Setting the Stage: A Glimpse into the World of Pips

For traders navigating the financial markets, understanding the concept of pips is paramount. Pips, or point in percentage, represent the smallest unit of price movement in a currency pair. They play a crucial role in determining profit and loss, making their calculation an essential skill for every trader.

Image: www.forexgdp.com

Let’s embark on a comprehensive exploration of pips, unraveling their intricate details, and empowering you with the knowledge to conquer the trading realm.

The Anatomy of Pips: Understanding the Significance

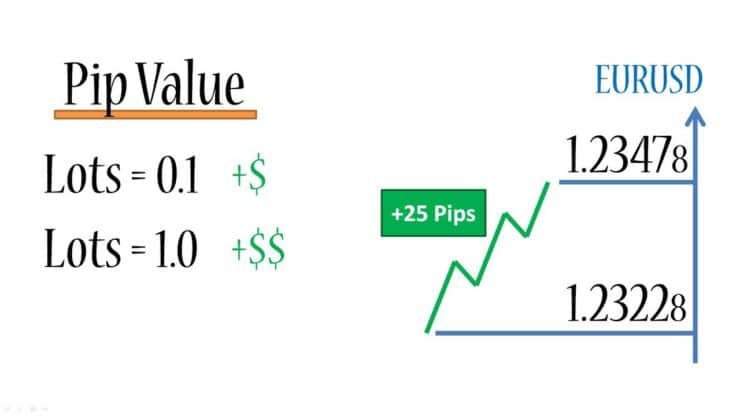

In essence, a pip measures the change in the exchange rate between two currencies. The majority of currency pairs are quoted to four decimal places, making the fourth decimal the value of a pip.

For example, if the EUR/USD exchange rate moves from 1.1234 to 1.1235, this represents a 1 pip increase. It’s important to note that the value of a pip can vary depending on the currency pair being traded and the specific brokerage firm.

Mastering Pip Calculation: A Step-by-Step Approach

Calculating pips is a straightforward process, ensuring traders can accurately assess market movements and trade effectively.

Here’s a step-by-step breakdown of pip calculation:

- Identify the Currency Pair: Determine the specific currency pair you are analyzing.

- Examine the Exchange Rate: Note the current exchange rate of the currency pair.

- Calculate the Pip Value: Identify the value of one pip for the currency pair. This information can usually be found on the brokerage platform.

- Determine the Pip Difference: Calculate the difference between the two exchange rates.

- Multiply the Pip Difference by the Pip Value: Multiply the difference calculated in step 3 by the pip value to determine the number of pips.

Pips in Practice: Real-World Examples for Clarity

Let’s reinforce our understanding with practical examples:

- EUR/USD: If the exchange rate moves from 1.1234 to 1.1235, the pip difference is 1. The pip value for EUR/USD is typically 0.0001, so the number of pips gained is 1 x 0.0001 = 0.0001 pips.

- USD/JPY: Suppose the exchange rate shifts from 107.3456 to 107.3462. The pip difference is 6. The pip value for USD/JPY is commonly 0.0001, resulting in 6 x 0.0001 = 0.0006 pips.

Image: learn2.trade

The Latest Innovations and Trends Shaping Pips

Technology and market dynamics are constantly reshaping the world of pips. Traders must stay abreast of these advancements to remain competitive and informed.

One notable trend is the emergence of pip-based trading strategies. These strategies utilize sophisticated algorithms to analyze price movements in pips, identifying potential trading opportunities and optimizing profit generation.

Additionally, the proliferation of online trading platforms has made it easier for traders to access real-time pip values and market data, empowering them with the tools they need to make informed decisions.

Expert Advice for Traders: Navigating the Pipscape

Seasoned traders have accumulated a wealth of knowledge and expertise regarding pips. Here are some invaluable tips to guide you on your trading journey:

- Understanding Leverage: Leverage can amplify both profits and losses. Use it judiciously, considering your risk tolerance and market conditions.

- Proper Stop-Loss Placement: Placing stop-loss orders at appropriate pip levels can minimize potential losses and protect your trading capital.

- Market Sentiment Analysis: Gauging market sentiment can provide valuable insights into potential price movements and pip fluctuations.

FAQs: Addressing Common Queries

To address lingering questions, here are answers to some frequently asked questions regarding pips:

- Q: How do I calculate pips for currency pairs with different decimal places?

A: Convert the exchange rate to four decimal places before applying the pip calculation formula. - Q: What is the purpose of pips in trading?

A: Pips are essential for measuring profit and loss, risk management, and comparing the performance of different currency pairs.

How Do You Calculate Pips

Conclusion: Embracing Precision and Profitability

Understanding pips is indispensable for maximizing your trading potential. By mastering the art of pip calculation, keeping abreast of industry trends, and employing expert advice, you can navigate the financial markets with confidence and precision, unlocking the path to profitability.

Are you ready to embark on a journey of financial empowerment? If so, delve into the world of pips today and witness the transformative impact it can have on your trading endeavors.