The foreign exchange (Forex) market is the world’s largest financial market, where currencies are traded in pairs. When you trade Forex, you are speculating on the changes in value between two currencies. The smallest unit of change in a currency pair is called a pip.

Image: forextrading20191.blogspot.com

Pips are used to measure the profit or loss on a Forex trade. By understanding how to calculate pips, you can determine the potential profitability of a trade before you execute it.

What Do Pips Stand for?

The term “pip” is an acronym for “point in percentage.” This technical term is commonly used to quantify changes in the exchange rate of a currency pair. Pips determine profit or loss on forex trades.

How Many Digits Are in a Pip?

The number of digits in a pip varies depending on the currency pair being traded. For most major currency pairs, such as EUR/USD, one pip is equal to 0.0001, or one-tenth of a percent.

For example, if EUR/USD is trading at 1.1000 and it moves to 1.1001, this is a change of one pip.

However, there are some currency pairs, such as JPY pairs, where one pip is equal to 0.01, or one percent.

Why are Pips Important in Forex Trading?

Pips are fundamental because they allow traders to compare currency price movements. For instance, a price change of 100 pips in the EUR/USD pair is considered a more significant movement than a change of 10 pips because the euro has a higher value than the yen.

Additionally, knowing how to calculate pips is crucial for determining the profit or loss on a trade. For example, if you buy one lot of EUR/USD at 1.1000 and sell it at 1.1010, you will have made a profit of 10 pips (1010 – 1000).

Image: tylaralesio.blogspot.com

How Do You Calculate Pips in Forex?

The formula to calculate the number of pips in a currency pair is as follows:

(Change in Price/Closing Price) x 10,000

For most currency pairs, the closing price is the price at 5:00 PM Eastern Time (ET).

Here is an example:

- Let’s say you buy one lot of EUR/USD at 1.1000.

- The closing price the next day is 1.1010.

- The change in price is 1.1010 – 1.1000 = 0.0010.

- The number of pips is (0.0010/1.1000) x 10,000 = 90.909 pips.

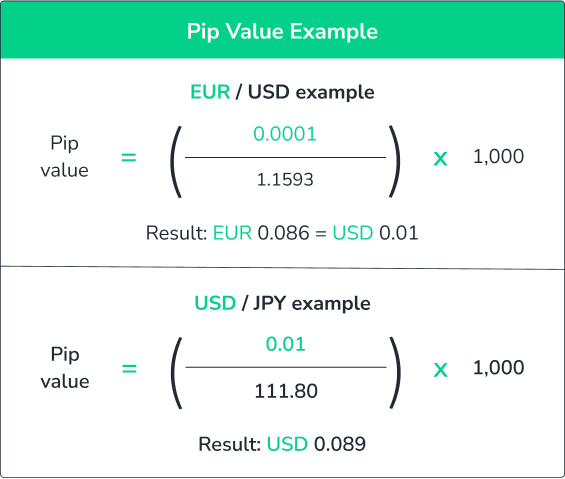

What Is a Pip Value?

The pip value is the monetary value of one pip. It is calculated by multiplying one pip by the contract size.

For example, if you are trading one lot of EUR/USD, which is equal to 100,000 units of the base currency (EUR), the pip value is:

(1 pip) x (100,000) = €10

This means that if EUR/USD moves by one pip, you will either make or lose €10.

How to Use Pips in Your Forex Trading Strategy

Pips can be used to:

- Measure your profit or loss on a trade

- Determine the potential profitability of a trade

- Set stop-loss and take-profit orders

- Track the performance of your trading strategy

How To Calculate Pips Forex

Conclusion

Understanding how to calculate pips is essential for anyone who wants to trade Forex. Pips are the smallest unit of change in a currency pair, and they are used to measure the profit or loss on a trade. By understanding how to calculate pips, you can make informed trading decisions and increase your chances of success.