In the captivating world of financial markets, candlesticks reign supreme as an indispensable tool for traders seeking to decipher the intricate language of price movement. These enigmatic formations, like ancient runes etched upon the tapestry of time, hold profound secrets that empower savvy investors to navigate the tumultuous seas of financial markets with precision and confidence.

Image: www.coteaux-val-arros.fr

As a seasoned trader, I’ve witnessed countless tales of triumph and despair unfold before my very eyes. The road to profitability, I’ve discovered, is not a path for the faint of heart but rather a journey that requires unwavering discipline, a keen eye for detail, and an intimate understanding of the intricate choreography of price patterns.

A Glimpse into Candlestick Lore: A Timeless Legacy

Candlesticks originated centuries ago in the bustling trading pits of feudal Japan, where rice merchants employed them to forecast market fluctuations. Their unrivaled ability to capture the interplay between buyers and sellers, emotions, and market sentiment has ensured their enduring relevance in the modern financial era.

Each candlestick represents a specific timeframe, typically ranging from one minute to one month. The body of the candle reflects the difference between the open and close prices, while the wicks (or shadows) denote the highest and lowest prices reached during that period.

Unveiling the Language of Candlesticks: A Guiding Light in Market Darkness

Understanding candlestick patterns is akin to mastering a secret language, a code that unlocks the true intentions of the market. By discerning the nuances of these formations, traders can anticipate price movements with astonishing accuracy.

Consider the following examples:

