In the vast landscape of financial markets, CFD trading stands as a dynamic and accessible option for investors of all levels. As a beginner, unraveling the complexities of CFDs may seem daunting, but fear not! This comprehensive guide will illuminate the essence of CFD trading, empowering you to navigate this intriguing realm with confidence.

Image: www.slideshare.net

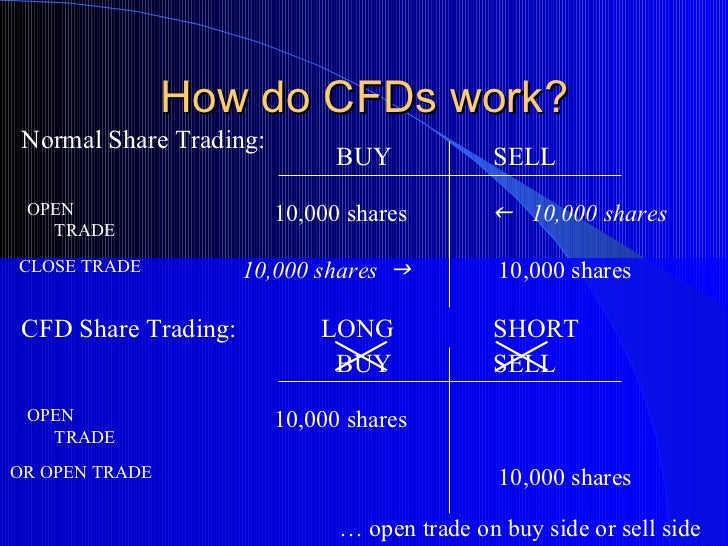

CFD, short for Contract for Difference, represents an agreement between two parties to exchange the difference in the value of an underlying asset over a specified period. Unlike traditional trading, CFDs allow you to speculate on the price movements of assets without physically owning them. This flexibility opens a world of opportunities, empowering you to take positions on various markets, including stocks, commodities, indices, and currencies.

Historical Origins and Evolution

The genesis of CFDs can be traced back to the late 1980s in the United Kingdom. They emerged as a means to address the limitations of traditional trading, offering investors a cost-effective and accessible alternative. Initially, CFDs were primarily used by institutional traders seeking exposure to underlying assets without the hefty upfront costs associated with direct ownership.

Over time, CFDs gained traction among retail investors as well, thanks to advancements in technology and the increasing availability of online trading platforms. Today, CFDs have become an indispensable tool for traders seeking to diversify their portfolios, hedge risks, or simply speculate on market movements.

Defining CFD Trading

Simply put, CFD trading involves entering into an agreement with a broker to exchange the difference in the value of an underlying asset from the time the contract is opened to the time it is closed. The profit or loss you realize is determined by the accuracy of your price prediction.

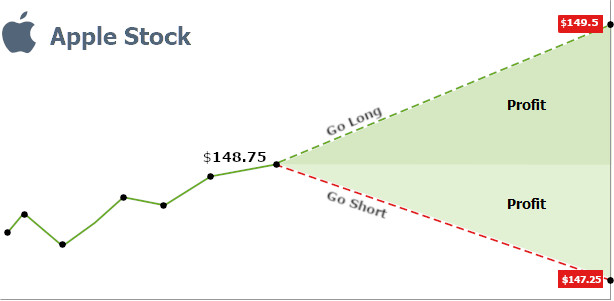

Suppose you believe the price of a particular stock will rise. In that case, you can buy a CFD contract representing that stock. If your prediction holds true and the stock’s price indeed increases, you profit from the difference between the opening and closing values. Conversely, if the stock’s price falls, you incur a loss.

Underlying Assets in CFD Trading

The versatility of CFDs lies in the wide range of underlying assets they encompass:

- Stocks: Speculate on the price movements of individual companies listed on stock exchanges worldwide.

- Commodities: Trade precious metals like gold and silver, or delve into the energy sector with CFDs on oil and gas.

- Indices: Gain exposure to broad market movements by trading CFDs based on indices like the FTSE 100 or the Dow Jones Industrial Average.

- Currencies: Capitalize on fluctuations in exchange rates with CFDs on currency pairs, such as EUR/USD or GBP/JPY.

Image: www.ifcm.co.uk

Benefits of CFD Trading

CFD trading offers a myriad of advantages for investors:

- Leverage: Magnify your potential profits with leverage, allowing you to trade larger positions with a smaller initial capital outlay.

- Flexibility: Trade on the go with mobile trading platforms and take advantage of market opportunities anytime, anywhere.

- Hedging: Offset risks in your existing portfolio by taking opposite positions in CFDs, effectively minimizing potential losses.

- Short Selling: Profit from falling prices by selling CFDs on assets you don’t own, a strategy typically unavailable in traditional trading.

Tips and Expert Advice for CFD Traders

Ignite your trading journey with these invaluable tips from seasoned professionals:

- Educate Yourself: Delve into the intricacies of CFD trading through online resources, books, and webinars to build a solid knowledge base.

- Manage Risk: Always implement a robust risk management strategy to safeguard your capital. Use stop-loss orders and take appropriate precautions to mitigate potential losses.

- Capitalize on Volatility: Embrace the dynamic nature of CFD trading. Leverage periods of high volatility to amplify your profits while exercising caution during market downturns.

- Follow Market Trends: Stay informed about economic data, political events, and industry news to make informed trading decisions based on market sentiment.

Frequently Asked Questions (FAQs)

- Q: Can I lose more than I invest in CFD trading?

- A: Yes, leverage magnifies both profits and losses. Exercise caution and trade within your means.

- Q: What is the minimum capital required to start CFD trading?

- A: Requirements vary across brokers. Research to find a broker with suitable account minimums.

- Q: Can I trade CFDs from anywhere?

- A: Yes, mobile trading platforms empower you to trade from any location with an internet connection.

- Q: How do I choose a CFD broker?

- A: Consider factors such as reputation, regulation, fees, platform usability, and customer support.

What Is Cfd Trading

Conclusion

Unlock the world of CFD trading, where possibilities abound. Whether you’re a seasoned professional or a novice seeking to tread new financial paths, this guide has equipped you with a comprehensive understanding of the essence, benefits, and nuances of CFD trading. As you embark on your trading journey, remember to prioritize education, manage risks wisely, and embrace market volatility with calculated precision. The realm of CFDs awaits your exploration; let curiosity be your compass and confidence your guide. Are you ready to navigate the dynamic waters of CFD trading and chart