In the ever-evolving terrain of foreign exchange, understanding the interplay between base and quote currencies is crucial for informed decision-making. These currencies form the bedrock upon which currency pairs are built, facilitating international trade, global investments, and financial transactions. Delving into the intricacies of base and quote currencies is essential for navigating the complexities of currency exchange and unlocking its full potential.

Image: corporatefinanceinstitute.com

Defining Base and Quote: A Tale of Two Perspectives

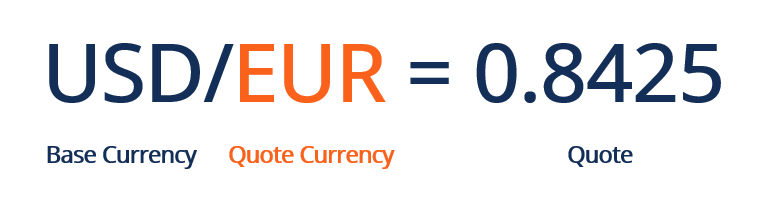

The base currency, often known as the transaction currency, represents the currency you possess and wish to exchange. It is the foundational element, the starting point of your currency conversion journey. The quote currency, on the other hand, denotes the currency you desire in exchange for your base currency. It is the end goal, the desired outcome of your transaction. Together, the base and quote currencies intertwine harmoniously, creating a pathway for monetary exchange.

Historical Significance: Tracing the Evolution of Currency Pairs

The establishment of base and quote currencies traces its roots back to the dawn of modern currency exchange, with the advent of the Bretton Woods system in 1944. This system ordained the U.S. dollar as the preeminent global reserve currency, pegging its value to gold. Consequently, the U.S. dollar became the de facto base currency for numerous currency pairs, a practice that continues to prevail in contemporary markets.

In recent times, the advent of electronic trading platforms and the globalization of finance have engendered a more diversified landscape. While the U.S. dollar still reigns as a dominant base currency, other currencies have gained prominence, including the euro, the Japanese yen, and the British pound. This evolving dynamic has led to the formation of a plethora of currency pairs, each catering to specific trading needs and reflecting the globalized nature of economic interdependence.

Practical Applications: Trading the Currency Pairs

In the vibrant arena of forex trading, understanding base and quote currencies is not merely an academic exercise but a practical necessity. It forms the foundation for informed decision-making, enabling traders to assess currency values, identify trading opportunities, and manage risk effectively. Whether you are a seasoned forex trader or just starting your journey, grasping the dynamics of base and quote currencies is paramount to success.

Image: www.exchangerates.org.uk

Base Vs Quote Currency

https://youtube.com/watch?v=-XJ3rTmm7Gk

Beyond Trading: The Significance in International Commerce

The interplay of base and quote currencies extends well beyond the trading arena, infiltrating the very fabric of international commerce. When engaging in global trade, it is imperative to understand the base and quote currencies involved in the transaction. This knowledge ensures accurate pricing, timely settlements, and seamless cross-border transactions.