Introduction

Image: www.financenews.global

In the realm of financial markets, a whole universe of financial instruments and investment strategies awaits discovery. Among them, Contracts for Difference (CFDs) have emerged as a popular instrument for traders seeking to capitalize on market movements without the ownership of underlying assets. In this comprehensive guide, we will delve into the intricacies of CFD trading, unveiling its mechanisms, benefits, and potential risks. Whether you are a seasoned investor or a curious beginner, accompany us on this journey as we explore the fascinating world of CFDs.

Understanding CFDs: A Quick Primer

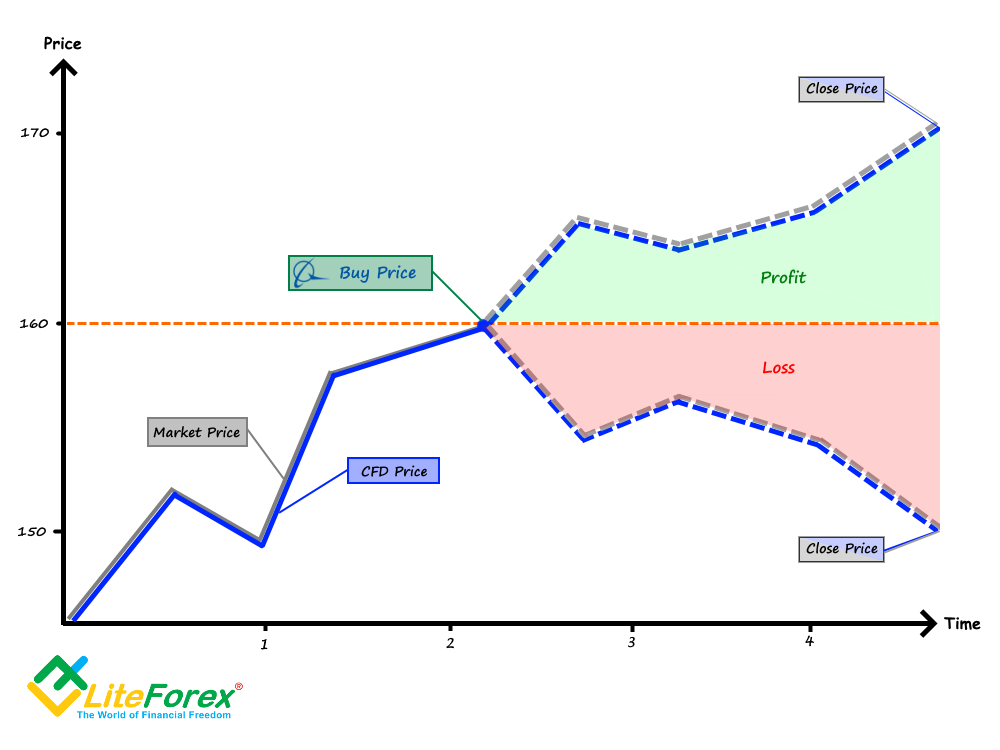

At their core, Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of various underlying assets without having to physically acquire or deliver the assets themselves. These assets may include stocks, forex currencies, commodities, and indices. In essence, when engaging in CFD trading, the trader agrees with a broker to exchange the difference between the opening and closing prices of the underlying asset. This enables traders to potentially profit from both rising and falling market conditions.

How CFD Trading Works

To initiate a CFD trade, you enter into a contract with a broker, specifying the underlying asset you wish to trade, the trade size (contract value), and whether you anticipate the price to rise (buy position) or fall (sell position). Upon entering a CFD trade, you do not actually purchase or sell the underlying asset itself. Instead, you agree with the broker to pay or receive the difference between the current price and the future price, depending on whether your position aligns with the actual market movement.

For instance, if you expect the price of a particular stock to increase, you can buy a CFD on that stock. If the stock’s price does rise, you will profit from the difference between the initial and final prices. Conversely, if the stock’s price falls, you will incur a loss.

Advantages of CFD Trading

Now that we have a clearer understanding of how CFDs work, let’s explore the advantages that make them a compelling choice for traders:

Leverage: CFD trading offers leverage, which enables traders to control a larger position with a smaller initial investment. This mechanism magnifies potential profits but also amplifies potential losses. It is crucial to employ leverage cautiously and responsibly, ensuring that you fully comprehend the associated risks.

Diversification: With CFD trading, you can access a wide range of underlying assets, including stocks, currencies, commodities, and indices. This diversification can help mitigate risk by distributing your capital across different asset classes, reducing the impact of downturns in any specific market.

Hedging: Seasoned traders utilize CFDs for hedging purposes. By taking a position opposite to an existing investment, traders can potentially offset potential losses if the market moves against them.

Flexibility: CFD trading provides great flexibility to traders. You can trade from anywhere with an internet connection and close your positions at any time during trading hours, enabling quick adjustments to your strategy.

Risks Associated with CFD Trading

While CFD trading offers advantages, it also carries inherent risks that traders must acknowledge and manage effectively:

Leverage Risks: As mentioned earlier, leverage can be a double-edged sword. While it can magnify profits, it can also amplify losses, potentially leading to substantial financial impairment.

Market Volatility: CFDs are highly vulnerable to market volatility. Rapid price fluctuations can result in significant losses if the market moves against your position.

Slippage: In high-volatility market conditions, slippage may occur, resulting in trade execution at a less favorable price than anticipated. This can negatively impact your trading results.

Counterparty Risk: CFDs are over-the-counter (OTC) derivatives, meaning they are not traded on regulated exchanges. As such, traders are exposed to the risk of their broker defaulting, potentially leading to financial losses.

Getting Started with CFD Trading

If you wish to venture into the world of CFD trading, here are some preliminary steps to consider:

1. Education: Before embarking on your CFD trading journey, it is imperative to educate yourself thoroughly about CFDs, their underlying assets, and trading strategies. Knowledge is crucial for making informed decisions and managing risks effectively.

2. Practice: Once you have gained a solid understanding of CFDs, consider practicing on a demo account to familiarize yourself with the mechanics of trading without risking real capital.

3. Broker Selection: Choose a reputable and well-regulated broker that aligns with your trading needs and offers a user-friendly trading platform. Ensure they provide clear trading conditions, including transparent fees and leverage options.

Conclusion

Contracts for Difference (CFDs) offer unique opportunities to speculate on the price movements of various underlying assets, potentially yielding lucrative returns. Yet, it is essential to be cognizant of the risks involved and to approach CFD trading with a strategic and disciplined mindset. By comprehending the fundamentals outlined in this guide and adopting prudent risk management practices, traders can enhance their chances of navigating the CFD market successfully, potentially unlocking profit while mitigating potential pitfalls.

Image: www.liteforex.com

What Is A Cfd Trading