Introduction

In the vast and ever-evolving world of financial markets, the ability to accurately gauge the performance of various investments is crucial for making informed decisions. One widely used metric for assessing the market’s overall trend is the price-weighted index, which provides a valuable snapshot of the price changes within a specific group of assets.

Image: www.youtube.com

This comprehensive guide delves into the intricacies of calculating a price-weighted index, exploring its history, underlying principles, and practical applications. You will gain an in-depth understanding of how this index is constructed, how it differs from other market indices, and how it can be used to make informed investment decisions.

Understanding Price-Weighted Index

A price-weighted index is a type of market index that measures the aggregate price movements of a predefined group of assets, typically stocks. It assigns a higher weight to assets with higher prices, making it more heavily influenced by the price changes of large-cap companies.

In contrast to market-capitalization-weighted indices like the S&P 500, which give more weight to larger companies based on their market capitalization, price-weighted indices give equal weight to each asset regardless of its size or market share. This unique weighting scheme makes price-weighted indices more sensitive to price changes among high-priced assets.

History of Price-Weighted Indices

The history of price-weighted indices can be traced back to the 19th century, when the first stock market indices were developed. These early indices were primarily price-weighted, as it was simpler to calculate and understand at the time.

One of the most famous price-weighted indices is the Dow Jones Industrial Average (DJIA), created in 1896 by Charles Dow. The DJIA tracks the performance of 30 large-cap companies listed on the New York Stock Exchange and is still widely used today as a benchmark for the U.S. stock market.

Calculating a Price-Weighted Index

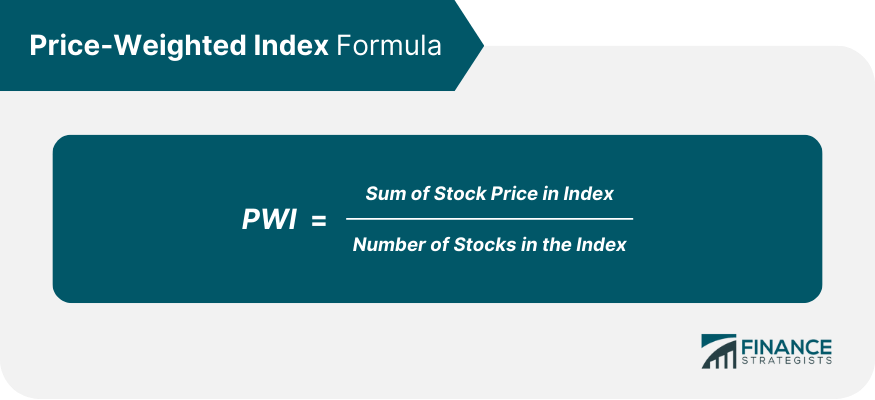

Calculating a price-weighted index involves a few simple steps:

- Select a Base Value: Determine a starting point for the index. This value can be set to any arbitrary number, such as 100.

- Calculate the Weighted Sum of Prices: Multiply the current price of each asset by its weight in the index. The sum of these products is the weighted sum of prices.

- Divide by the Base Value: To create an index value, divide the weighted sum of prices by the base value.

The resulting index value reflects the overall price movement of the selected assets. It can be tracked over time to observe market trends and compare the performance of different sectors or industries.

Image: www.financestrategists.com

Applications of Price-Weighted Indices

Price-weighted indices have several practical applications in the financial industry:

- Market Benchmarking: Price-weighted indices serve as a benchmark against which the performance of individual stocks or portfolios can be compared.

- Industry Analysis: Price-weighted indices can help investors track the performance of specific sectors or industries, providing insights into their growth potential or relative value.

- Passive Investment: Price-weighted indices are often used as the basis for passively managed funds, such as exchange-traded funds (ETFs), that track the performance of the index.

Advantages and Limitations of Price-Weighted Indices

Price-weighted indices offer several advantages:

- Simple and Transparent: Price-weighted indices are easy to understand and calculate, making them accessible to investors of all levels of experience.

- Less Bias: Price-weighted indices are less subject to bias than other types of indices, as they give equal weight to all assets regardless of their size or market share.

- Sensitivity to Price Changes: Price-weighted indices are more sensitive to price changes, especially among high-priced assets.

Conversely, price-weighted indices also have some limitations:

- Can Overweight High-Priced Assets: Price-weighted indices can be heavily influenced by the price movements of high-priced assets, potentially overrepresenting their impact on the overall market.

- Less Representative of Market Capitalization: Price-weighted indices do not reflect the market capitalization of the underlying assets, which may not provide a complete picture of the market’s performance.

Latest Trends and Developments

The field of price-weighted indices is constantly evolving, with new developments and trends shaping their application.

One notable trend is the use of price-weighted indices in emerging markets. As these markets become increasingly accessible to global investors, price-weighted indices provide a transparent and efficient way to track their performance.

Another development is the emergence of smart beta indices, which incorporate a more sophisticated weighting scheme. While traditional price-weighted indices give equal weight to all assets, smart beta indices use factors such as volatility, earnings, or dividends to adjust the weights, offering investors alternative ways to track the market.

Calculate Price Weighted Index

Conclusion

Understanding how to calculate and interpret a price-weighted index is essential for any investor looking to navigate the financial markets confidently. By considering the unique characteristics, applications, and limitations of price-weighted indices, you can make informed decisions that align with your investment goals.

Whether you are a seasoned investor or just starting out, price-weighted indices can provide valuable insights into market trends and help you make more informed investment decisions. Take advantage of the resources available to equip yourself with the knowledge and tools necessary for success.