changes in the index’s composition.

Applications in the Financial Landscape

Price weighted indices serve a multitude of purposes in the financial world. They are frequently used by investors and fund managers as benchmarks to compare the performance of their portfolios against the broader market. By tracking the movement of a price weighted index, investors can gauge the overall market trend and assess the performance of individual companies relative to the index.

Additionally, price weighted indices play a significant role in the creation of index funds and exchange-traded funds (ETFs). These financial products offer investors a convenient and diversified way to invest in a basket of assets by tracking a specific index. The performance of these funds is directly tied to the movement of the underlying index.

:max_bytes(150000):strip_icc()/dotdash_Final_Equal_Weight_Apr_2020-01-6b2bdb8ccaf74b8d9170fafe5851d5df.jpg)

Image: rhayzlzenia.blogspot.com

Embracing the Value of Accuracy and Timeliness

The accuracy and timeliness of a price weighted index are paramount for its practical applications. To ensure reliability, the calculations must be based on accurate and up-to-date data, usually derived from reputable data providers.

Timeliness is also crucial, as the index needs to reflect the latest market conditions. Most indices are calculated and disseminated in real-time or with minimal delay to provide investors with the most current information.

The Essence of Transparency and Disclosure

Transparency and disclosure are the cornerstones of trust in financial instruments. In the case of price weighted indices, it is imperative that the composition and calculation methodology are clearly disclosed to investors. This information ensures that investors fully understand how the index is constructed and how their investments are being tracked.

Transparency fosters confidence and enables investors to make informed decisions based on a comprehensive understanding of the index’s underlying factors.

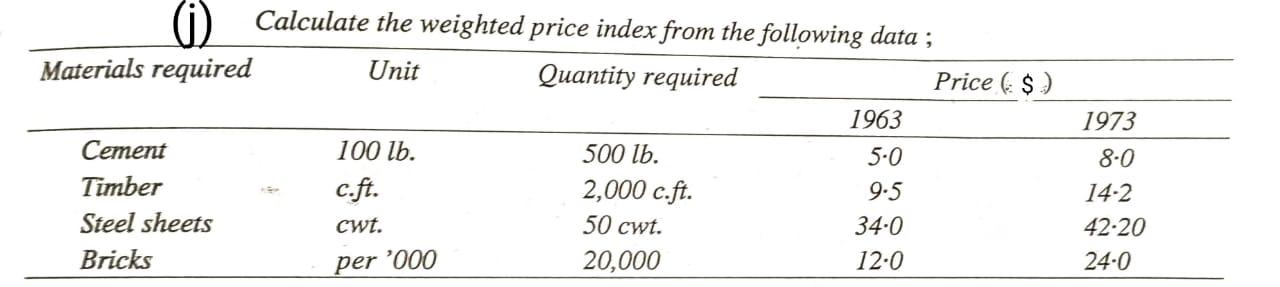

Calculating Price Weighted Index

Conclusion: Empowering Investors with Informed Decisions

Price weighted indices serve as valuable tools in the investment arena, providing a robust measure of market performance and facilitating informed decision-making. By understanding the mechanics and significance of these indices, investors can navigate the financial landscape with greater confidence and leverage these insights to achieve their financial goals. Remember to seek guidance from trusted sources and engage with financial professionals to tailor your investment strategies to your individual circumstances.