Uber Technologies, the global ride-hailing service provider, recently released its quarterly earnings report, offering investors and analysts insights into the company’s financial performance. In this comprehensive analysis, we delve deeper into the report to examine Uber’s key metrics, revenue breakdown, profitability status, and the outlook for its future earnings.

Image: appdriver.co.uk

Key Financial Metrics and Revenue Streams

Uber’s earnings report showcased a solid financial performance in the recent quarter. The company’s Gross Bookings, representing the total value of transactions facilitated through its platform, reached a staggering $30.7 billion, indicating a substantial increase from the same period last year. This surge in Gross Bookings primarily stems from the company’s consistent expansion in its global operations and the gradual recovery of the travel industry following the COVID-19 pandemic.

Uber’s revenue streams are primarily divided into three categories: Mobility, Delivery, and Freight. Mobility, which includes ride-hailing services, accounted for the majority of the revenue, contributing close to 85% of the total. The company’s mobility revenue witnessed a significant 28% year-over-year growth, reflecting the strong demand for ride-sharing services as cities and countries gradually lifted COVID-19 restrictions.

Profitability Status and Outlook

Despite the notable recovery in revenue, Uber remains in a state of financial loss. The company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) recorded a loss of $276 million in the recently reported quarter. This loss can be attributed to factors such as ongoing investments in technology and expansion efforts, the lingering impact of the pandemic on certain aspects of its operations, and the highly competitive nature of the ride-hailing industry.

Nevertheless, Uber’s management expressed optimism about the company’s future earning prospects. The company plans to continue its global expansion, targeting new markets and introducing new products and services. By diversifying its revenue portfolio and ramping up its marketing efforts, Uber aims to strengthen its position in the ride-hailing space and accelerate its path toward profitability.

Market Reaction and Analyst Perspectives

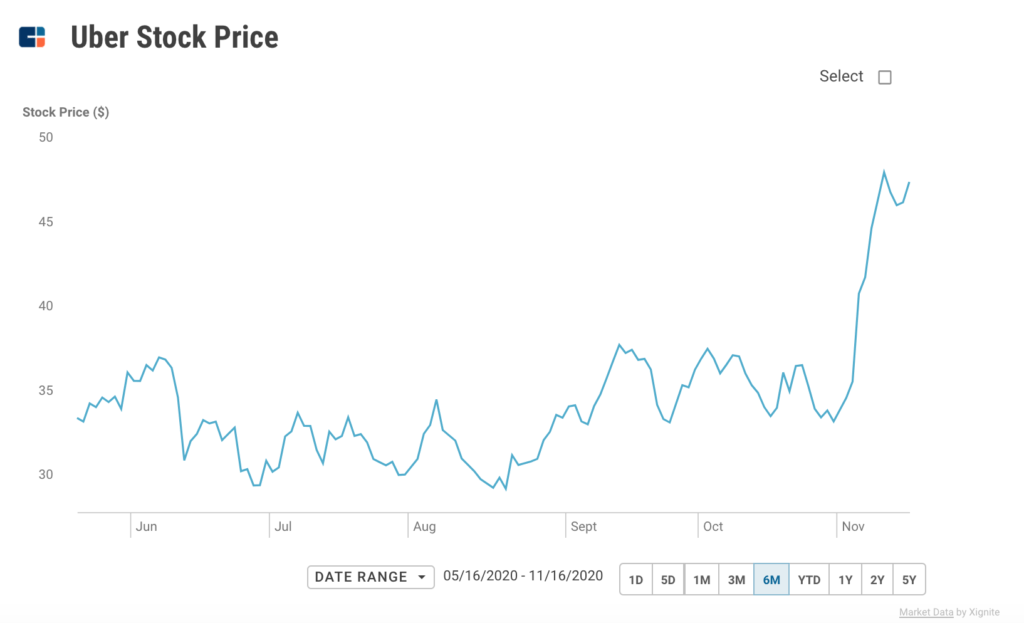

The release of Uber’s earnings report was met with a mixed reaction from the market. The company’s stock price initially surged in the immediate aftermath of the report’s release, as investors were encouraged by the robust revenue growth. However, the stock price later retreated, indicating a cautious approach by some investors who might be concerned about the company’s ongoing losses.

Analysts provided varying interpretations of Uber’s financial performance. While some expressed confidence in the company’s long-term potential, others emphasized the importance of addressing profitability challenges and adapting to the changing competitive landscape.

Image: www.cbinsights.com

Future Prospects and Investment Considerations

Uber’s future earnings are contingent upon several factors, including its ability to capitalize on the increasing demand for ride-hailing services, effectively manage costs and enhance margins, and fend off competition from existing and emerging mobility providers.

For investors, Uber’s stock presents both risks and potential rewards. The company’s strong brand recognition, global presence, and technological advancements make it a compelling investment opportunity for those with a long-term investment horizon. However, it’s crucial for investors to monitor Uber’s progress toward profitability, regulatory changes, and the evolving competitive dynamics within the industry before making investment decisions.

Uber Stock Earnings Report

Conclusion

Uber’s recent earnings report provides a multifaceted view of the company’s financial performance and future prospects. While revenue growth remains strong, the company’s ongoing financial losses and the intense competitive environment present both challenges and opportunities. Investors should carefully weigh these factors and monitor Uber’s progress over time to determine whether its stock aligns with their investment objectives and risk tolerance.