Managing personal finances can be a daunting task, and understanding paycheck deductions is crucial. One term that often raises eyebrows is “STP Net Pay Adjustment.” As a veteran in this field, I’ve witnessed firsthand the confusion surrounding this concept. Allow me to demystify the STP Net Pay Adjustment and empower you with a clear understanding of its implications for your pay.

Image: www.chegg.com

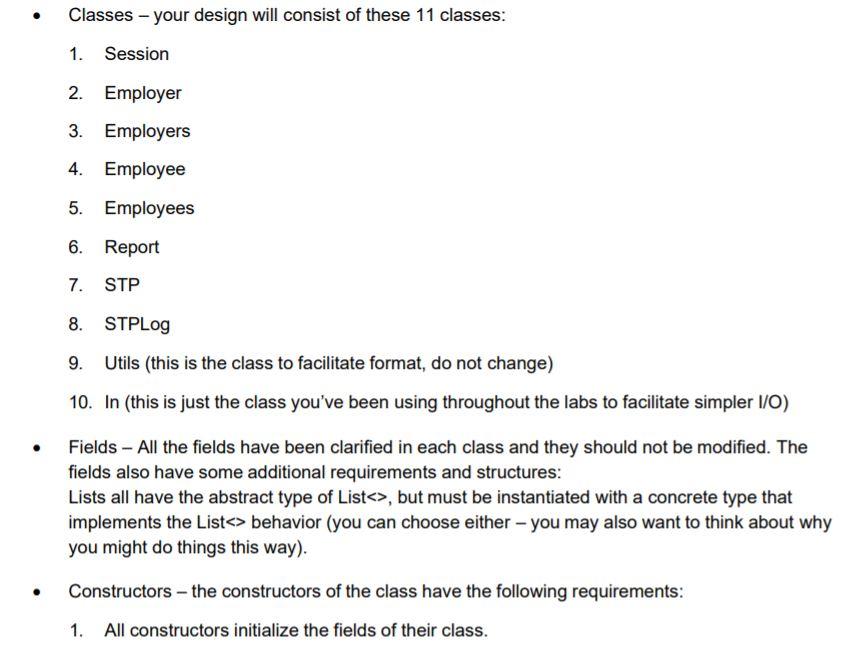

STP: A Brief Overview

STP stands for Single Touch Payroll. Implemented in Australia in 2019, STP is a transformative payroll reporting system designed to simplify and streamline interactions between employers and the Australian Taxation Office (ATO). Through STP, employers report employees’ income and withholding information directly to the ATO on or before each payday.

Net Pay Adjustment: Explained

A Net Pay Adjustment refers to a change made to an employee’s pay in a subsequent pay period to rectify errors or omissions in the original payment. These adjustments can be either positive or negative, increasing or decreasing the net pay amount, respectively.

Types of Net Pay Adjustments

- Overpayment Correction: This adjustment reduces the net pay amount when the employee was overpaid in a previous pay period.

- Underpayment Correction: This adjustment increases the net pay amount when the employee was underpaid in a previous pay period.

- Non-Cash Benefit Correction: This adjustment accounts for non-cash benefits received by the employee, such as a company car or health insurance.

- Leave Payment Correction: This adjustment rectifies errors related to leave payments or entitlements.

Image: www.patriotsoftware.com

Reasons for Net Pay Adjustments

Net Pay Adjustments may arise due to various reasons, including:

- Errors in calculating deductions or allowances

- Late or incorrect information provided by the employee

- Changes in employee circumstances, such as a change in tax residency or dependent status

- Retrospective adjustments related to benefits or leave entitlements

Impact on Net Pay

Net Pay Adjustments can significantly impact an employee’s net pay. A negative adjustment will reduce the amount of money the employee receives in their bank account, while a positive adjustment will increase it. It’s important to note that these adjustments do not affect the employee’s gross pay, which remains constant throughout.

Expert Tips for Understanding Net Pay Adjustments

- Review Your Pay Stubs Carefully: Pay stubs provide a detailed breakdown of your earnings and deductions. If you notice any discrepancies or unfamiliar terms, reach out to your employer or payroll provider for clarification.

- Keep Records: Maintain a record of your pay stubs and any correspondence related to net pay adjustments. This documentation will serve as evidence in case of any disputes.

- Contact Your Employer: If you have any questions or concerns about a net pay adjustment, don’t hesitate to contact your employer for an explanation.

Frequently Asked Questions About STP Net Pay Adjustment

- Q: Why do I have a negative net pay adjustment?

A: A negative adjustment indicates that you were overpaid in a previous pay period

- Q: How can I avoid net pay adjustments?

A: While not always possible, providing accurate and up-to-date information to your employer can minimize the likelihood of adjustments.

- Q: Can I dispute a net pay adjustment?

A: Yes, if you believe an adjustment is incorrect, you should contact your employer to discuss your concerns.

Stp Net Pay Adjustment

https://youtube.com/watch?v=3KM9sTP9DCg

Final Thoughts

Understanding STP Net Pay Adjustment is crucial for managing your finances effectively. By following the tips and advice outlined above, you can confidently navigate these adjustments and ensure that you receive the correct net pay amount. Remember, financial literacy empowers you to make informed decisions about your money and plan for a secure future.