Introduction

The world of investing is a vast and ever-evolving landscape. Amidst the complex charts and technical indicators, one tool stands out as a beacon of clarity and insight: candlestick patterns. These enigmatic formations on a price chart whisper tales of market sentiment, hidden trends, and potential opportunities. Understanding and interpreting candle patterns is akin to possessing a secret decoder ring, unlocking the mysteries that often elude even seasoned investors.

Image: jooinn.com

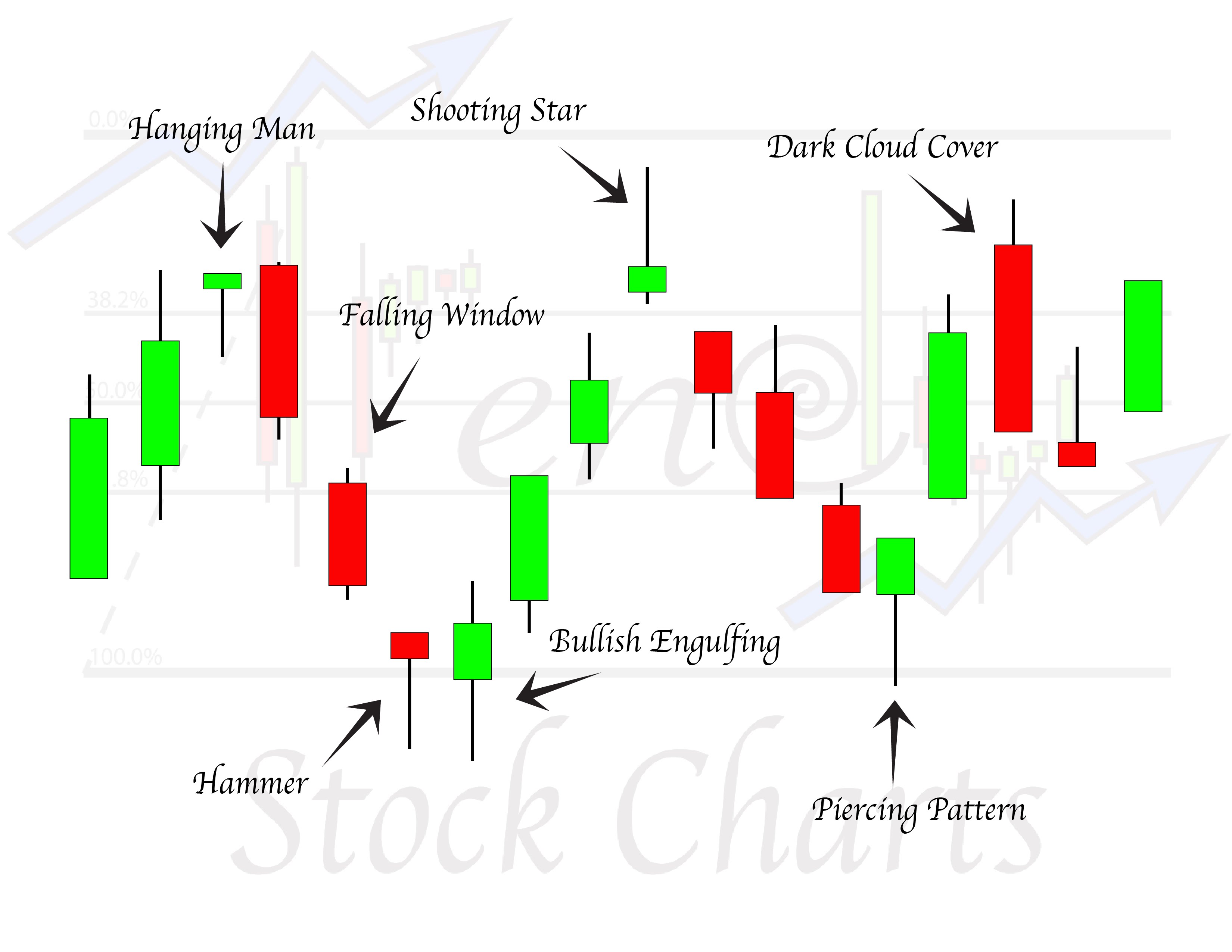

In essence, a candle pattern is a graphical representation of price action over a specified period, typically a day or a week. Each candle consists of a body and shadows, known as wicks. The body, filled or hollow, indicates the difference between the opening and closing prices. Wicks extend above and below the body, capturing the high and low prices. By analyzing the shape, size, and position of these candles, traders can discern valuable insights into market dynamics.

A Tapestry of Candle Patterns

The world of candle patterns is a diverse and colorful tapestry, each formation carrying its unique significance. Some of the most common and influential patterns include:

Bullish Patterns:

Bearish Patterns:

Image: www.lupon.gov.ph

Neutral Patterns:

Practical Applications

The true power of candle patterns lies in their practical applications. By recognizing and interpreting these formations, traders can enhance their trading strategies and make more informed decisions:

Evolving Landscape

The world of candle patterns is not static but constantly evolves alongside market behavior. As trading instruments and trading styles change, so too do the significance and interpretation of certain patterns.

Traders must remain adaptable and open to learning new patterns and nuances. By monitoring market trends and studying historical data, investors can refine their understanding of candle patterns and leverage them effectively in their trading strategies.

Stock Market Candle Patterns

Conclusion

Candle patterns are an invaluable tool for traders seeking to penetrate the complexities of the stock market. By understanding the history, types, and practical applications of candle patterns, investors can unlock the secrets hidden within price charts. Mastering the art of candle pattern interpretation provides a distinct advantage, guiding trading decisions, managing risk, and ultimately increasing the chances of investment success.

As the market continues to evolve, so too must our understanding of candle patterns. By embracing adaptability and staying abreast of the latest developments, we can enhance our ability to harness the power of these enigmatic formations, illuminating the path to investment success.