Introduction

In the dynamic and ever-evolving world of finance, understanding the forces that determine share prices is crucial for investors seeking to navigate market volatility and achieve profitable outcomes. Share price, a reflection of a company’s value, is influenced by a complex interplay of internal and external factors that can make or break an investment strategy. This comprehensive guide will delve into the multifaceted landscape of share price determinants, providing investors with the knowledge they need to make informed decisions.

Image: www.reneelab.com

Company Performance and Fundamentals

The foundation of share price lies in a company’s financial health and operational effectiveness. Investors meticulously analyze financial statements and operating metrics to assess a company’s earnings potential, profit margins, revenue growth, and overall financial stability. Strong financial performance, coupled with a solid business strategy and a proven management team, instills confidence in investors, leading to higher valuations.

Economic Conditions and Industry Trends

The broader economic landscape plays a significant role in shaping share prices. Economic growth, interest rates, inflation, and political stability can influence consumer spending, business profitability, and investor sentiment. Positive economic conditions often lead to rising share prices, as companies benefit from increased economic activity. Conversely, economic downturns can exert pressure on company earnings, leading to price declines.

Competitive Advantage and Market Position

Companies with a clear competitive advantage over their peers stand out in the eyes of investors. Strong brand recognition, unique products or services, intellectual property, and a loyal customer base can create a sustainable competitive advantage that translates into higher profits and, subsequently, premium share prices. Investors seek companies that are well-positioned within their industries, with a strong market share and the ability to fend off competitors.

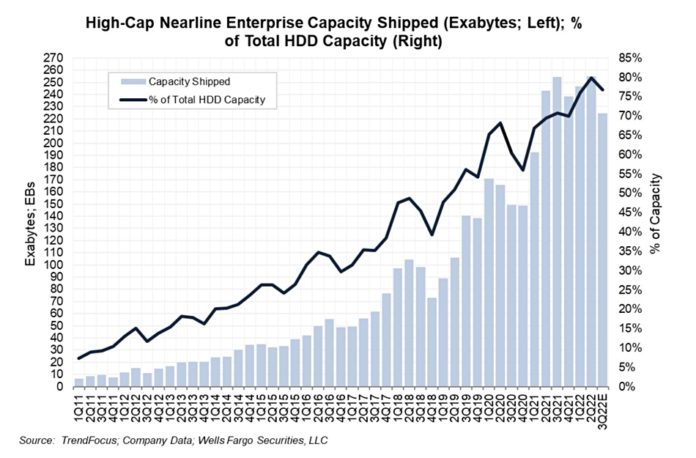

Image: blocksandfiles.com

Supply and Demand

Ultimately, share price is a result of supply and demand in the stock market. As more investors seek to buy a particular stock, its price will rise, reflecting the increased demand. Conversely, if more investors sell their shares, supply increases, driving the price down. Understanding supply and demand dynamics helps investors anticipate price movements and capitalize on market trends.

News and Market Sentiment

Positive news about a company, such as new product announcements, partnership agreements, or earnings reports that exceed expectations, can trigger a buying frenzy, pushing share prices higher. Similarly, negative news can lead to sell-offs and price declines. Market sentiment, the prevailing attitude towards the overall market or a specific industry, can also influence share prices.

Speculation and Technical Analysis

While fundamental factors play a critical role in determining share price, speculation and technical analysis also come into play. Some investors base their decisions on past price trends, chart patterns, and technical indicators. While technical analysis may not be foolproof, it can provide additional insights and help investors make informed trading decisions.

External Factors and Geopolitical Events

Beyond internal factors, external events can significantly impact share prices. Global conflicts, trade disputes, natural disasters, and political uncertainties can create market volatility and affect the performance of companies within specific industries. Investors must stay abreast of current events and geopolitical developments to anticipate potential market reactions.

What Drives Share Price

Conclusion

Understanding the factors that drive share price is essential for investors seeking long-term success in the stock market. By considering a company’s financial performance, economic conditions, competitive advantage, supply and demand dynamics, news and market sentiment, and external factors, investors can gain a deeper insight into the true value of a stock and make informed investment decisions. Remember that stock prices are subject to fluctuations, and diversifying your portfolio, conducting thorough research, and exercising patience are key to achieving long-term investment goals.