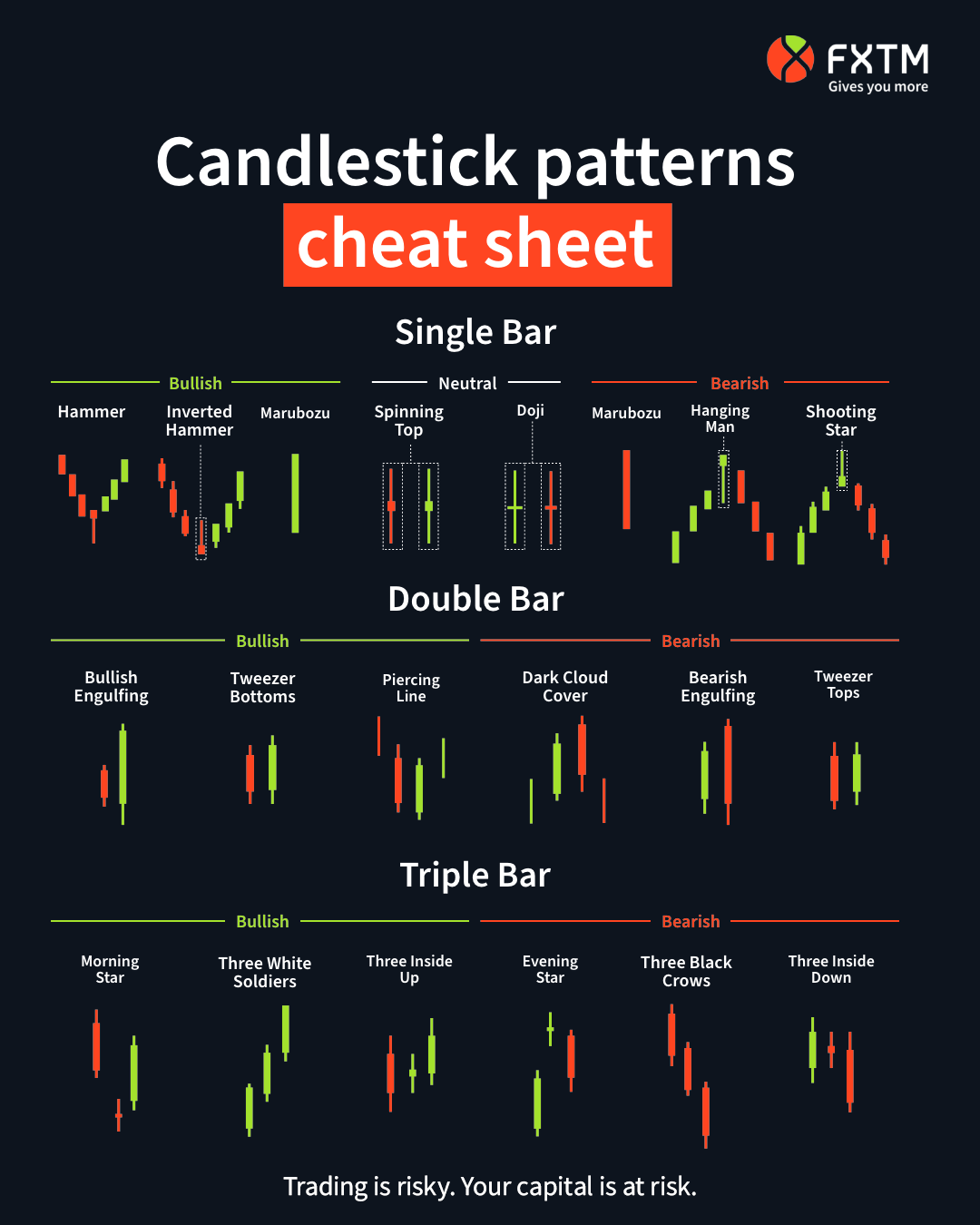

- Bullish Candlestick Patterns: These patterns indicate potential upward momentum in the market. They include hammer, bullish engulfing, and morning star patterns, among others.

<li><strong>Bearish Candlestick Patterns:</strong> Conversely, these patterns suggest a potential downtrend. Examples include hanging man, bearish engulfing, and evening star patterns.</li>

<li><strong>Neutral Candlestick Patterns:</strong> These formations signal indecision or consolidation in the market. Doji patterns (such as gravestone doji and dragonfly doji) often fall within this category.</li>Candlestick Trading in Motion: Charting Your Course to Success

The true power of candlesticks lies in their ability to corroborate each other, forming complex formations that provide invaluable insights into market psychology. By combining multiple candlestick patterns, traders can gain a comprehensive view of market dynamics and anticipate potential price movements with increased confidence.

For instance, a bullish engulfing pattern followed by a confirmation candle (such as a hammer or bullish harami) can significantly increase the probability of an impending uptrend. Similarly, a bearish engulfing pattern coupled with a subsequent bearish confirmation candle (e.g., hanging man or bearish harami) can strongly suggest a potential downtrend.

Image: www.forextime.com

Expert Advice and Insights: Illuminating the Path to Profitability

Harnessing the wisdom of seasoned traders can accelerate your mastery of candlestick trading. Here are some invaluable tips and expert advice to guide your journey:

- Master a Few Key Patterns: Focus on understanding and mastering the most common candlestick patterns (e.g., bullish/bearish engulfing, hammer, hanging man). This will provide a solid foundation for your trading decisions.

<li><strong>Practice Patience and Discipline:</strong> Candlestick patterns should be used in conjunction with other technical analysis tools (e.g., support and resistance levels, moving averages) and a sound understanding of market fundamentals. Avoid emotional trading and stick to your trading plan.</li>FAQ: Unveiling the Answers to Your Candlestick Queries

To quench your thirst for knowledge, here’s a collection of frequently asked questions (FAQs) that will help you delve deeper into the world of candlestick trading:

- Q: How do I identify candlestick patterns?

A: Examine the relationship between the open, close, high, and low prices of the timeframe being analyzed.

<li><strong>Q: Which candlestick patterns are considered most reliable?</strong>

<p>A: Engulfing patterns (both bullish and bearish) are generally considered highly reliable, as they indicate a strong reversal of trend.</p></li>

<li><strong>Q: Can candlestick trading be profitable?</strong>

<p>A: Yes, but profitability in candlestick trading depends on proper education, practice, and risk management techniques.</p></li>What Is Candlestick Trading

Conclusion: Embracing the Power of Candlesticks

Candlestick trading empowers you with an ancient yet modern tool that bridges the gap between market data and human psychology. By mastering the language of candlesticks, you unlock a profound understanding of market dynamics and position yourself for success in the ever-evolving financial landscape.

Are you ready to embark on your journey to candlestick trading mastery? Embrace the knowledge and insights shared within this guide to navigate the market with confidence and uncover the secrets that have eluded so many before you.