In the volatile world of foreign exchange (forex) trading, risk management is paramount. Determining the appropriate position size is a cornerstone of this strategy, ensuring you navigate the markets with confidence and minimize potential losses.

Image: forexscalpingwebinar.blogspot.com

This comprehensive guide will empower you with the knowledge and tools to calculate your optimal position size precisely. We’ll delve into the intricacies of risk management, provide expert insights, and offer actionable tips to enhance your forex trading journey.

Understanding Forex Position Sizing: The Key to Risk Mitigation

Forex position sizing refers to the predetermined amount of currency you’re willing to buy or sell in a single trade. It directly influences the potential profit or loss you can incur. The goal is to strike a balance, allowing for profit opportunities while managing risk within acceptable limits.

By carefully calculating your position size, you can minimize the impact of adverse market movements on your trading capital. This strategic approach allows you to preserve your financial resources and trade with greater confidence, even in volatile market conditions.

Calculating Your Forex Position Size: A Step-by-Step Blueprint

Several factors play a crucial role in determining the optimal position size for your forex trades. These include:

- Account Balance: The starting point is assessing your available trading capital. Your position size should be proportionate to your account balance, allowing you to maintain sufficient margin and avoid overleveraging.

- Risk Tolerance: Every trader has a unique risk appetite. Determine your tolerance level to assess how much potential loss you’re comfortable with on each trade.

- Market Volatility: Volatility measures the rate at which prices fluctuate. Higher volatility requires a smaller position size to manage risk, while lower volatility allows for a larger exposure.

- Profit Target and Stop Loss: Establish clear profit targets and stop-loss levels for each trade. These parameters will help you define the potential reward and risk involved.

To calculate your position size accurately, follow these steps:

- Determine Your Risk Percentage: This represents the acceptable loss you’re willing to tolerate on each trade. It should be a small fraction of your account balance, typically 1-2%.

- Calculate the Market Risk: Determine the potential price fluctuation based on market volatility and your profit target and stop-loss levels. Convert this into a dollar amount.

- Set Your Position Size: Divide your risk percentage by the market risk. This will give you the appropriate position size in the specified currency.

Expert Insights: Mastering Risk Management in Forex Trading

Renowned forex trader George Soros, known for his audacious market moves, emphasized the crucial role of risk management in his success:

“If you don’t cut your losses, your losses will cut you.”

Mark Douglas, an industry leader in trading psychology, highlights the importance of emotional discipline:

“The successful individual is one who has the emotional strength to do what is necessary, rather than what is convenient.”

Embrace these insights to develop a robust risk management framework and enhance your trading performance.

Image: www.tradingview.com

Actionable Tips for Optimal Forex Position Sizing

To ensure optimal position sizing in your forex trading, follow these practical tips:

- Simulate Trades: Practice your position sizing strategy on a demo account before risking real capital. This allows you to fine-tune your approach and evaluate potential scenarios.

- Monitor Market Conditions: Continuously assess market volatility to adjust your position size accordingly. Consider using technical indicators to measure market conditions.

- Trade Within Your Risk Tolerance: Never deviate from your predefined risk tolerance levels. Stick to your strategy to avoid emotional decision-making.

- Use Position Scaling: Adjust your position size dynamically based on market movements. Increase your position when the market favors your trade and reduce it if it goes against you.

By implementing these actionable tips, you can refine your risk management approach and improve your overall trading outcomes.

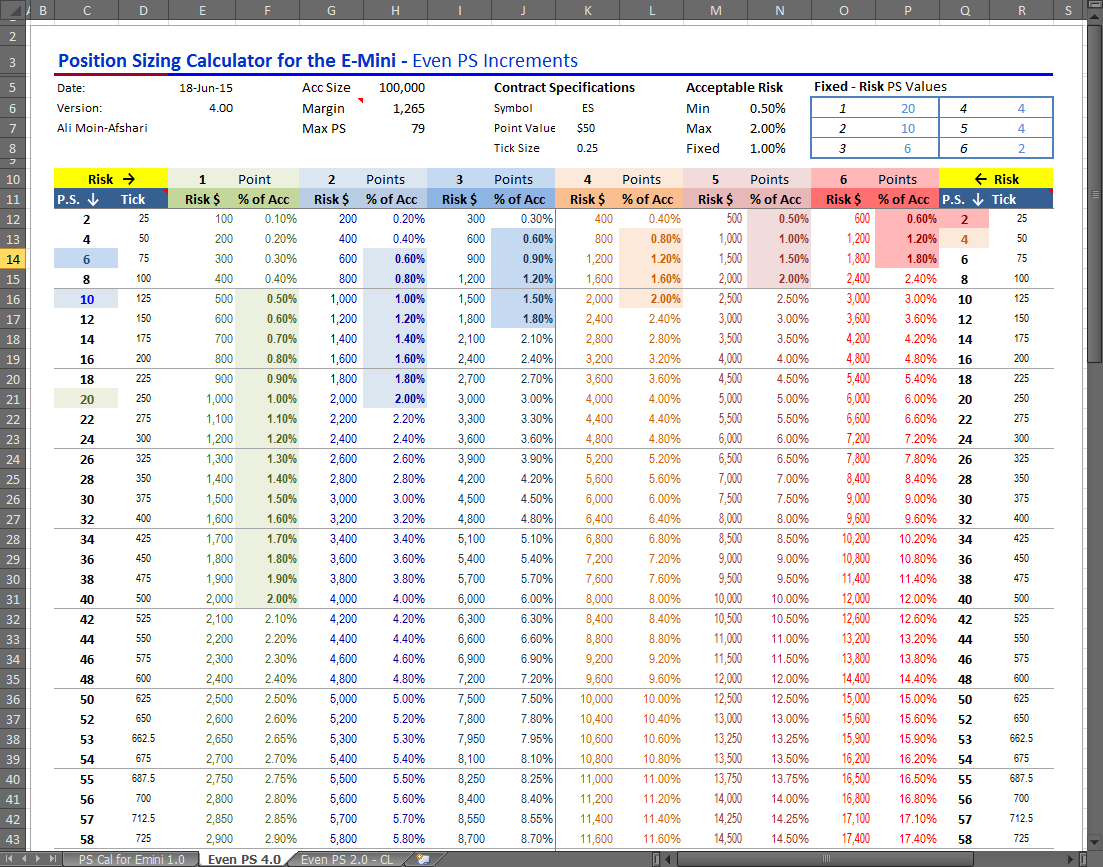

Forex Position Size Calculator

Conclusion: The Path to Calculated Confidence in Forex Trading

Mastering forex position sizing is an indispensable skill for every trader seeking success in this dynamic market. Embrace a risk-conscious mindset, meticulously calculate your position size, and incorporate expert insights into your trading strategy.

Remember, the path to calculated confidence lies in thorough preparation and unwavering discipline. As you navigate the forex markets, leverage this guide’s knowledge and tools to enhance your decision-making and mitigate potential losses. Embrace the empowering journey of calculated risk management and thrive in the ever-evolving world of forex trading.