Introduction

The tumultuous world of financial markets demands reliable benchmarks to assess investment portfolios’ performance. Amidst a plethora of indices, the price-weighted stock index stands out as a cornerstone in the investment landscape. It’s a simple yet effective tool that provides investors with a comprehensive overview of market trends and their portfolio’s alignment with those trends. In this article, we endeavor to delve into the intricacies of price-weighted stock indices, exploring their history, mechanics, and relevance in modern investment strategies.

Image: www.investorgreg.net

Understanding Price-Weighted Stock Indices

In essence, a price-weighted stock index is a statistical measure that tracks the performance of a group of stocks based on their current market prices. Unlike market capitalization-weighted indices like the S&P 500, where a company’s market capitalization (stock price multiplied by the number of outstanding shares) heavily influences the index’s movement, price-weighted indices assign equal weight to each stock included in the index, regardless of their capitalization.

Historical Evolution and Significance

Price-weighted indices predate their market capitalization-weighted counterparts. The Dow Jones Industrial Average (DJIA), created in 1896, is a prime example of a price-weighted stock index. Its inception marked a significant milestone in the financial world, providing investors and analysts with a standardized measure of market performance. Over the years, other price-weighted indices have emerged, catering to diverse industries and market segments.

Calculation and Mechanics

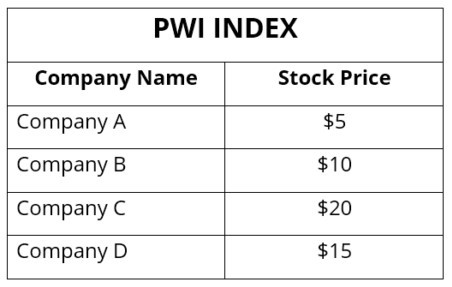

The calculation of a price-weighted stock index is straightforward. First, the current market price of each stock included in the index is determined. Next, an average of these prices is computed. The resulting average serves as the value of the index at that particular point in time. As stock prices fluctuate, the index value is recalculated to reflect these changes.

Image: datalya.com

Advantages of Price-Weighted Stock Indices

Price-weighted stock indices offer several advantages that make them valuable tools for investors.

-

Equal Representation: Each stock within the index holds equal weight, regardless of its market capitalization. This allows investors to track the performance of smaller companies that may be overlooked in market capitalization-weighted indices.

-

Simplicity: The calculation of price-weighted indices is relatively simple, making it easy for investors to understand and interpret.

-

Historical Consistency: Price-weighted indices have been in existence for a longer period than market capitalization-weighted indices, providing investors with a long-term historical perspective on market performance.

Limitations of Price-Weighted Stock Indices

While price-weighted stock indices offer several advantages, they also come with some limitations.

-

Market Dominance: The equal weighting of stocks in price-weighted indices means that large price changes in a few stocks can disproportionately influence the index’s value.

-

Limited Insight: Price-weighted indices do not take into account the impact of company fundamentals, such as earnings or dividends, on stock prices.

Applications in Investment Strategies

Despite their limitations, price-weighted stock indices remain valuable tools for investment strategies.

-

Benchmarking: Price-weighted indices serve as benchmarks against which investors can compare the performance of their portfolios.

-

Stock Selection: Investors can use price-weighted indices to identify undervalued stocks that have the potential to outperform the broader market.

-

Sector Analysis: Price-weighted indices can provide insights into the performance of specific industry sectors or themes.

Price Weighted Stock Index

Conclusion

Price-weighted stock indices are indispensable tools in the investment world, offering a unique and meaningful perspective on market performance. Their simplicity, historical consistency, and ability to track smaller companies make them valuable for both individual investors and seasoned professionals. Whether it’s serving as a benchmark for portfolio evaluation or providing insights into sector dynamics, price-weighted indices continue to play a vital role in the pursuit of informed and successful investment strategies.