Introduction

Venturing into the global forex market as a broker requires navigating a complex regulatory landscape. One of the crucial components is obtaining a forex broker license, which serves as a legal mandate that authorizes you to facilitate currency trading activities on behalf of clients. This guide delves into the intricate details of forex broker licensing, highlighting the significance, application process, and ongoing compliance obligations associated with this regulatory framework.

Image: b2broker.com

Understanding Forex Broker Licensing

A forex broker license is a regulatory certification issued by a recognized financial authority, such as the Financial Conduct Authority (FCA) in the United Kingdom or the National Futures Association (NFA) in the United States. This license grants brokers the legal authority to operate in the forex market and offer trading services to clients.

The primary objective of forex broker licensing is to protect investors and promote market integrity. Regulators impose stringent requirements on brokers to ensure they adhere to ethical and transparent business practices. Brokers must demonstrate financial stability, maintain robust risk management practices, and abide by regulatory guidelines to qualify for a license.

Applying for a Forex Broker License

The application process for a forex broker license varies depending on the regulatory jurisdiction. However, common requirements typically include:

-

Business Plan: Applicants must submit a comprehensive business plan outlining their operational structure, risk management strategies, financial projections, and client onboarding procedures.

-

Financial Requirements: Brokers must meet minimum capital requirements set by the regulator to ensure they have the financial capacity to manage trading risks and protect client funds.

-

Personnel Qualifications: Key personnel, such as directors and senior managers, must possess relevant experience and qualifications in the forex industry.

-

Compliance Systems: Brokers must establish robust compliance systems to monitor and mitigate regulatory risks, including anti-money laundering (AML) and know-your-customer (KYC) procedures.

-

Technology and Security Measures: Applicants must demonstrate that they have adequate technology infrastructure and security measures in place to safeguard client data and prevent unauthorized access.

Ongoing Compliance Obligations

Maintaining a forex broker license requires ongoing compliance with regulatory obligations. Brokers must adhere to the following:

-

Financial Reporting: Regular submission of financial statements to demonstrate financial stability and compliance with capital adequacy requirements.

-

Risk Management: Continuous monitoring and management of trading risks to protect client funds and mitigate operational losses.

-

Client Protections: Implementation of robust client protection measures, such as segregated client accounts and negative balance protection.

-

Market Transparency: Ethical and transparent conduct in dealing with clients, including fair pricing and timely execution of trades.

-

Compliance Audits: Regular audits by regulatory authorities to ensure ongoing adherence to licensing conditions.

Image: www.personal-reviews.com

Benefits of a Forex Broker License

Acquiring a forex broker license offers numerous benefits to brokerage firms:

-

Legal Authorization: A license provides legal authority to operate as a forex broker, ensuring compliance with regulatory requirements.

-

Market Credibility: A licensed broker gains credibility and trust in the eyes of potential clients, signaling adherence to ethical and transparent practices.

-

Investor Protection: Clients can trade with confidence, knowing that their funds are protected by regulatory safeguards.

-

Risk Management: Licensing encourages brokers to implement robust risk management frameworks, minimizing risks associated with forex trading.

-

Market Expansion: A license can facilitate market expansion into new jurisdictions, providing access to a broader client base.

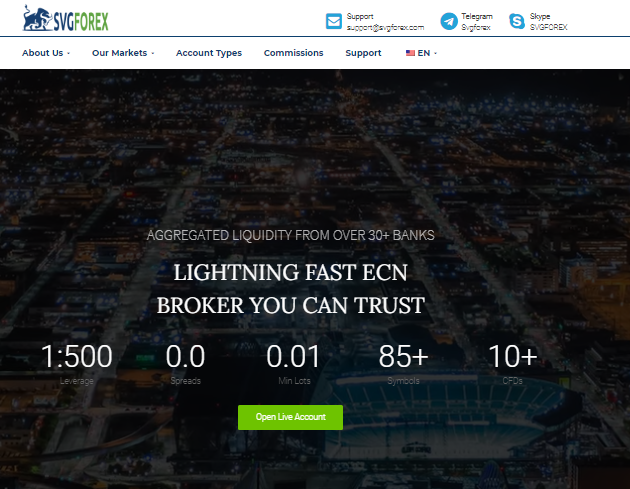

Forex Broker License Svg

Conclusion

Obtaining and maintaining a forex broker license is crucial for any brokerage firm seeking to operate in a compliant and ethical manner. The stringent regulatory requirements associated with licensing serve to protect investors, promote market integrity, and foster trust in the forex industry. By embracing these obligations and adhering to regulatory guidelines, brokers can ensure long-term success and contribute to the stability and growth of the global forex market.